Technical Indicators:

Can you imagine entering an amusement park without a map? That's what the world of finance feels like without indicators. 📊 Those magical tools are the ones that tell you if you're riding the roller coaster of an uptrend or if you better buckle up because an epic downturn is coming.

🚀 Let's break this down to make getting into the markets as fun as a fairground ride. 🎡

What are Financial Indicators? 📊✨

Financial indicators are essential tools in the trading and investment universe, acting as true compasses for those seeking to successfully navigate the often turbulent seas of the market. 🧭 Designed to analyze trends, spot opportunities and better understand what's happening in the financial environment, these instruments are essential for beginners and experts alike.

If you've ever felt overwhelmed looking at charts full of lines, bars and colors that don't seem to make sense, don't worry: indicators are here to help you bring order to all that chaos. They are like your secret allies in the market, translating the “language” of prices, volumes and trends into something you can understand and, more importantly, use to make informed decisions.

But they're not just for analyzing numbers: financial indicators also give you key insights into human behavior in the market. Yes, markets are not just numbers; behind every price movement there are emotions, fears and ambitions. That's why indicators not only measure data, but also capture the emotional pulse of the market.

And why are indicators so important? 🤔✨

Imagine driving a car with no GPS, no road signs and a broken speedometer. Sounds like a recipe for disaster, right? Well, the same is true in the world of trading and finance if you try to navigate without indicators. These small but powerful instruments are the eyes and ears of any investor, providing essential information to make informed decisions.

