WETH — The ERC-20 Suit for Ether

🧐 What it is:

WETH is ETH wrapped into an ERC-20 token. Because native ETH isn’t ERC-20 (no approve/transferFrom), many DeFi protocols can’t handle it directly. WETH fixes that: convert 1:1 ETH → WETH to “speak ERC-20” wherever it’s required — and unwrap 1:1 back to ETH when you’re done.

🔑 Key facts:

🔢 Decimals: 18

🧾 Canonical contract (Ethereum L1):

0xC02aaA39b223FE8D0A0e5C4F27eAD9083C756Cc2— (always verify the full checksummed address before interacting)- 🔗 Refs: Etherscan — WETH

💰 Solvency: Fully collateralized 1:1 by ETH held in the contract. Verifiable on-chain.

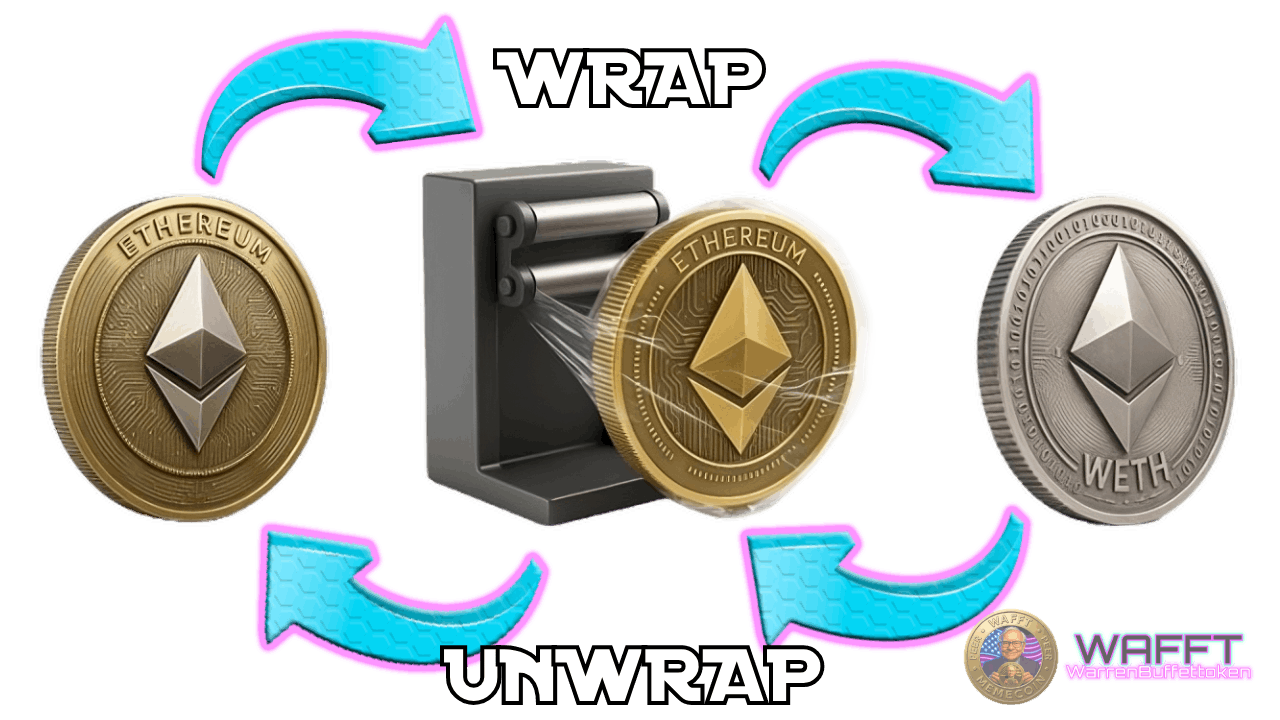

🛠️ How it works: beginner-friendly

- 🔁 Wrap: Call the deposit function and send ETH to the WETH contract. The contract mints the same amount of WETH and credits it to your address at a 1:1 rate.

- Mint: Creating new tokens in the contract’s internal ledger.

- Units: ETH uses 18 decimals on-chain. Internally, amounts are in wei; 1 ETH = 1e18 wei.

- Mint: Creating new tokens in the contract’s internal ledger.

