Payment Tokens 💳

What Are Payment Tokens?

Imagine sending money across the world as easily as firing off a meme on WhatsApp. That’s the essence of Payment Tokens: cryptocurrencies built and tuned specifically to act as direct payment methods. Their mission is simple—move value from point A to point B efficiently, with no traditional banks, no hidden fees, and no “office-hours” downtime. They run 24/7, just like your urge to send memes at 3 a.m.

When and Why Did They Emerge? The Spark of Decentralization 💥

The purest form of Payment Tokens was born with the first major cryptocurrency: Bitcoin in 2009. Satoshi Nakamoto’s original vision was precisely that—“a peer-to-peer electronic cash system.” The 2008-2009 financial crisis laid bare the fragility and opacity of a bank-dominated system packed with middlemen.

Against that backdrop, the need—and the opportunity—arose to build an alternative payment rail: transparent, censorship-resistant, and controlled not by banks or governments but by its own user network. Bitcoin proved it was possible to transfer value digitally without trusted third parties. From there, other cryptocurrencies (Litecoin, Ripple, etc.) chased the same payment dream—often promising faster transactions or lower costs—broadening the concept of “decentralized digital money.”

Regulatory Framework (GENIUS Act, Mar 2025)📜

This U.S. law lays out clear rules for all payment tokens—both stablecoins and base-layer coins:

Federal License for Stablecoins 🏷️: One nationwide permit instead of dozens of state rules.

Audited Reserves ✅: Third-party checks to confirm issuers actually hold the dollars (or other assets) backing their tokens.

Capital Requirements 🏦: A safety cushion—issuers must keep a minimum amount of funds on hand.

Regular Reporting 📊: Issuers file updates (like a bank statement) so everyone sees their reserves in real time.

Non-Security Status 🚫📈: Tokens that follow these rules aren’t treated like stocks or bonds, so they avoid extra securities regulations—they are explicitly not classified as securities.

Unified Oversight 🌐: One federal standard replaces a patchwork of varying state laws, cutting red tape and lowering costs for issuers and users alike.

🌈 By defining these terms and treating compliant payment tokens as non-securities, the GENIUS Act makes it easier—and safer—for anyone to issue, trade, and use crypto payments on any blockchain.

Why Are They the Financial Anti-System? 🚫

| Traditional Banks | Payment Tokens |

|---|---|

| Hidden fees (hello, SWIFT!) | Fees of $0.001–0.1% (see the cost before you send) |

| Limited by business hours/holidays | Operate 24/7/365 (Christmas, late nights—no exceptions) |

| Transfer validation takes ~3 days | Transactions complete in seconds–minutes |

| Require KYC and supporting documents | Only need a wallet¹ (no names, no history) |

The Promise of Financial Freedom 🦅

👤 No Middlemen (Bye-bye, Bureaucracy!)

• There are no counters, ATMs, or long waiting times. No third party must bless your transfer. The blockchain validates and records each move automatically and transparently, removing banks and traditional processors from the equation. Less paperwork, fewer “system unavailable” messages. Your money, your control.

🌍 Global by Default (Your Money Travels, You Decide)

• It doesn’t matter if your friend is in the Canary Islands or on Mars (well, almost 🪐). Payment-token transactions zip across the network in minutes—sometimes seconds—crossing borders without the usual delays or restrictions. Picture paying for something in China while lounging on your sofa in Argentina, almost instantly. That’s real global reach.

🤯 Transparent Fees (No More Bill-Shock)

• Tired of surprise “bank charges” or hidden online-payment fees? With Payment Tokens, the network fee is crystal-clear before you hit Send. In most cases, that fee is tiny—especially compared with international wire costs or credit-card charges. Total control over what you pay to move your own money.

At WAFFT, we say Payment Tokens are the anti-bank system with flow: they give you full control of your money, make it slick and fast, and wipe out every excuse for not paying that bill (yep, buddy, it’s all on you now 😜).

That’s it for now. Don’t worry about the technical details—in the next sections of WAFFT: The Path to Wealth, we’ll walk you through everything: from how Payment Tokens work, to what the future holds for them. Because this guide isn’t just about crypto hype — it’s your financial education from A to Z. 🏋️♂️

Get ready to leave banks behind... and flex your balance without needing to explain it in some endless phone call. ⛔️🏦

Ready for the future of transactions? Follow us and join the movement!

👉 Find us on X, Telegram, and Instagram as @WarrenBufettoken.WAFFT — where we drop crypto memes, hacks, and wallet wisdom daily. 😉

🧐 Let your wallet get smarter, one post at a time.

How Do Payment Tokens Work?

Payment tokens are like financial Swiss army knives—they cut out intermediaries, absurd fees, and banking delays. But how do they actually work? Here’s the breakdown with clear examples:

1. Issuance & Consensus ⛏️

How are they created, and who decides which transactions are valid?

✌️ There are two major methods for issuing and validating transactions:

🔹 Mined (Proof of Work / PoW):

• Like Bitcoin. Validators (miners) compete to solve complex mathematical puzzles. The first to solve it earns the right to add a new block and gets newly minted tokens as a reward.

⚡ Cost: high energy consumption.

🛡️ Security: very strong, but slow and expensive.

🔹 Staked (Proof of Stake / PoS):

• Like Solana or Avalanche. Validators lock up a certain amount of tokens (staking) to prove their commitment to the network. The more tokens you stake, the higher your chances of validating a block.

🔋 Cost: low energy consumption.

🚀 Speed: faster and cheaper transactions.

🧠 WAFFT Data Insight:

“PoW burns energy like a Ferrari; PoS like a Tesla. Today, 73% of new payment-focused tokens use PoS or hybrid models (like Ethereum, which blends both).”

2. Transactions & Verification ✅

Here’s how it works in 3 simple steps:

🖊️ Signature

Your wallet uses your private keys to “seal” the transaction. It’s like a digital stamp: it guarantees that only you have given the green light and that no one can forge it.

🌐 Propagation

The transaction enters the mempool (the “waiting room” where all pending operations sit) and, in milliseconds, spreads to thousands of network nodes—like a message you forward to everyone at once. Before you even pour yourself a coffee, thousands of nodes already know it.

🔒 Confirmations

Think of the blockchain as a stack of bricks. When your transaction enters the first brick (block), it’s “glued” in, but it could still come undone if someone messes with the foundation. Each new block stacked on top adds another layer of cement. The more blocks, the harder it is to remove.

- Bitcoin: To go to bed without worries, wait for 6 blocks—about 60 minutes. That secures your payment like a concrete wall.

- Fast networks (Avalanche, Solana): Their cement sets almost instantly; with just 1 or 2 blocks (seconds), your transaction is already sealed and museum-ready.

😎 WAFFT explains:

On Bitcoin you wait a bit for maximum security; on modern networks, your payment is nearly irreversible before you finish your coffee.

🔍 Real-Life Example

On networks like Solana (SOL), a transaction confirms in under half a second. Yes, you read that right—faster than a blink!

In contrast, on Bitcoin (BTC) you might wait up to 10 minutes for a confirmation.

And on Ethereum (ETH), each block takes about 12 seconds, but after about 12 confirmations it’s considered rock-solid.

✨ WAFFT Translation

Your payments confirm in real time, no weird delays, no mysterious cancellations, and with maximum security. This is money sent and done. 💸⚡

3. Scalability & Layers⚡

When your favorite blockchain starts going viral, bottlenecks show up: slow transactions, skyrocketing fees, and frustrated users. But fear not—there are multiple “layers” that help your crypto move faster than a rocket. 🚀

🔍 The Base Layer Problem

Bitcoin’s base layer handles only about 7 transactions per second (tx/s).

The result? During high demand, millions of users fight for space in each block, and fees shoot up like foam. 💸

So how do we fix it? Enter the “layers”...

| Layer | Token / Network | Approximate Speed |

|---|---|---|

| Lightning Network | Bitcoin (BTC) | ~1,000,000 tx/s |

| Solana Pay | Solana (SOL) | ~65,000 tx/s |

| USDC on Layer 2 | Polygon (MATIC) | ~7,000 tx/s |

Lightning Network (BTC): Off-chain payment channels that allow instant micro-transactions without clogging Bitcoin’s mainnet.

Solana Pay (SOL): A lightning-fast network with near-zero fees—perfect for mass payments.

USDC on Layer 2 (Polygon): Brings the world’s most popular stablecoin to a secondary layer, cutting fees and boosting speed.

🎯 WAFFTip

Buying a smoothie or a soda? Go with Lightning. Collecting an NFT? Use SOL or ETH on Layer 2 for fast and cheap transactions. 🥤⚡

✨ Bonus WAFFTip: Check out zk-Rollups (like zkSync or Polygon zkEVM) and Arbitrum—Layer 2 tech that lets you move assets on Ethereum with tiny fees and strong security.