📈 Detecting clear trends

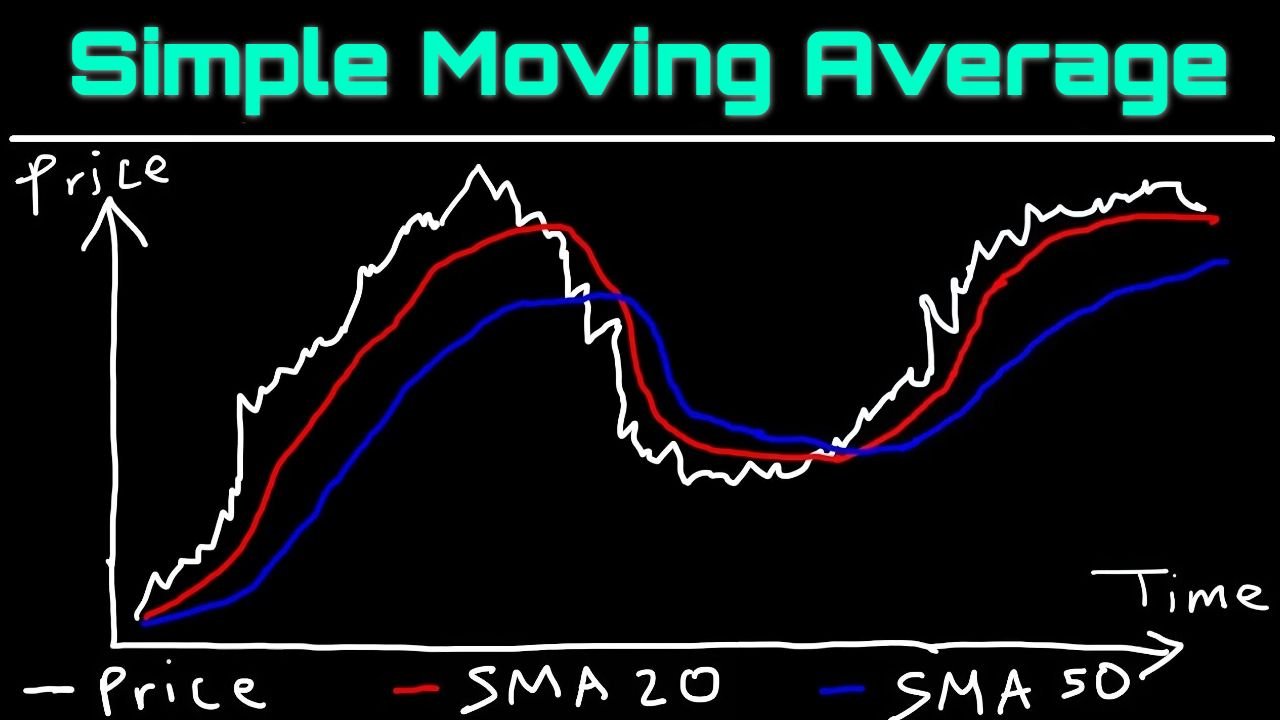

One of the biggest challenges when analyzing the market is identifying where it is heading. Indicators such as moving averages not only smooth out market noise, but also show you whether an asset's price is following an uptrend, downtrend or sideways trend. Detecting these trends can make the difference between maximizing profits or suffering unnecessary losses.

📊 Pinpoint key action points

There are critical moments in the market that define your strategy, such as knowing when an asset is overbought or oversold. Tools like the RSI (Relative Strength Index) alert you to these situations, helping you avoid buying at the peak of a bubble or selling just before a rally. It's like a proximity sensor that tells you if you're too close to a danger or opportunity.

⚖️ Confirm moves before acting

Making impulsive decisions can be dangerous in the market. This is where indicators like the MACD (Moving Average Convergence/Divergence) come into play. This indicator helps you verify whether a trend is strong enough to justify a market entry or exit. It is like the wise companion that gives you the go-ahead before you make a major move.

🛠️ Customized to your needs

Every strategy is unique, and indicators are as flexible as Swiss Army Knife tools. Are you a short-term trader? Use the Stochastic for fast movements. Prefer long-term analysis? Try the ADX (Average Directional Index) to measure the strength of the trend. There's an indicator for every trading style!

🚀 Reduce risk and increase confidence

Trading without a clear plan can be scary. Indicators give you a roadmap based on data, not emotions. This not only reduces the risk of making bad decisions, but also increases your confidence knowing you are backed by solid technical analysis.

Bottom line

Financial indicators are more than numbers on a screen; they are your strategic allies. They help you navigate complex markets with greater precision, minimizing risks and maximizing opportunities. Without them, trading would be like jumping into the void without a parachute. And now, ready to explore in detail how they work and which ones are the most useful?

Read on! ![]()

What do indicators do?🧐

Financial indicators are like that expert friend who always has a timely tip. 🏎️💨 They take market data - such as prices, volume, and time - and process it through mathematical formulas to turn it into useful, visual information. In other words, they transform numbers into clear signals that help traders decide whether it's time to buy, sell, or wait.

Imagine you're driving on a winding road: indicators would be the road signs that tell you when to brake, accelerate or turn to keep you on the right track. 🚦

Types of Indicators: More than Math📊

Although indicators are grouped into different categories based on their focus, they are usually divided into two main types:

1. Technical Indicators🛠️

These analyze historical market data, such as prices and volume, to identify patterns and trends. They are especially useful for predicting future movements and are often favored by short and medium-term traders.

Popular examples:

Moving Average (MA): Smoothes price fluctuations to detect general trends.

- RSI (Relative Strength Index): Indicates whether an asset is overbought or oversold.

- MACD (Moving Average Convergence/Divergence): Helps identify changes in the direction of trends.

Here, we’ve looked at some of the most well-known examples. But watch out—these aren’t the only ones. Within technical indicators, we can also distinguish various subtypes based on their focus:

Trend indicators 🏔️

- Momentum indicators ⚡

- Volume indicators 📈

- Volatility indicators 🌪️

In another section further down (patience—it’s coming soon!), we’ll dive into the details of the most important indicators in each category. Plus, we’ll explore the different variations you can use to fine-tune your analyses. This way, you’ll continue your education with WAFFT and become the investor you were meant to be.

Let’s go! 🚀

2. Fundamental Indicators🔍

These focus on analyzing economic and financial factors to determine if an asset has an attractive intrinsic value (that means being aware of Macroeconomics, Geopolitics and crumbling company data). They are used more for long-term investments and not so much for quick trades.

Key examples:

Price-Earnings Ratio (P/E Ratio): Assesses whether a stock's price is overvalued relative to its earnings.

- Return on Investment (ROI): Measures how much return an investment generates compared to its initial cost.