- Also valid: Many WETH contracts auto-wrap if you send ETH directly to the contract address; the contract internally executes deposit and mints WETH to your address.

- Also valid: Many WETH contracts auto-wrap if you send ETH directly to the contract address; the contract internally executes deposit and mints WETH to your address.

- 🔄 Unwrap: Call the withdraw function with the amount you want to burn. The contract burns that amount of WETH and sends the same amount of ETH 1:1 to the calling address (the caller).

- Burn: Permanently removing tokens from circulation.

💫 WAFFTip: If you want the ETH to arrive at a different wallet, first transfer the WETH to that wallet and have that wallet execute withdraw.

- Burn: Permanently removing tokens from circulation.

- ⚙️ERC-20 behavior: Once you hold WETH, it behaves like any ERC-20. You can:

- transfer to send tokens.

- approve to grant a third party a spending limit (allowance) — revoke.cash

- transferFrom to let that third party move your tokens within the approved limit — ERC-20 Approve and TransferFrom

- balanceOf to check an address’s balance — ERC-20 balanceOf

- totalSupply to see the total number of tokens in existence.

- transfer to send tokens.

- ⛽ Fees (gas): The WETH contract does not charge a protocol fee. You only pay gas, which is the network fee in ETH. Some applications may add their own fee and should display it before you confirm.

- ⚠️ Important: Keep some ETH for gas; you cannot pay gas with WETH.

- ⚠️ Important: Keep some ETH for gas; you cannot pay gas with WETH.

- 🧪 Quick example:

✺ Wrap 1 ETH → deposit transaction → you receive 1 WETH. (You send 1 ETH to the WETH contract via the deposit function; the contract mints 1 WETH to your wallet, and you pay a small network (gas) fee in ETH.)

✺ Unwrap 0.5 WETH → withdraw transaction with 0.5 ether (i.e., 500000000000000000 wei) → you receive 0.5 ETH back at the calling address.

The amount is passed in wei because the blockchain represents values as integers (no decimals).

🔄 Remember: the operation returns 0.5 ETH, but the transaction also consumes gas (paid in ETH).

💡 Why it matters:

- 🔐 Approvals: Giving permission for a contract to move your token.

Imagine handing a cashier a slip that authorizes spending up to X$ from your account.👉 approve is that: you authorize a contract (e.g., a DEX) to move your s without having to sign every transfer. This enables automated “swap”-style flows without prompting each time.

🔗 Review or revoke allowances: Etherscan Token Approval Checker · Revoke.cash

🔗 Create or update an approval on-chain: Etherscan — WETH (Write Contract)

- 🤝 transferFrom: The movement that uses that permission.

If you already granted permission, the contract calls transferFrom and moves your WETH for you. It’s the practical execution of the permission: the contract takes the token from the owner and puts it where it belongs, all in a single logical operation.🔗 Do it on-chain (transferFrom): Etherscan — WETH (Write Contract)

- 🧩 ERC-20 standardization: Everyone speaks the same language.

Native ETH does not follow ERC-20, which forces developers to write special-case code. WETH is ETH in ERC-20 form: same standard, same functions (approve, transfer, balanceOf, etc.). That simplifies code and speeds up integrations: if your contract understands ERC-20, it can already handle WETH with no extra tricks.🔗 vReference: ERC-20 Standard (EIP-20)

- 🏧 AMMs/DEXs (Automated Market Makers / Decentralized Exchanges): Token vending machines.

These automated systems need ERC-20 tokens to quote prices and execute swaps. With WETH you can put ETH into those pools like any other token: provide liquidity, make swaps, earn fees. WETH makes ETH “compatible” with the machines.

- 🎨 NFT marketplaces and auctions: Uniform payments and rules.

Many NFT markets expect ERC-20 tokens for transfers, deposits, and auctions. If you want to bid or receive payments in “ETH,” converting it to WETH makes it straightforward: same call, same logic, no workarounds.🔗 Guide: OpenSea Help — What is WETH

- 🏦 Vaults/strategies/compound actions: Multiple moves in a single play.

Complex strategies (e.g., you deposit, stake, and reinvest) need to move tokens across several contracts within one operation. WETH enables atomic operations (everything in a single tx): you deposit WETH into a vault and the contract can route it without asking you for multiple signatures.🔗 Explore vaults: Yearn Docs — Vaults

- ☢️ Atomic operations (all-or-nothing): Everything or nothing, without getting stuck halfway.