Thanks to these scaling layers, your crypto experience levels up: faster speed, lower costs, and no more endless waits.

Less waiting, more winning. Welcome to next-gen payments. 🌐🚀

4. Fees: The Great Banking Lie 💸

Compare and cry, WAFFTer! 😭👇

Method | Sending $100 to Argentina | ⚡ Time |

|---|---|---|

| Traditional Bank | $12 + 3% markup | ⏳ ~3 days |

| Stablecoin USDC (Polygon) | $0.001 | 🚀 ~5 sec |

| Bitcoin (Lightning Network) | $0.0001 | ⚡ ~1 sec |

Banks charge you up to 50× more… just to be slower! Capitalist irony, bro. 🤯

🤔 Why such a big difference?

• Traditional banking: SWIFT fees, currency conversion, third-party intermediaries… and of course, their “just-in-case” margin.

• Stablecoins: Run on efficient blockchains (Polygon, Solana, etc.), with near-instant validation and laughably low costs.

• Lightning Network: An extra layer on top of Bitcoin that enables micro-payments at light speed without clogging the main chain.

🔍 Things You Should Know

Before you go all-in, keep these in mind:

Fees vary depending on network congestion and the exchange you use, but they’re rarely anywhere near traditional banking costs.

Fiat conversion: If the receiver needs cash (like pesos or dollars), there’ll be a small exit fee—still way lower than banks.

Regulation: Some countries still impose restrictions. Always check before sending to avoid surprises.

💥 Bottom line:

The old financial system charges premium prices for a horse-and-cart experience—while crypto moves at rocket speed. 🚀

Master these numbers and let WAFFT: The Path to Wealth show you how to ride them—without letting banks dig into your pockets. 💪🦊

5. Security & Censorship 🛡️

Why do Payment Tokens make governments and banks squirm? Because they turn you from a “tolerated user” into a sovereign owner of your own money.

🗝️ Private Keys | 🌐 P2P Networks | 🔍 Transparency |

|---|---|---|

| Your keys = your cash. No custodians → no freeze “on suspicion”—only you control your funds. | As long as at least one node is running (even in Antarctica 🐧), your transactions stay live. | Every move is permanently recorded on-chain— censoring without a trace is nearly impossible. |

🔥 Real-world examples

Nigeria, 2024: Government froze protesters’ bank accounts—but couldn’t touch their BTC wallets.

- Canada, 2022: Donations to truckers were seized in banks; crypto flows still went through.

- Belarus, 2020–: Activists received USDT donations to dodge state restrictions.

💡 Key points to know

1. Self-custody ≠ invincible: Lose your seed phrase? You lose your funds. Back it up securely in multiple locations.

2. Partial censorship exists: Centralized exchanges can block users under court order. True freedom is in non-custodial wallets.

3. Privacy ≠ total anonymity: Public blockchains are traceable. Use new addresses, legal coin mixers, or Layer‑2 networks to stay discreet.

4. Hardware wallets 🔐: For serious amounts—keep your keys offline and away from malware.

5. Stay updated: Keep your firmware and nodes current—don’t be the weakest link.

🏁 Final WAFFT Reminder:

“If your money depends on a banker’s signature, it was never truly yours. With Payment Tokens, your signature is the law.” 🤘

Master security and censorship-resistance, and you’ll unlock a financial superpower no bureaucrat can confiscate. Want more tricks? Head over to the WAFFT search engine—your "Google of money"—and find everything you need to shield your capital like a true crypto ninja. 🥷💸

Because whoever controls their security, controls their financial destiny. 🧠🔐

6. Interoperability: Bridges That Matter 🔗

Moving value between blockchains is no longer a leap of faith… if you pick the right highway. Here are a few solid options beyond the typical “wrapped token” gimmicks:

Solution | 🌐 What it does | ⚙️ Use case |

|---|---|---|

| Circle CCTP | Instantly “burns and mints” USDC across chains (burns on chain A, mints on chain B)—no custodial bridges. | Coinbase and Binance move USDC from Ethereum to Avalanche in minutes. |

| Solana Pay | Enables payments with SOL (or USDC on Solana) in online stores. | Shopify: you send SOL, the store gets USD instantly. |

| LayerZero | Omnichain protocol that connects networks like BNB, Avalanche, Arbitrum, etc. | NFT games that transfer items cross-chain with no friction. |

| Thorchain | “Cross-chain DEX” for native swaps (BTC ↔ ETH ↔ ATOM) without wrapped tokens. | Swap BTC for ETH directly, no centralized exchange needed. |

⚠️ WAFFT Alert:

Avoid unaudited bridges—billions in crypto have vanished in hacks. Speed means nothing if your assets vanish into thin air.

🛟 Tips for Crossing Chains Safely

1. Check audits and TVL: More liquidity = less slippage and greater trust.

2. Test with small amounts before sending your fortune.

3. Verify contract addresses: fake clones are everywhere.

4. Diversify bridges: don’t rely on just one—have a Plan B (and C).

5. No weird delays or sketchy pop-ups: legit bridges execute in seconds. If it lags, be suspicious.

6. Stay updated: trustworthy protocols publish security patches and audit notes regularly.

With the right bridges—whether it’s Circle CCTP’s instant burn-and-mint, LayerZero’s omnichain messaging, or Thorchain’s native cross-chain swaps—your funds glide through the crypto multiverse like the monkey from the gif above confidently crossing the bridge. 🐒😂

Want to keep up with the safest routes? Follow our socials and stay sharp with every WAFFT update. 🤘

WAFFT Take 🔥

Payment Tokens are ballistic missiles aimed straight at the heart of traditional banking: fast, precise, and asking permission from no one. 💥

▶️ Prioritize security: Use Bitcoin on-chain. It’s the most censorship-resistant network out there and nearly double-spend-proof. Yes, it’ll cost a bit more and take longer, but your transaction becomes almost indestructible.

▶️ Low-cost speed: Go with the Lightning Network (BTC in milliseconds) or Solana (fees are fractions of a cent). Perfect for microbpayments and instant transfers.

▶️ Global payments without volatility: Send USDC over a Layer 2 (Polygon, Base, Arbitrum…). You keep dollar value and pay cents to move it.

“Forget banks with 9-to-5 hours. Your money should move 24/7, borderless, and for pennies.

If not, it’s not really your money—because if you don’t control it, someone else does.”

🚀 Next Steps – WAFFT Style

• Send 10,000 sats (~€0.50) via Lightning and feel that instant ping.

• Pay for a coffee with Solana Pay or USDC and watch the merchant get paid instantly—no middlemen.

• Try sending a remittance with USDC via Polygon, compare it with your bank… then decide which one truly earns your trust.

Enjoy your financial freedom… and if it clicks, head back to your bank with a smile and wave goodbye to “maintenance fees.” 😎

Simple as that: adopt the money of the future today and show the elite that financial control has officially changed hands. WAFFT power! 🧠💸

Top Payment Tokens & Their Use Cases

When we talk about Payment Tokens, we’re referring to cryptocurrencies born to be “digital cash”: fast, cheap, and—above all—accepted. They’re not memecoins or stablecoins; their main purpose is to circulate as P2P payment tools or remittance rails. Here are the heavyweights every WAFFTer should know, with their strengths, weaknesses, and the real trenches where they’re used. 💥

Bitcoin (BTC)

🔹 Bitcoin (BTC) — Mobile Gold 👑

🔸 Why it matters

Universal acceptance 🌍 → If a business accepts “some crypto,” chances are it's BTC. It’s supported by most wallets, ATMs, and global merchants.

Lightning Network ⚡ → A Layer‑2 with payment channels that settle in milliseconds and cost just a fraction of a cent. Perfect for micropayments (like buying a juice 🧃) or instant cross-border remittances.

Brand and liquidity 💧 → It has the deepest market liquidity in the space. Getting in and out of BTC is way easier and faster than with 90% of other payment tokens.

🌐 Real-world, expanded uses

DIY remittances 🌐 → Migrant workers send weekly pay to their families using BTC; local conversion is handled via P2P kiosks or prepaid cards.

Mobile treasury 🏥 → NGOs in conflict zones store funds in BTC + Lightning to dodge sudden banking restrictions.

Micro‑ecommerce 🛍️ → Websites charge just 100 sats per article or download—no credit card fees involved.

Street payments 📱 → In places like El Salvador, Lugano, or Bitcoin Beach, people already pay for coffee, fuel, and even taxes by scanning a QR code.

🧠 Technical Details—No Headache Needed

- SegWit 🧩 → An upgrade that reduces transaction size and lowers on‑chain fees.

- Taproot 🌲 → Enables more compact signatures and advanced scripts, boosting privacy for Lightning channels.

- Fee Market 📈 → Each block has limited space. When the network gets busy, fees spike. That’s why Lightning is key to avoiding delays and high costs.

👉 These upgrades make Bitcoin more efficient, more private, and more accessible for everyone—even when the network gets crowded.