Although both types are important, here we will focus on technical indicators, as they are the most commonly used by those looking to take advantage of short- and medium-term price movements.

But for our community, there are no secrets. In another section of WAFFT: The Path to Wealth, we’ll dive deep into everything you need to know to understand what a “fundamental analysis” is. And that’s not all: in another article, we’ll teach you how to analyze a company based on those fundamentals.

Want to get started right away? Just go to the search bar and type “fundamentals” (or any other financial term that interests you), and that’s it! ⚡🔍✨

Let's keep onbuilding the best f#@king financial guide on the web!🫣![]()

How do Technical Indicators Help?🎁

1. Detect Trends📈

An indicator can help you answer key questions such as:

Is the price rising, falling or moving in a sideways range?

- Is the current trend strong or losing strength?

For example, a 200-day Moving Average can confirm an uptrend if prices are consistently above it.

2. Identifying Key Moments🕒

Is it a good time to enter the market or should you wait? Indicators such as RSI or Stochastic can alert you if an asset is overbought (potential downside) or oversold (potential rebound).

3. Confirm Signals✅

Don't rely on a single piece of data; indicators work best in aggregate. For example:

MACD can confirm that the trend identified by a Moving Average is actually gaining strength.

Bollinger Bands can indicate whether the price is ready to break out of a range.

4. Manage Risk⚠️

In addition to looking for opportunities, indicators also serve to identify risks. If volume decreases dramatically during an uptrend, it could be a warning sign that buying strength is drying up.

Tips for Getting the Most Out of Indicators🧙♂️

1. Don't abuse them: More is not always better. Using too many indicators can generate contradictory signals.

2. Customize the parameters: Adjust the periods and settings according to your trading strategy.

3. Use them as a complement: Indicators are not infallible; always use them together with other analysis, such as fundamental analysis or pattern analysis.

4. Test before use: Before applying an indicator to your real portfolio, test it on a demo account to understand how it works in different scenarios.

WAFFT Conclusion

Technical indicators not only make traders' lives easier, they also offer a clearer perspective on market behavior. By understanding how to use them correctly, you can make more informed decisions and reduce the impact of emotions on your trading.💓❄️

Key Technical Indicators and how they work🎯

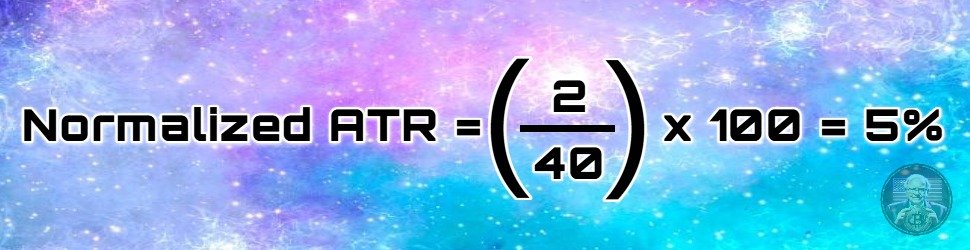

Financial indicators are essential tools for traders and investors. They provide valuable insights into market trends, price movements, and potential entry or exit points. Below, we're going to break down the types of technical indicators in true WAFFTstyle, and you might be wondering, types? Yes, types: Trend Indicators 🏔️, Momentum Indicators ⚡, Volume Indicators 📈, and Volatility Indicators 🌪️. We'll explore some of the most commonly used indicators in detail, explaining their purpose, calculation, and practical applications.

Trend Indicators🏔️:

These types of indicators help identify whether a market is rising, falling or moving sideways.

Momentum indicators⚡:

They measure the speed of price movements.

Volume indicators 📈:

They analyze how many people are buying or selling.

VWAP: The intraday trader's compass

The VWAP is like that cousin who is not 100% of the family, but is always at the important meetings. It doesn't measure volume directly like other indicators, but uses it as its main ingredient to calculate an average price “with substance.” The result? A super useful tool that mixes price and volume to help you find key levels in the market. So yes, we can technically lump it into the volume indicators, though it has its own personality. 😎📊

Want to know what the famous VWAP is all about and why everyone is talking about it? 🤔 At WAFFTlabs, we love to break down these concepts so you can understand them like a pro. 🎓✨ Here's what it is, how it works and why, even though it's not 100% a volume indicator, it has everything to be in this category.