If a workflow bundles several steps (swap → add liquidity → stake), doing it in a single transaction prevents you from getting stuck mid-process. WETH lets contracts execute those steps internally using transferFrom, etc., and if anything fails, the tx reverts—you don’t get stuck.🔗 Background: ethereum.org — Transactions (atomicity)

- 🧭 UX / Auto-wrap: The app does it for you.

Many dApps detect when you need WETH and automatically call deposit behind the scenes (or show “Convert ETH → WETH” as a step). For the user it feels like magic: you sign and the app handles the rest, because internally it needs the asset to be ERC-20.🔗 Example interface: Uniswap Web App

✩ WAFFT summary: WETH matters because it turns ETH into a token that all DeFi contracts and UIs understand. That enables permissions (approve), automatic transfers (transferFrom), clean integrations with AMMs/marketplaces/vaults, and compound operations in a single tx—in short, it makes ETH as flexible and composable as any ERC-20 token. ✨

💼 Use it for:

- 🧪 Provide liquidity and trade on AMMs/DEXs: WETH pairs with almost everything (e.g., WETH/USDC). If you provide liquidity, you deposit WETH alongside another token and receive LP tokens — they represent your share of the pool and the fees it earns; swaps with WETH are straightforward and don’t require odd adapters.

✺ Short example: you want to add liquidity on Uniswap V3 — deposit WETH + USDC into the corresponding pool.

🖼️ Bid and list on marketplaces/auctions that accept ERC-20: Many markets allow payments in WETH for bids or purchases (convenient because it follows the ERC-20 standard).

✺ Short example: in NFT auctions that accept tokens, paying in WETH enables instant transfers using transferFrom.

🧰 Vaults, yield & on-chain automations: Tools that manage strategies (deposit, reinvest, rebalance) usually require ERC-20. With WETH you can deposit your “tokenized” ETH and let the contract handle the automation.

✺ Short example: a vault receives WETH, allocates positions, and rebalances without you having to sign each step.

📒 Treasury / on-chain accounting: For projects or DAOs, it’s easier to track inflows/outflows when ETH is in ERC-20 form (balanceOf, events). WETH simplifies on-chain reporting and reconciliation.

✺ Short example: a project treasury keeps its reserve in WETH to make ERC-20 payments and move funds programmatically.

🔁 Bridges and cross-contract flows (composability): When multiple actions must be chained within a single transaction (swap → add liquidity → stake), WETH lets contracts pass tokens between themselves without special conversions.

✺ Short example: a contract calls transferFrom to pull WETH, performs a swap, and deposits the result — all in a single transaction.

🛡️ Allowance hygiene & security:

🔍 Approval = permission for a contract (e.g., a DEX or a vault) to move your tokens on your behalf up to a limit you define.

🧼 Review your approvals periodically: Over time you grant permissions to many dApps and then forget them. Open the “Token Approvals” section in the explorer or use a revocation tool to see which contract can spend how much of your WETH and revoke what you no longer use.

🔗 Useful links: Etherscan — Token Approvals / Revoke.cash — Approval Revoker

- 🔒 Avoid unlimited approvals (unlimited): An “unlimited” is like giving a blank check. Convenient, yes (it won’t ask every time), but if that dApp becomes insecure, the risk is greater. It’s better to approve only what you will use; if you already granted an unlimited, revoke it when you’re done and, if needed, approve a specific amount again.

🧠 How to read an approval in the UI: It usually says “Allow this contract to spend up to X WETH.”

🔸 Spender: the contract that will be able to spend (e.g., the DEX router).

🔸 Amount: the spending cap. If you see “unlimited” or an enormous number, that’s the no-limit mode.

- 🖊️ permit (EIP-2612) vs traditional approve:

🔸 Traditional approve: you send an on-chain transaction to grant permission (you pay gas).

🔸 permit: you grant permission with an off-chain signature (no gas for that approval).

🔸WETH9: (canonical) does not have permit; some alternative wrappers (e.g., “WETH10”) do implement it, but don’t assume it: if the token doesn’t support permit, the dApp will ask for a normal approve.