🔸 Pros & Quick Warnings

| 🟢 The Good | 🔴 Things to Watch |

|---|---|

Higher liquidity, lower slippage when converting to fiat | High volatility: ideal for payments, not for preserving value long‑term |

Hardware wallets, custodians, and ATMs available globally | During on‑chain congestion, fees can spike to several dollars → consider Lightning as a plan B |

Most audited and robust network (high hashrate + many nodes) | Final on‑chain confirmations take ~10 min; for instant purchases, Lightning is essential |

📌 WAFFT Tips

Charge with Lightning ⚡ → If you use the Lightning network to receive payments (it’s super fast and with minimal fees), remember that it’s like having money on an active server. If your node (a kind of mini computer that keeps your network running) shuts down, you could temporarily lose access to your funds.

Solution: store important funds on the main Bitcoin network (on-chain), which is slower and a bit more expensive, but much more secure, as everything is recorded directly on the blockchain.

🔗 Here’s an official resource to get started with the Lightning Network:

➡️ Visit Lightning Network – official site to explore full documentation and guides on how to make instant and low-cost payments with Bitcoin.

🔗 You can also follow this step-by-step guide:

How to use LN: download a wallet that supports Lightning (for example, Blue Wallet or Wallet of Satoshi) and open your first payment channel. learncrypto.com

WAFFT Final Note

“Grandpa runs with a cane on‑chain, but on Lightning he puts on his Nikes and takes you down before you finish your juice sip.” 🧃⚡

Litecoin (LTC)

🔹 Litecoin (LTC) — Satoshi’s Silver Bullet 🥈

🔸Why it matters

- Speed without drama ⚡→ Litecoin processes blocks every ~2.5 minutes—4× faster than Bitcoin. That means near-instant confirmations, perfect for everyday payments.

- Microscopic fees 💸→ Even when the network gets busy, moving funds costs mere cents. You can literally send hundreds (or thousands) of dollars for the price of a piece of gum.

- Liquidity bridge 🔁→ Many exchanges use LTC to transfer funds between regions. Why? Because it’s fast, cheap, and always available.

- Solid infrastructure 🧩→ No hype, just reliability. Litecoin has been running smoothly for over a decade without major outages. In crypto terms, that’s practically a miracle.

🌐 Real-world uses, no fluff

Express retail payments 🛍️ → For e‑commerce, POS systems, vending machines… anywhere you need fast confirmation without waiting 20 minutes like Bitcoin.

Quiet remittances 🌍 → Sending money abroad without banks, fees, or delays—fast, direct, and censorship-resistant.

Inter‑exchange transfers 🔗 → Big exchanges use LTC to move funds across borders quickly and cheaply.

Freelancer payments 🧑💻 → Client not into Ethereum or weird tokens? Pay them in LTC and everyone’s happy.

🧠 Tech breakdown (no headache)

Bitcoin fork 📦 → Litecoin started as a BTC fork but with key upgrades: faster, cheaper, more efficient.

🔧👉 SegWit and MWEB

SegWit: Improves efficiency by slimming down transaction size.

MWEB (MimbleWimble Extension Block): Optional privacy—like sending a sealed envelope instead of a postcard.

High availability 💪 → Its node network is well-distributed and steady—no influencer hype, just dependable performance.

🔸 Fun fact

Litecoin’s creator, Charlie Lee, sold all his LTC in 2017 to avoid conflicts of interest. The result? The coin operated as normal, drama-free. No reliance on its founder—a near-perfect trait for money.

📊 Compared to other payment tokens

| Token | Speed | Fees | Privacy | Payment Popularity |

|---|---|---|---|---|

| BTC | Slow | Medium–high | Medium | Very high |

| SOL | Super fast | Very low | Low | Growing |

| LTC | Fast and steady | Very low | Optional with MWEB | High for direct payments |

| USDT/USDC ( L2 ) | Depends on network | Very low | Low | Huge for commerce |

👉 Litecoin doesn’t aim to shine—it aims to function. It’s not here for speculation—it’s here for utility. Period.

💭 WAFFT Take

Litecoin is like that dependable friend—quiet, reliable, always there when you need it. It’s not the fastest, most famous, or most viral… but it’s efficient, cost-effective, and built to last.

That’s why in the WAFFT guide, it’s one of the go‑to tools for anyone looking to move in the crypto payment world without friction.

Official site: litecoin.com

WAFFT Final Note

"Don’t expect to get rich quick with Litecoin... but that’s exactly why the pros trust it—it works reliably, moves without drama, and stays steady without wild swings." 😏💸

Solana (SOL)

🔹Solana (SOL) — The Low-Cost “Express” 🚄

🤔 Why is it on the list if it didn’t start as a payment token?

✺ Solana was built as a smart-contract superhighway (DeFi, NFTs, gaming). But its sub-second block times and ~$0.0005 fees have propelled it into checkout rails: Solana Pay offers a “tap → pay” UX with no extra layers.

🔸 Why it matters

Ultra-fast finality 🚀 → Blocks close every ~400 ms (blink and it’s done), the chain pushes ≈2,000 transactions per second at rush hour (2k customers tapping at once) and logs 50 M+ tx per day—your payment clears before the barista even reaches for the cup.

Micro-fees 🪙 → Transactions cost roughly $0.0005; with over $5 billion in USDC liquidity on Solana, merchants enjoy minimal slippage and predictable costs—ideal for businesses operating on razor-thin margins.

Solana Pay toolkit 🔧 → A single QR code accepts SOL and native USDC, with 200+ out-of-the-box integrations (Shopify, WooCommerce, Android POS) and automatic reconciliation plugins to simplify accounting.

🌐 Real-world uses

Retail & cafés 🏪: QR checkouts in SOL or USDC that settle on-chain in seconds—your payment is fully confirmed by the time the register prints the receipt, not hours later.

E-commerce 🛒: Digital goods and tickets clear in native USDC (automated order matching: the system spots your payment and marks your order as “paid” in a snap—nobody has to lift a finger), with refunds landing back in your wallet almost instantly.

Freelance & micro-payments 💸: Designers invoice in USDC-Solana and cash out locally in minutes via on-ramps.

Gaming economies 🎮: Buy in-game skins or pay tournament entry fees in SOL—settlements happen in seconds and cost just a few cents, so you dodge the multi-minute delays and $20+ gas fees common on other blockchains.

🧐 WAFFT View: SOL Pros & Risks

| 🟢 Turbo Advantage | 🔴 What to Watch |

|---|---|

| Sub‑second finality + ~$0.0005 fees → user experience as good as (or better than) Apple Pay. | The network has suffered outages in the past; upgrades have reduced downtime, but keep a fallback rail ready. |

| Official infrastructure ( Solana Pay ) makes non‑custodial integration plug‑and‑play. | You rely on a single “super‑chain”; if your wallet’s node goes down, the POS halts until it resynchronizes. |

| Native stablecoins (USDC, PYUSD) mint on Solana → choose to get paid in a stable or volatile asset, depending on your risk. | Auto‑swaps on DEXs add tiny extra fees (still just cents)—factor these into your pricing. |

At WAFFT, we’re not here to give investment advice—just the wake-up call your wallet needs.

🔧 WAFFT Power Tips

📲 Dual-QR checkout – Create a single QR code that lists both SOL and USDC as payment options. When the customer scans it, they pick the coin they like, and you receive the funds instantly—no extra steps, no currency juggling. (Bonus: you can even print the code for offline, in-person sales and it still works.)

🔄 One-tap auto-swap – Connect your wallet to an aggregator such as Jupiter or Orca. The moment SOL hits your address, it’s auto-converted to USDC inside the same transaction, so your accounting stays in stable dollars and you dodge price swings. (Routing fees are usually less than 0.3%, so the swap still costs just pennies.)

🎮 Gamified cashback – Some Solana dApps drop NFT badges with every purchase. They work like digital loyalty stamps: customers collect them and unlock perks, and you skip building a separate rewards program. (Example: BonkRewards dishes out collectible badges that stack into merch discounts.)

Official site: solana.com

WAFFT Final Note

Solana wasn’t built to be your everyday wallet, yet with micro-cent fees and video-game speed it can pay for your bubble tea before you even finish your first sip. Less to the middleman, more to every tapioca pearl!

Monero (XMR)

🔹 Monero (XMR) — The Invisible Ghost of Transactions 👻

🔸 Why it matters

🔒 Nuclear privacy → Monero combines three core technologies to make tracing virtually impossible:

Ring Signatures mix your transaction with dozens (or even hundreds) of others, so an outside observer can’t tell which input in the group is yours.

Stealth Addresses generate a one-time destination for every payment, meaning only you and the sender know where funds landed—no address reuse.

RingCT (Ring Confidential Transactions) hides the exact amount being sent, so outsiders see a valid transaction but know nothing about its value.