What is the VWAP?🎯

The VWAP (Volume Weighted Average Price) is basically the average price of an asset over a period of time, but with an important twist: it is volume weighted. This means that it does not just take random prices and averages them, but gives more weight to prices where more volume is being traded.

In other words, the VWAP is not just any “average price”; it's the price where the important things are really happening, where the big players in the market are moving their money. Think of it as the “just price” of the day, the level that tells you where the real action is. 💰

And who are the big fans of this indicator? Intraday traders. 🎯 For them, VWAP is a key tool because it helps them identify whether they are buying or selling at competitive prices compared to the market average. They also use it to find potential support or resistance levels in their quick and strategic trades.

But it's not just intraday traders who use it; fund managers and institutional traders also consider it an important benchmark to assess whether a trade is executed efficiently during the day. It's like their compass in a market that never stops moving. 🧭

So when you hear about VWAP, you know: it's not just another number, it's a tool that combines price and volume to give you a key break-even point in the markets. Perfect for those looking for precision and efficiency. 🚀

How does VWAP work?🔎

As you may already know, thanks to WAFFT😁, theVWAP (Volume Weighted Average Price), or Volume Weighted Average Price, is a key tool in the financial markets. How it works is based on the idea of combining price and volume to get an average value that reflects where money is actually moving over a period of time.

Let's break it down so you understand it 100%!

🧮Step-by-Step: How VWAP is Calculated

The VWAP calculation is based on a simple but powerful formula:

1️⃣ Key multiplication:

First, you take each price at which a trade is executed and multiply it by the volume traded at that price. This ensures that prices where there was more activity (more volume) have more relevance in the calculation.

2️⃣ Cumulative sum:

Next, all the results obtained in the previous step are added together. This is the “weighting” that gives strength to the indicator.

3️⃣ Magic division:

Finally, the total sum is divided by the total volume traded in the period. This results in the volume-weighted average price, i.e., the VWAP.

Complicated? Don't worry, charting magic does the heavy lifting. You just need to know what it means. 🎩✨

💯Practical example of VWAP calculation

Imagine that a stock has the following prices and volumes traded for one hour:

Price 1: $100, Volume: 1,000

- Price 2: $105, Volume: 2,000

- Price 3: $110, Volume: 3,000

To calculate the VWAP:

- Multiply:

- $100 × 1,000 = $100,000

- $105 × 2,000 = $210,000

- $110 × 3,000 = $330,000

- Add totals:

- $100,000 + $210,000 + $330,000 = $640,000

- $100,000 + $210,000 + $330,000 = $640,000

- Divide by total volume:

- $640,000 ÷ 6,000 = $106.67

The VWAP would be $106.67, which means that this is the volume-weighted average price for that period.

🧑🏽💻What does the VWAP look like on a chart?

On charts, the VWAP is shown as a solid line that moves along with the price throughout the day. But it's not just any line; it's a reference point that indicates the weighted average price up to that point.

If the price is above the VWAP, it indicates that buyers are in control of the market.

- If the price is below the VWAP, sellers are dominating.

🔄How is the VWAP updated?

The VWAP is not static, it changes in real time throughout the day as more transactions are processed. This makes it a dynamic indicator, ideal for intraday trading. However, once the market closes, the final VWAP remains fixed as the weighted average for the entire day.

Conclusion🏁

The VWAP acts as a compass for traders, helping them identify whether they are trading at advantageous prices compared to the market average. Whether for intraday traders looking for quick entries and exits or for institutional investors who need to assess the impact of their trades, the VWAP is a versatile and essential tool. 🌟

So, when you see that line on your charts, remember: it's not just another average, it's a reflection of the price where the money is really moving. 💰🚀

Types of VWAP (in this case, Variations)📚

VWAP itself does not have “types” like other financial indicators that come with multiple variations, but it can be adapted or calculated in different ways depending on the context or trading strategy, these adaptations allow VWAP to be useful not only for intraday traders, but also for swing trading strategies or more detailed analysis.