🔗 References: EIP-2612 — Permit / WETH10 — GitHub

- 📨 Permit2 is not part of WETH9: Some dApps use Permit2 (a signature-based permission system) to manage approvals more conveniently. That belongs to the dApp, not a native WETH9 feature. Before signing, read carefully: which token? how much? who (spender) will be able to spend? If something doesn’t add up, cancel.

🔗 Reference: Uniswap Docs — Permit2

- 🧩 Scope of approvals (what they cover): An approval is per token and per contract. If you revoke the approval of WETH → Spender A, it does not affect WETH → Spender B or other tokens. This lets you clean permissions selectively without breaking everything.

- 🧿 Phishing and fake “WETH”: Always verify that the token is the canonical one:

🔸 Exact checksummed address (don’t trust the name alone).

🔸 Decimals = 18 for WETH.

🔸 Your explorer marks the contract as verified and correctly referenced. If the name says “WETH” but the address doesn’t match your network’s official one, it’s not the right token.

🔗 Quick check: Etherscan — WETH token page

- 🧰 Mini-procedure to revoke (step by step):

🔸 Open “Token Approvals” / a revocation tool.

🔸 Connect your wallet in read-only mode.

🔸 Filter by WETH → identify the spender you no longer use.

🔸 Click Revoke → confirm (you’ll pay a bit of gas).

🔸 Done: that contract can no longer move your WETH.

- 🧪 Why this matters with WETH: WETH is used in AMMs/DEXs, vaults, and automations thanks to approve/transferFrom. That power comes with responsibility: you control who can move your WETH and up to how much. Approval hygiene lets you enjoy DeFi composability without leaving doors open.

💡WAFFTip : monthly routine — review approvals → limit by amount → revoke the old stuff.

At WAFFT lab, this is the pro investor’s “hand-washing.” 🧼👐

⚠️ Watch out for…

- 🧭 Not a bridge or a peg:

🔸 Bridge = moving value across chains.

🔸 Peg = fixed parity backed by reserves.

WETH doesn’t do that: it only wraps your ETH on the same network in ERC-20 form and unwraps 1:1 on that same network.

✵ Example: WETH on Arbitrum → ETH on Arbitrum (not L1). For L2 ↔ L1 you need a separate bridge.

🔗 Background: ethereum.org — Bridges / ethereum.org — Layer 2

💤 Not yield-bearing: Holding WETH in your wallet doesn’t earn interest. The yield comes from where you use it (pools, lending, strategies). WETH is the key; the yield is behind the door. 🔑

📝 Final note:

WETH is ETH’s universal adapter in DeFi. Master it, and you’ll move your Ether like a pro—fast, clean, and no drama-free. It’s the bridge between raw ETH and the ERC-20 world. And if you ever need to clarify a concept, search it in WAFFT’s own "Google of money". 🔎🚀

Mini-glossary

🔸 Smart contract: A program that runs on Ethereum exactly as written; it can hold funds and enforce rules automatically.

🔸 ERC-20: A common set of rules for tokens on Ethereum; defines standard functions such as transfer, approve, balanceOf, and others.

🔸 Gas: The network fee paid in ETH to execute a transaction or call a contract.

🔸 Wei: The smallest unit of ETH. 1 ETH = 1,000,000,000,000,000,000 wei (1e18). Contracts operate internally in wei.

🔸 deposit: WETH function for wrapping: you send ETH and receive WETH 1:1.

🔸 withdraw: WETH function for unwrapping: you burn WETH and receive ETH 1:1 at the address that executes the call.

🔸 Payable: Indicates that a function can receive ETH along with the call.

🔸 Caller: The address that initiates the transaction; when unwrapping, the ETH is sent to this address.

🔸 Mint / Burn: Create or remove tokens within the contract’s accounting.

🔸 Allowance: A spending limit you grant to another address (for example, a dApp) so it can move your tokens on your behalf.

🔸 Approve: Action to set or update that spending limit.

🔸 TransferFrom: Movement of tokens by the authorized third party, always within the allowance.

🔸 Total supply: The total number of tokens that exist for that contract.

👉 Up next: explore wstETH — Wrapped Staked Ether (Non-Rebasing) and learn how Ethereum staking meets ERC-20 perfection: fixed balances, yield through exchange rate, and seamless composability. 🧩⚡