• Together, these layers ensure that neither the sender, the receiver nor the transaction amount can be linked or revealed—true “nuclear” privacy. ☢️

🌐 ASIC resistance → In many blockchains, mining is dominated by expensive, custom-built machines called ASICs (Application-Specific Integrated Circuits). Monero fights this by using a CPU/GPU–friendly algorithm, so:

Anyone with a regular computer (your laptop’s processor or a gaming graphics card) can mine XMR—no need to buy a $10K ASIC rig.

Mining power stays distributed among thousands of hobbyists and small operators, not concentrated in giant data centers.

⚖️ Dynamic supply → Monero issues new coins at a steady, predictable rate of about 0.6 XMR per minute, which means:

Steady, low inflation: Instead of large “block rewards” that flood the market, Monero’s slow drip keeps annual inflation under 1%, and that rate shrinks over time.

Long-term scarcity: As emission falls, existing XMR become relatively more valuable—helping the coin act as both a reliable store of value and a medium of exchange.

• In short, Monero’s controlled, continuous emission balances incentives for miners with protection against runaway inflation—making it both a practical payment token and a sustainable digital savings asset. 💰

🛡️ Bulletproof network → For over 10 years, Monero’s code has never suffered a flaw that froze funds or let attackers steal coins. That unbroken record of on-chain reliability builds cryptographic trust: you know the protocol has been battle-tested and won’t let your money down.

🌐 Real-world use cases (With names and places!)

| Case | WAFFT Detail |

|---|---|

| 🇻🇪 Venezuela Remittances | Platforms like Hodl Hodl (+120 active P2P offers) and various Telegram escrow communities enable XMR → bolívares without currency control blocks. |

| 🇦🇷 Argentina Merchants | CryptoSI (IT consultancy) and jewelry stores in Palermo Soho (Buenos Aires) accept XMR to protect VIP transactions from peso devaluation (15–20 ops/month). |

| 💊 Humanitarian Aid | ProtonMail receives XMR donations (visible on xmrchain.net) to avoid freezes in Haiti and Sudan. |

| 🌍 Anti-leak Services | Njalla (DNS/VPN) and Flokinet (hosting) operate exclusively in XMR for anonymous payments (policy confirmed on their official websites). |

| 🛒 Privacy Retail | Nitrokey (hardware wallets) and IVPN (top-5 VPN service) run 100% on XMR to prevent corporate tracking (30%+ in XMR sales since 2024). |

"Monero's landscape shifts rapidly. Always verify real-time status via xmrchain.net explorer and community discussions at r/Monero before trusting any platform or liquidity claim."

⚠️ WAFFT Risk

🚫 Hostile exchanges → Major platforms like Binance (delisted XMR in 2024) and Kraken (only available in the U.S. with strict Level-3 KYC) block private access to Monero. To trade XMR without revealing identity:

• Use atomic swaps (P2P wallet-to-wallet trades) via audited protocols like farcaster.xyz (limit: 0.1 BTC/XMR ≈ $6,000).

• Or turn to decentralized exchanges like haveno.exchange — no intermediaries, no forced KYC, and no delisting risk.

📉 Variable liquidity → The Monero market moves $156 million daily (vs. $18,400 M for Bitcoin*), so large orders (>$10,000) can cause up to 8% slippage.

✨ WAFFTip:

☆ For trades over $10,000, use Bisq.network (decentralized P2P exchange):

• Standard lots up to 0.5 BTC per order.

• No KYC and virtually zero slippage: pairs settle between users on an open order book.

• Indicative fees: 0.1% maker / 0.7% taker (about half if paid in BSQ).

👉 Open the app, go to DAO › BSQ wallet › Receive for real-time BSQ offers; check “Trading Fee” and the order book to see spreads before moving capital.

📯 Just a heads-up—this isn’t investment advice!

Official site: getmonero.org

WAFFT Final Note

In WAFFT: The Path to Wealth, Monero is your weapon when:

An oppressive government freezes accounts.

Competitors spy on your payments to suppliers.

You prioritize sovereignty over convenience.

“Bitcoin makes you traceable. Monero makes you invisible. Choose your side.” 👁️🖤

(DASH)

🔹Dash (DASH) — The Lightning Bolt of Digital Corner Shops ⚡

🔸Why it matters

- 1‑second payments ⏱️ → With InstantSend, transactions are locked and confirmed in ~1 second. (Real-world speed, not just “lab results.”)

- Microscopic fees 💸 → Moving $50 costs ~0.0001 DASH (≈ $0.001). Almost free, even during peak usage.

- DAO treasury 🔁 → 10% of each block goes to a community fund for marketing, adoption, and education—everything voted on-chain.

- Rock-solid infrastructure 🧩 → Over ten years online without serious outages. It just works.

🌐 Real-world use cases

- Micropayments in LatAm 🌮 → Food-trucks, small shops, and urban transport already accept it thanks to speed and zero banking friction.

- Crypto ATMs 🏧 → ATMs that dispense cash in exchange for DASH in seconds.

- Plug-and-play wallets 📲 → Official apps with InstantSend and private mode built in.

⬆️ Tech details without the headache

- ⚙️ InstantSend → A network of masternodes (each collateralizing 1,000 DASH) signs the transaction and secures it in 1 s.

Want to learn more? Dive into the official breakdown here: What is Dash InstantSend and how does it work?. - ChainLocks 🔒 → A second “lock” seals the newly mined block in ~2 s, preventing reorganizations and 51% attacks.

- Integrated DAO 👥 → Proposals are funded from the communal pool; the community decides.

- PrivateSend 🕶️ → Optional mixing of inputs for extra privacy (not anonymous by default).

⚠️ WAFFT Risk

PrivateSend makes some regulators uneasy—several strict‑KYC exchanges have delisted DASH.

Plan B: Always have another route (USDT, LTC…) ready in case your favorite platform restricts access.

📊 Flash comparison

| Token | Avg Speed | Typical Fee | Key Difference |

|---|---|---|---|

| SOL | ≤ 0.4 s | ≈ $0.00025 | Ultra-fast, no DAO |

| DASH | ~ 1 s | ≈ $0.001 | DAO + optional privacy |

| XRP | ~ 4 s | ≈ $0.0005 | Banking‑focused |

(No investment advice—just hard facts, bro.)

💭 WAFFT Take

Dash is that friend who shows up, pays, and disappears before the line moves. It doesn’t brag, but its combination of speed, tiny cost, and community funding makes it a secret weapon for micropayments and remittances.

Official site: dash.org

WAFFT Final Note

In WAFFT: The Path to Wealth, Dash earns a spot when you need to move fast and spend less—no drama, no delays. Whether it’s street food, a tip, or a cross-border transfer, it just works.

“Fast, cheap, and always on time—Dash doesn’t wait in line, it skips it.” ⚡💸

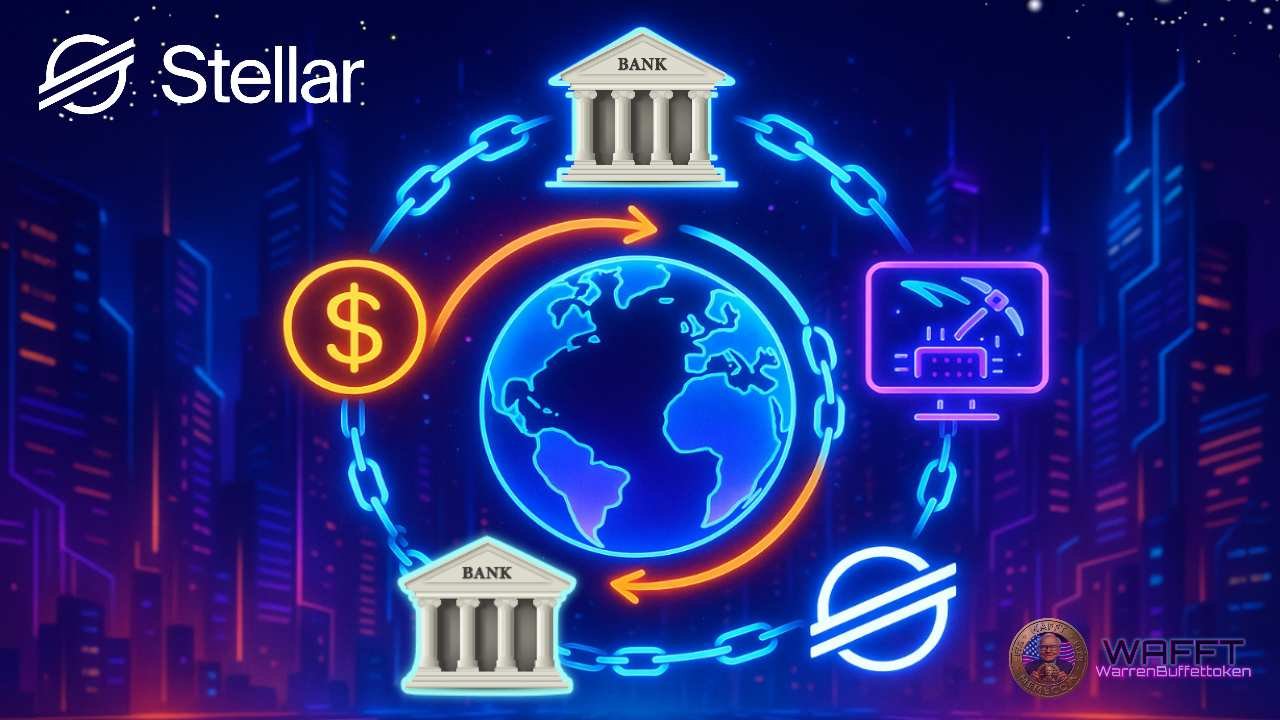

Stellar (XLM)

🔹Stellar (XLM) — The Supersonic Mailman of Remittances ✈️

🔸 Why it matters

- Settlements in ~5 seconds 🌠 → Stellar’s Consensus Protocol uses federated consensus (FBA), a system where each participant (or "node") chooses a few trusted others to form their own "quorum." These overlapping trust groups make the network reach agreement fast—without the need for energy-hungry mining. That’s how Stellar confirms transactions in about 5 seconds. Fees? Tiny: around 0.00001 XLM (≈ $0.000001).

- Institutional liquidity 💼 → IBM, MoneyGram, and Circle leverage Stellar for real-time fiat transfers; native USDC already moves billions over the network.

- Global anchor network 🌐 → Stellar relies on a system of anchors: licensed financial institutions or fintechs that act as bridges between local fiat currencies (like USD, EUR, NGN…) and the XLM blockchain. Anchors issue fiat-backed tokens and handle deposits/withdrawals. With over 90 anchors worldwide, users can convert between fiat and crypto easily—some even allow onboarding without mandatory KYC/AML, depending on local regulations.

🌐 Real-world use cases

- On/off-ramp fiat‑crypto 💳 → With MoneyGram, you deliver USDC to a wallet, the store scans a QR, and cash walks out the door instantly; backend runs on XLM.

- Stellar Disbursement Platform 🌍 → NGOs and agencies like UNHCR distribute tokenized vouchers to refugees; they’re redeemed in seconds without requiring bank accounts.

- 24/7 remittances 💸 → Payment apps use XLM to bypass banks, time zones, and high fees: send ARS (Argentine pesos) and your cousin receives PHP (Philippine pesos)—all in one jump. This means local currencies are automatically converted mid-route, letting users transfer value across continents without needing bank accounts or manual exchanges.

🧠 Technical details without headaches

- SCP & Quorum Slices 🧩 → Each validator picks trusted peers; consensus is quick without mining.

- Anchors & Asset Issuance 🏦 → Regulated entities issue 1:1 fiat tokens that travel at XLM speed.

- Path Payments 🔄 → Stellar finds the cheapest route, executing conversion in one move.

- Soroban Smart Contracts 🖥️→WebAssembly-based engine with predictable fees and no gas surprises.

(WebAssembly is a fast, secure format that lets contracts run efficiently without unexpected fee spikes—ideal for developers and predictable apps.)

⚠️WAFFT Risk

- Relative centralization 🏗️ → Many validations go through nodes close to the Stellar Development Foundation, though it's decentralizing yearly.

- Anchor dependency 🚧 → If a fiat issuer fails or breaks the peg, the corresponding token (e.g., USD‐XLM) could lose value. Always have a Plan B—like USDT or USDC on another network—to avoid getting stuck with a useless token.

- More payments, less DeFi 🔒 → Stellar focuses on fast, secure payments and compliance—not on wild yield farms. Don’t expect high APYs; think stability and utility instead.

📊 Quick comparison

| Token | Avg Speed | Typical Fee | Main Focus |

|---|---|---|---|

| XLM | ~ 5 s | ≈ $0.000001 | Remittances & fiat on/off ramps |

| XRP | ~ 4 s | ≈$0.0005 | Wholesale banking |

| DASH | ~ 1 s | ≈ $0.001 | Fast retail payments |

| SOL | ≤ 0.4 s | ≈ $0.00025 | DeFi apps & extreme speed |

(Just facts; not investment advice.)

💭 WAFFT Take

Stellar is digital airmail: delivering value where others don’t even take off, with micro-costs and compliance features trusted by real-world operators.

Official site: stellar.org

👉 Follow us on X, Telegram, and Instagram — just tap the icons at the top of the page and share the terms that spark your interest with your friends. At WAFFT, we build wisdom, not noise — the kind of clarity the elites would rather you didn’t have. 💥📲

WAFFT Final Note

“Stellar isn’t here to dazzle—it’s here to deliver. In a world of hype, quiet efficiency is the real flex.” 🌐💸

(XRP)

🔹XRP — The Express Lane for Banks & FinTechs 🏦

🔸Why it matters

- Settlement in ~3 s ⚡ → The XRP Ledger (XRPL) settles payments in just a few seconds with dust-level fees (≈ $0.0002).

- On-Demand Liquidity (ODL) 💧 → Businesses can send currency A → B without pre-funding nostro/vostro accounts. XRP acts as the bridge asset—currency A is converted into XRP, sent instantly, then converted into currency B, eliminating the need to lock up capital in intermediary accounts.

- RippleNet’s global network 🌍 → Over 50 countries connected; banks and PSPs (Payment Service Providers—authorized platforms that execute electronic payments on behalf of businesses and users) move millions of dollars daily outside of SWIFT.

- Legal clarity 📜 → The U.S. GENIUS Act confirms that regulated payment tokens (including XRP) are not securities—reducing legal uncertainty for all transactions on the ledger. While the federal licensing framework applies specifically to stablecoin issuers, its affirmation of payment tokens’ non-security status also benefits other payment tokens on the network.

🌐 Real-world use cases

B2B Treasury 🏢 → Instead of routing payments through SWIFT—where your money hops through several correspondent banks (each taking time to process, reconcile and charge fees, and often requiring you to pre-fund “nostro/vostro” accounts (i.e. accounts that banks hold with each other, funded in advance to facilitate cross-border clearing))—you do this:

On-Ramp: Your SME sends local currency (USD, EUR, JPY, etc.) to a regulated crypto provider or exchange and swaps it for a payment token (e.g. XRP or USDC).

On-Chain Transfer: That token moves directly over the blockchain to your Asian supplier’s wallet in minutes (or seconds), not days.

Off-Ramp: The supplier uses a local on-ramp/off-ramp service to convert the token back into their local fiat and receive it in their bank account.

Key benefits:

⏱️ Speed: Settlement in minutes instead of 1–3 business days.

💸 Lower costs: You pay only the small network fee, no multi-bank markups.

🔍 Transparency: Every swap and transfer is immutably recorded on-chain—no hidden steps. That’s the beauty of crypto and blockchain 🤩: everything’s out in the open. No behind-the-scenes tricks, no smoke and mirrors—just verifiable moves you can track like receipts on a group chat.

🔓 Capital efficiency: No need to lock up funds in pre-funded correspondent accounts (these are traditional bank accounts that companies must maintain in foreign countries just to process cross-border payments 🌍). With XRP, that middle step disappears: your working capital stays in your control until the exact moment you need to pay. That's the kind of freedom blockchain unlocks.

With this flow, B2B treasurers get near-instant, low-cost, fully transparent cross-border payments—replacing SWIFT delays and expensive nostro/vostro requirements with a seamless crypto rail.

- Stablecoin rails 🏗️ → Issuers tokenize MXN, EUR, or USD on XRPL for instant interbank payments.

- Corporate liquidity 🏭 → Large remittance companies use ODL to eliminate pre-funding, freeing up capital and reducing FX costs.

🧠 Tech breakdown made easy

- RPCA consensus 🔄 → 120 validators reach agreement every 3–5 s, without mining or staking.

- Built-in DEX & AMM 🏦 → On-chain order book plus XLS-30d liquidity pools (an AMM, or Automated Market Maker, is an automated mechanism that creates “pools” of two tokens and adjusts prices in real time based on supply and demand), all within the same ledger for direct, hassle-free swaps. This becomes a full-fledged DEX, combining the best of order books and AMMs in a single platform.

- Hooks & smart features 🖥️ → Lightweight scripts (on testnet) enable automated payments and compliance without unpredictable gas.

- Optional clawback 🛡️ → Regulated assets (e.g., bank-issued stablecoins) can be revoked by the issuer if required—something regulators love. (Think of it as a blockchain “chargeback”: if there’s a court order, fraud, or a hack, the issuer can freeze or claw back tokens to keep things legit.)

👀 What to look out for

- Ripple seeks U.S. bank license 🏛️ → Ripple is applying for its OCC banking charter under the GENIUS Act—once approved, it will be able to issue RLUSD and custody its reserves directly with the Federal Reserve.

- ERP & API integrations 🔗 → Accounting software providers are adding XRPL support for automated reconciliations.

- CBDC pilots 🏦 → Central banks are testing XRPL sidechains for national digital currencies.

⚠️ WAFFT Caveat

- Regulatory past ⚔️ → The SEC vs Ripple case shook its price, though XRPL never stopped processing payments.

- Jurisdiction risk 🏷️ → If regulators reclassify XRP as anything other than a “utility token,” institutional access could be limited. Always have a plan B (USDC, XLM…).

📊 Quick comparison

| Token | Speed | Typical Fee | Main Focus |

|---|---|---|---|

| XRP | ~ 3 s | ≈ $0.0002 | Banking rails & ODL |

| XLM | ~ 5 s | ≈ $0.000001 | Retail remittances & anchors |

| SOL | ≤ 0.4 s | ≈ $0.00025 | DeFi & high throughput |

| DASH | ~ 1 s | ≈ $0.001 | In‑store instant payments |

(Data for reference; not investment advice.)

🌟 WAFFT Bonus Stats

• On-chain volume — XRPL processes over 2 million transactions daily on average, with payments making up nearly 60% of total.

• Real decentralization — There are more than 150 active validators; Ripple itself runs only one—universities, exchanges, and independent operators manage the rest.

• GENIUS Act in context — This new federal law confirms that payment stablecoins aren’t securities and opens the door to bank licenses for issuers like Ripple.

Official site: xrpl.org

WAFFT Final Note

XRP is the high-speed highway connecting banks, fintechs, and stablecoins under one roof. With the GENIUS Act’s regulatory clarity and Ripple’s banking license bid, the lane is widening to move tokenized dollars in seconds. 🛣️

Nano (XNO)

🔹Nano (XNO) — Fee-Free Digital Cash ⚡

🔸 Why it matters

- Zero fees—literally 🆓 → Nano’s block-lattice is a type of DAG (Directed Acyclic Graph): imagine every wallet owning its own tiny blockchain. When you send XNO your wallet writes a send-block, and the receiver writes a receive-block on their chain—no one else competes for space, no miners have to approve, so there’s no gas and no fee, whether you move $100 or $0.01.

Blink-and-it’s-done speed ⚡ → Average settlement time is ~0.3 s; the payment hits before you even blink.

Tiny carbon footprint 🌍 → A single transaction uses less energy than sending an email—perfect if you don’t want to leave a CO₂ trail when you pay.

Plenty of breathing room 🚀 → Even on a normal laptop-grade server, the Nano network has been stress-tested at about 1,000 transactions per second (TPS)—roughly 60,000 payments a minute—so your money still lands in a blink, even when the network is buzzing at full throttle.

🌐 Real-world uses

Streaming tips & donations 🎮 → Twitch, Reddit, and tech forums use Nano for instant tips—because, unlike traditional platforms that keep up to ~30% as a “cut”, Nano lets 100% of your money reach the creator in real time.

Bubble-tea in inflation zones 🧋 → In economies where every cent counts, XNO lets you pay for a bubble tea without bleeding profit in payment fees: zero-fee transfers mean the vendor keeps virtually 100% of that small-ticket sale, preserving tight margins even under runaway prices.

- Geo-reward micro-payments 📱 → With the WeNano app (official download at https://wenano.net), the system distributes little sprinkles of XNO: you open the map, walk around your city, and when you enter a hotspot you receive fractions of Nano with no fees. It’s like Pokémon GO, but instead of catching creatures you’re hunting tiny, fee-free Nano drops that fall straight into your wallet.

🧠 Tech side—plain-English edition

Block-lattice 🧩 → Think of thousands of mini-blockchains—one per account. No global bottleneck.

Open Representative Voting (ORV) 🗳️ → Users delegate their voting power to representatives who confirm transactions. No mining, no staking, hence no fees.

Today there are 150 + active reps; no single node holds more than ~15% of vote weight, cutting capture risk.

Finality that’s free & fast ✅ → With no miners or stakers, there’s no gas auction—everyone pays zero and gets confirmation in seconds.

Theoretical throughput ⚡ → Community tests show peaks around 1,000 TPS; the limit is hardware, not protocol.

🫗 Liquidity snapshot

Over a 24-hour period, XNO (Nano) trading volume moves about ~$770 K (roughly $770,000 in buys and sells), primarily on centralized exchanges like Binance or Kraken. This activity is concentrated in XNO/USDT and XNO/BTC pairs, which feature deep order books—that is, ample liquidity with many active buyers and sellers, preventing easy price swings.

✺ Not every CEX lists it, so check availability before moving big sums.

⚠️ WAFFT Warning

Security rests on the representatives: if you hold large balances, spread your delegation across several trusted reps so one outage can’t freeze you. And because there’s no staking, you won’t earn “passive yield”—Nano is pure spendable cash, not farming fodder. 💸

🏌️♂️Flash comparison

| Token | Typical fee | Speed | Energy use | Star use‑case |

|---|---|---|---|---|

| XNO | $0 | ~ 0.3 s | Tips / micro‑payments | |

| XLM | $0.000001 | ~ 5 s | Low | Fiat remittances |

| DASH | $0.001 | ~ 1 s | Medium | Retail payments |

| BTC (LN) | $0.0005 | ms | Low | Micro‑payments |

(No investment advice—just hard facts, bro.)

👀 WAFFT at a Glance

Nano is like snapping a digital coin: instant, planet-friendly and truly fee-free. It’s tailor-made for those tiny payments where even a single cent in fees would spoil the fun—whether you’re firing off a $0.25 boost to your favourite streamer or grabbing a bubble-tea on the street, the full amount lands in seconds with no middle-man skimming a cut. 🎥🧋⚡

Official site: nano.org

WAFFT Final Note

✺ And remember: in WAFFT: The Path to Wealth, we turn everyday folks into finance wizards. Follow along, and whenever a money term trips you up, just type it in—chances are we’ve broken it down for you already, simple and practical. 🚀📚

(CELO)

🔹CELO — Mobile Money & Stable-First 📱

🔸 Why it matters

Designed for low-cost phones 🤳 → Lightweight wallet, SMS-friendly and biometric login; runs smoothly even on a $50 Android.

Native stablecoins 💵 → cUSD, cEUR and cREAL live on-chain and can be used for gas fees, so you never have to juggle two tokens.

User-Friendly Proof-of-Stake 🌳 → Validators lock up CELO to secure the network, and any user can delegate from just 1 CELO to a validator group and earn around 5% APY in rewards—no need to run your own node.

Fraction-of-a-cent fees 🪙 → Transactions cost mere fractions of a cent thanks to a proof-of-stake protocol optimized for mobile networks.

Mento Reserve 🏦 (backing cUSD, cEUR & cREAL) → Crypto-collateral fund + oracles keep the peg in check; if markets swing wildly, the reserve cushions the impact.

Want to explore how Mento really works? Check out the deep-dive box below! 📦⬇️

Mento Reserve Explained 🏦

📦[WAFFT Explains]

The Mento Reserve is Celo’s on-chain “ballast tank” that keeps native stablecoins (cUSD, cEUR & cREAL) pegged to their target values. Here’s the nutshell:

The Collateral Pool 🏊♂️ (backing assets): a smart-contract–governed fund holds crypto assets (CELO, ETH, etc.) to back every stablecoin in circulation.

The Oracles 🕰️ (price feeds): decentralized data providers continuously update the on-chain value of the collateral.

The Stability Buffer ⚖️ (peg adjustment): if market swings threaten the peg, the reserve automatically buys or burns stablecoins—using the collateral as a shock absorber.

The Governance Controls 🗳️ (community oversight): CELO holders vote on which assets back the reserve, set minimum reserve ratios, and adjust protocol fees to keep everything rock-solid.

Because all adjustments happen on-chain and under protocol-defined rules, anyone can inspect the reserve’s health in real time.

🔗 Dive deeper into the mechanics in the official Mento Reserve documentation

- Scalability on the horizon 🚀 → Celo 2.0 will become an Ethereum Layer 2, inheriting mainnet security without losing its tiny fees.

🌐 Real-world uses

Cash relief in Africa 🌍 → NGOs send cUSD straight to phone numbers (e.g., Valora Wallet); recipients cash out or save without a bank.

P2P farm markets 🚜 → Farmers list produce in WhatsApp-style groups; buyers pay in cUSD and receive goods instantly.

Street commerce 🛒 → Moto-taxi drivers in Kigali and food stalls in São Paulo accept cREAL via simple QR scans.

Valora Wallet 📲 → Official app (iOS/Android) syncs in seconds and lets you send stablecoins to any contact using just their phone number.

🧠 Tech without headaches

Phone-number keys 🔢 (account alias) → Your SIM becomes your account ID; sending crypto is as easy as an SMS.

Ultra-light clients (Plumo) 💡 → Plumo is Celo’s official ultra-lightweight client framework for mobile devices: it uses compact cryptographic proofs (Verkle proofs) to verify the blockchain and stay in sync even on weak 3G connections.

PoS validators 🌳 → ~110 nodes secure the network; you can delegate from as little as 1 CELO.

+2 million wallets 📈 → Unique addresses since 2020 (per CeloScan).

⚠️ WAFFT Warnings

Peg risk 🏷️ → A severe drop in collateral value could stress cUSD, cEUR or cREAL—monitor the Mento Reserve health.

Regulatory fog 🌫️ → SMS-based KYC is light; some jurisdictions may impose extra checks on humanitarian or nonprofit transfers. Keep a backup option (e.g., USDT, XLM).

| Network | Fee range | Mobile-first | Native stables | Star use case |

|---|---|---|---|---|

| CELO | < $0.001 | ✅ | cUSD, cEUR, cREAL | NGO aid / retail |

| XLM | ≈ $0.000001 | ✅ | External anchors | Fiat remittances |

| SOL (Pay) | ≈ $0.00025 | ❌ | USDC/SPL | High‑speed checkout |

| DASH | ≈ $0.001 | ❌ | None | Physical POS |

(Just facts; not investment advice.)

🔍 WAFFT Analysis

Celo puts QR payments and native stablecoins in every pocket—no fuss, sub-cent fees, instant settlements, and a UI even your grandma’s old phone can handle. From humanitarian cash drops to P2P micro-markets and true “branchless banking,” it proves that money on-chain can be both simple and powerful. 🏦🌍⚡

Official site: celo.org

WAFFT Final Note

Think of Celo as your pocket-sized superhero🦸🏼♂️: it swoops in to rescue the unbanked, small biz owners, and anyone tired of bank fees. It’s not just tech—it’s financial freedom served with a side of dignity. Ready to join the revolution? 🤙🚀

WAFFTer Quick-Take 🔥

| Token | Speed* | Typical Fees** | Key Thesis |

|---|---|---|---|

| BTC (Lightning) | < 1 s | < $0.001 | Permissionless global remittance |

| LTC | ~ 2.5 min | < $0.01 | Retail payments & exchange bridge |

| SOL | ~ 0.4 s | < $0.001 | Ultra-fast for DeFi and in-store payments |

| XMR | ~ 2 min | ~ $0.005 | Privacy-preserving digital cash |

| DASH | ~ 1 s | < $0.01 | Instant payments ➕ DAO-funded growth |

| XLM | ~ 5 s | < $0.01 | Remittance corridor & on/off-ramp |

| XRP | ~ 3 s | ~ $0.001 | Interbank B2B rails |

| XNO | ~ 1 s | $0.00 | Tips & micropayments |

| CELO | ~ 5 s | < $0.01 | Mobile-first stablecoin economy |

* Average time for funds to be considered final on each payment rail (layer-2 in the case of BTC Lightning).

** Fees may fluctuate with network congestion; values shown are typical under normal conditions.

🎯 WAFFT Final Zap

The moment Visa’s swipe fee costs more than your network fee, users will sprint to the chain where every tap is cheap and the sub-penny gas is invisible.

Payment tokens win on speed, user experience, and real-world partnerships. Choose the highway that fits your use-case, not the shiny logo—because in payments, the best marketing is a confirmation that lands before the waiter drops the check. 💳🏃♂️💨

🚀 Thirsty for next-level money moves? Crack open WAFFT: The Path to Wealth and level up from curious scroller to wallet-wielding wizard. Smash that follow button, join the WAFFTers, and snatch our meme-powered money hacks on every feed. Your financial glow-up starts now—let’s light it up! ✨📈🔥💸

Why Payment Tokens Matter

Payment tokens are the unleaded fuel of the crypto economy: if stablecoins are the savings account and governance tokens are the neighborhood vote, payment tokens are the street coins. From WAFFT, here’s why they matter today:

💸 Break the Fee Monopoly

Every time Visa or PayPal takes 2%–3% for “processing,” a payment token charges ~0.1$.

That means more margin for the barista, the streamer, or the NGO.

With real micropayments (pennies), business models flourish that the traditional system crushes with fees.

🕒 24/7/365, No Questions Asked

No bank holidays, no time zones; money flies the same on a Sunday at 3 AM.

Perfect for global freelancing, late-night e-commerce, and remittances that don’t wait for Monday.

🔓 Censorship Resistance

Governments freeze accounts; payment networks block entire countries (for example, SWIFT or PayPal can cut off all transactions to and from a sanctioned nation). But a truly decentralized payment token—running on hundreds of independent nodes worldwide—has no single “off switch,” so it keeps confirming transactions even if a minister despises your meme. For activists and crisis-ridden economies, that unstoppable flow of funds isn’t a luxury—it’s financial survival.

⚡ Lightning-Fast UX

Layer-2s, DAGs (Directed Acyclic Graphs—a blockless ledger that confirms each transaction individually for extreme speed), or turbo blockchains: transaction finality in milliseconds.

The experience feels as instant as Apple Pay, but without the invisible toll.

🌍 Remittances 8× Cheaper

Migrants send wages home paying pennies instead of an 8% fee and an hour in line.

The savings go to food, education, and micro-businesses—not into Western Union’s balance sheet.

🛠️ On-Ramp to Crypto Life

Buying your first NFT, entering DeFi, paying for an AI node… it all starts with a token you can actually spend.

If stablecoins are the passport, payment tokens are the SIM card to navigate the crypto city.

🚀 Fuel for Emerging Economies

Countries with galloping inflation adopt payment tokens because their local currency is melting.

Merchants accept crypto directly: less cash, less theft, fewer counterfeit bills.

🧪 Innovation Playground

NFT cashback, block lotteries, invisible streaming tips: payment tokens are financial Lego.

Whoever controls the payment rail controls the user experience—so elites try to slip in CBDCs “with freebies.” WAFFT says: learn the tech before they package it for you.

♻️ Eco-Angle

Zero cash trucks, zero paper money: less carbon in the money logistics.

Networks like Lightning or DAGs consume less energy per transaction than a web search.

🎯 WAFFT Final Note

Elites thrive on opaque fees and restricted banking hours; payment tokens break them with lines of code and a couple of nodes. Learn to use them, teach your grandma, and keep what’s yours: every satoshi, every SOL, every penny in fees you don’t pay is free capital to build your path to wealth (and to fund another espresso, if you prefer). Don’t know where to start? Send a dollar on Lightning and feel the difference. 💳 🏃♂️ 💨

👉 For those charting these waters, remember to tap into our "Google of money"—the ultimate search engine for crypto and finance—to stay ahead of the curve. 🚀

Stay free, stay informed, stay WAFFT.

Things to Keep in Mind — Payment Tokens Edition

📉 Volatility ≠ Stability

- BTC can swing ±10% during your coffee break; Litecoin and SOL aren’t immune either.

- WAFFT rule: If you don’t want surprises, invoice in stablecoin or auto-swap at the end of each day.

🌊 Fees Change with the Tide

- Cheap Lightning today → on-chain congestion tomorrow → opening/closing channels gets pricey.

🤔 What Are Lightning Channels?

📦[WAFFT Explains]

What is a channel? 🤔

A Lightning channel is a private payment lane between two nodes (for example, you and your supplier). It works like an open tab: you can swap funds instantly without touching the main chain each time.

Example → 🧋

A local bubble-tea shop and a regular customer open a channel for the day. The customer “tabs” each drink purchase off-chain—instantly and for free—and at day’s end they settle the net total on-chain in a single transaction.

How to open a channel ➡️

1. Both parties agree on an amount of BTC to “lock” in a multisig script (a special wallet setup that requires signatures from both parties).

2. You publish that funding transaction on the Bitcoin blockchain (this is on-chain and incurs fees).

3. Once confirmed, the channel is live: you can move funds back and forth by exchanging signed balance updates—no further on-chain transactions needed.

How to close a channel ⬅️

Cooperative close 🤝: Both parties exchange a final signed closing transaction and publish it on-chain, redistributing funds according to the last agreed balance.

Unilateral (force) close 🚨: If one party won’t cooperate, you can broadcast your latest signed state on-chain; it takes longer to finalize and usually costs higher fees.

In short, opening or closing a channel requires one on-chain transaction at the start and one at the end, while all intermediate micro-payments happen off-chain for free. That’s why if the base layer gets congested, opening/closing channels becomes more expensive.

🟥 Single-Rail Risk

Relying solely on Solana means that if the network ever restarts for maintenance or hits a bug, all your customer payments stop—no QR scans go through and no funds clear until Solana is back online. Spread your payment options across multiple rails—e.g.:

LTC Layer-1 for cheap, straightforward BTC-style transfers.

Bitcoin Lightning (Layer-2) for instant, micro-payments.

Stablecoin Layer-2 (USDC on Polygon, Arbitrum, etc.) for price certainty.

🫵 Let your customers pick the network they trust most. If one goes down, the others keep your till ringing—and you never miss a sale.

🔐 Custody & Security

- Mobile POS with a hot wallet = convenience + hacker risk.

- For balances > your daily coffee budget, move funds to a hardware wallet or multisig.

- Enable 2FA—even for your cat’s account.

🏦 Fiat Conversion

- Not every country has low-fee on/off-ramps BTC → fiat.

- Calculate spread + taxes; sometimes it’s a hidden 2%.

- WAFFTip: Use a reputable P2P service or on-chain stablecoin for a better rate.

🏛️ Shifting Regulations

- Some governments classify crypto payments as “international transfers” (extra taxes).

- Privacy tokens (Dash PrivateSend, XMR) may get banned on exchanges.

- Keep income records—tax authorities won’t accept “I lost my keys” as an excuse.

🔄 Chargebacks vs. No-Chargebacks

- Pro: crypto payments are final → no fraudulent reversals.

- Con: if a customer mistypes an address, the money’s gone.

- For e-commerce, offer clear support and a manual refund policy.

💧 Point-of-Sale Liquidity

- Accepting Nano or XLM is cool, but… do you have a quick way to cash out into fiat or stable?

- Check daily volume on your local pairs; avoid “ghost crypto” that’s hard to liquidate.

♻️ Network Sustainability

- Lightning and DAGs are energy-light, but pure proof-of-work (PoW) eats power.

- Show your customers you pick the eco-friendly route when you can.

🏁 WAFFT Reality Check

Payment tokens are freedom in QR form, but freedom demands responsibility. Know your rails, have a Plan B, and don’t be seduced by a shiny logo alone. Remember: on the financial game board, the “oops, I lost my keys” square costs more than any Visa fee. Stay ready, stay WAFFT.💪🚦

What’s Next? — The Future of Payment Tokens

Paying with crypto today is already fast and cheap, but the party is just getting started. Here’s WAFFT’s radar on what’s coming 📡: trends, wild inventions, and the elite’s greenwashing traps. Read it now and it’ll still smell like the future years from now.

🤖 Autonomous Payments (IoT-Pay)

- Electric cars that buy kilowatts directly from the charger using Lightning or SOL → no Visa, no app.

- Refrigerators that reorder milk and pay micro-bills of 0.01 USDC.

- Each device with its own wallet; you just set the limit.

⚡ Layer-2 Everywhere

- BTC Lightning (a second-layer network for instant, off-chain Bitcoin payments), ETH Layer-2 rollups (which bundle many transactions off Ethereum’s mainnet into one) and “hyperchains” like Celestia (specialized chains for data availability and settlement) will move payments in milliseconds (~400 ms).

- Gas fees become invisible: they’re automatically deducted in the same token you’re spending, so end users never see a separate “0x…” fee line—your grandma will just tap and pay without ever knowing about transaction hashes or extra charges.

🌉 Native Bridges, No More Wrapped

L1 and L2 will talk via secure, signed cross-chain messages (CCIP, IBC 2.0), passing transaction proofs directly between networks.

Instead of locking up USDC on one chain and minting “wrapped USDC” on another (via custodial bridges that can be hacked), you’ll move the same USDC token natively across all chains.

🪪 Zero-Knowledge Identity Wallets

Prove age without ID 🆔→🔒: Use cryptographic proofs (zero-knowledge proofs) to confirm you’re “over 18” without ever uploading your passport or driver’s license. (Imagine tapping a button to prove you’re 18+ without showing your passport.)

Modular KYC 🧩: Share only the minimum data required by law (e.g., age, residency), keeping the rest of your personal info private.

☆ With these wallets, you get privacy and compliance in one: your identity checks out, but your full details stay in your control.

🏛️ Stablecoin 2.0 & RWA Rails

- Checkout with tokenized T-Bills, gold, or S&P indices on-chain.

- You choose to get paid in USD, bonds, or digital grams of gold.

💸 Streaming Money & Sub-Second Salaries

- Salaries drip every 10s; freelancers get paid by the minute worked.

- Artists receive tens of sats/sec on streaming platforms instead of a monthly check.

🛡️ Smart Compliance On-Chain

Real-time AML checks 🔍: Automated algorithms scan the mempool (the pool of pending transactions) and block any payments to sanctioned addresses—no personal data leaked. (Think of it as a bouncer that only checks the guest list, not your ID photo.)

Selective privacy & audit 📋: Share just enough info to satisfy compliance—then prove it on-chain for instant, tamper-proof audits without revealing your full identity.

☆ With smart compliance on-chain, you get the best of both worlds: robust sanctions enforcement and privacy protection, all in milliseconds. (At WAFFT, we’re not fans of anything that limits freedom—yet if we want to merge the best of traditional finance and crypto, we need to find a middle ground. 😮💨)

🌱 Green Blocks → Mandatory Marketing

CO₂ per transaction display 🌿

DAG and Layer-2 networks will compete by showing their on-chain carbon footprint (in some cases, even less CO₂ than sending a single email).

(For instance, Polygon zkEVM reports just ~0.05 Wh per transaction, setting a high bar.)Filter by efficiency ⚖️

Customers can set their wallets or checkout plugins to “only rails with footprint <0.1 Wh,” ensuring you actually back the lowest-impact networks.Watch for greenwashing traps 🚨

Some projects may game the metrics—offsetting instead of reducing emissions, or excluding data-heavy operations. Always dig into the protocol’s whitepaper (or your favorite WAFFT deep-dive) before trusting the badge.

☆ The elites will jump on the “save the planet” bandwagon, plastering their logos with green badges—so you’ll soon see every chain shouting its eco-credentials. But don’t let the marketing haze distract you: look at the real numbers.

📱 Crypto-Native NFC & Biometrics

Tap, Sign, Pay 🏷️

Wearable rings, stickers or embedded NFC chips let you complete a transaction with a simple tap—no wallet app to open.Biometric Locks 🔐

FaceID or fingerprint scans replace PINs and seed phrases, so you authorize payments in cafes or on public transit without exposing sensitive keys.No Seed, No Stress 🌪️

Your private key stays sealed in a secure element—if your device is lost or stolen, biometrics and PIN backup keep funds safe.Real-World Use Case ☕

In a camera-filled coffee shop, just tap your ring and glance at the reader—transaction done before your latte art cools.

💥 CBDC vs. Free Token Market

- Central banks will launchCBDCs with “free” cashback… funded by stealth inflation.

- Permissionless payment tokens will be the anti-surveillance alternative.

☆ WAFFT Rule: if they pay you to use it, read the fine print—the tax is called money printing.

🎯 WAFFT Final Note

The next rails will make the grocery store POS as fast as a TikTok swipe and as cheap as sending a GIF. But technology is neutral: the elites will try to wrap their digital leash in gift paper. Learn the free rails today and avoid the golden cage tomorrow.

👉 WAFFTer Task: open a Lightning channel with ~$20 and send $1 to a friend (close the channel during low-traffic hours to save fees). Feel the future in three seconds.

Stay WAFFT, stay rebel 💪

WAFFT Wrap-Up — Payment Tokens

Payment tokens are living proof that money can move as fast as a meme and without paying tolls to any financial empire. Today you settle a cold brew with SOL for mere cents; tomorrow your electric car will pay for its own recharge via Lightning ⚡ while you queue up your favorite podcast 🎧.

Freedom of hours ⏰: 24/7/365, no “bank holiday.”

Microscopic fees 💸: what used to be 3% becomes ~0.1$.

Zero censorship 🚫: if your QR works, no one can freeze your life.

Permissionless innovation 🛠️: micropayments by the second, ZK identities 🔐, and eco-friendly L2 rails 🌱.

The elites will never explain this on TV 📺; they’d rather have you accept “cashback” with their CBDC and smile 🙂. WAFFT says the opposite: learn the free rail now, experiment with a satoshi, and teach your family how to store a seed and sign a payment. Every fee you DON’T pay, every border you cross with a QR code, is one fewer brick in the wall they’ve built to watch your wallet.

👉 Master your rails, diversify them, and never let anyone else hit Send for you.

☆ Stay WAFFT—take control, share knowledge, and pay your cold brew in milliseconds ⏱️.

Wanna explore other token types taking over the crypto world? Don’t be shy—click away! ![]() Below, you’ll find clickable names that’ll teleport you straight to each section. Still curious or looking for anything related to crypto, traditional finance, or economics? Hit up our search bar and find everything you need to level up your knowledge.

Below, you’ll find clickable names that’ll teleport you straight to each section. Still curious or looking for anything related to crypto, traditional finance, or economics? Hit up our search bar and find everything you need to level up your knowledge.

Let’s go! ![]()

![]()