Below, I explain the most common variants or approaches related to the VWAP:

VWAP Intraday📈: The Key Tool to Optimize your Daily Trading

Attention, trading rookies and future wolves of Wall Street! 🐺💼 Get ready to dive into the fascinating world of intraday VWAP, the indicator that makes even the numbers exciting. 😎📊 If you trade intraday, this indicator is your best friend. Designed specifically to reset at the start of each market session, the VWAP accumulates data from the first trade to the last cross of the day.

Let's take a look at how it works, why it's so popular and how you can use it in your strategies.

🤔How does the Intraday VWAP Work?

1. Start of the Calculation:

When the market opens, the VWAP starts collecting data from the first trade of the day. It records the price of each transaction and the volume traded.

2. Continuous Update:

Throughout the day, the VWAP recalculates in real time. Each new transaction updates the volume-weighted average.

3. End of Day:

At the close of the market, the VWAP stops calculating and is “reset” for the next day. Therefore, it is ideal for analyzing movements within a single trading day.

Why Is It So Popular Among Intraday Traders?

Identifying Key Levels 📍:

- The VWAP is used as a reference to determine whether the current price is “expensive” (above the VWAP) or “cheap” (below the VWAP).

- The VWAP is used as a reference to determine whether the current price is “expensive” (above the VWAP) or “cheap” (below the VWAP).

- Quick Decisions ⚡:

- Intraday traders need real-time signals. By constantly recalculating itself, the VWAP is perfect for this.

- Intraday traders need real-time signals. By constantly recalculating itself, the VWAP is perfect for this.

- Volume and Price Based Strategies 📊:

- Combines price and volume to provide a more complete view of the market, rather than being limited to price alone.

- Combines price and volume to provide a more complete view of the market, rather than being limited to price alone.

Common Uses of Intraday VWAP

1. Institutional Benchmark🏦:

Many institutions use VWAP to measure the efficiency of their trading. If they buy below the VWAP or sell above it, they consider that they have achieved a good price.

2. Algorithmic Trading 🤖:

This is a key tool for algorithms, which use the VWAP to execute orders without impacting the market too much.

3. Entry and Exit Strategies➰:

- Buy: When the price is below the VWAP and starts to rise towards it, it can be a buy signal.

- Sell: If the price is above the VWAP but starts to fall towards it, it can be a sell signal.

4. Dynamic Support and Resistance➖:

The VWAP acts as a dynamic line of support or resistance during the day, depending on whether price is above or below it.

🕒📈Practical Example: Using the VWAP Intraday

Imagine you are trading Tesla stock and you want to use the VWAP (Volume Weighted Average Price) to make decisions during the day. Here I explain step by step how it works and how to apply it on a chart.

Step 1: Configure the VWAP in your trading platform 🛠️

- Open your trading platform (e.g. TradingView or whatever you use).

- Look for the option to add an indicator.

- Type “VWAP” in the search bar and select the indicator.

- Make sure it is set to calculate the intraday VWAP (it usually does this by default).

Step 2: Interpret the VWAP 📊

Suppose the market opens at 9:30 AM, and Tesla starts the day with a price of $200.

- As the price fluctuates, the VWAP begins to be calculated considering both the price and the volume traded.

- During the first few hours, the price rises from $200 to $210, but the VWAP remains at $205.

- This means that, although the price is rising, most of the volume has been traded near $205.

Step 3: Identify signals using the VWAP 🔍

Scenario 1: Price bounces off the VWAP (Buy Signal) 💹

- At 11:00 AM, the price starts to pull back from $210 and goes down towards the VWAP level at $205.

- If the price touches the VWAP and starts to move up again, this may indicate that the VWAP level is acting as a support.

- In this case, it could be a good opportunity to buy, as the price could resume its uptrend.

Scenario 2: Price breaks the VWAP downward (Signal of weakness) 📉.

- At 12:30 PM, the price drops below the VWAP, reaching $202.

- This indicates that the uptrend is losing strength and sellers are taking control.

- Here you might consider closing long positions or even looking for a short-sale opportunity.

Step 4: Add confirmation with other indicators 🔗

VWAP is most effective when used in conjunction with other indicators. For example:

- RSI (Relative Strength Index): if the RSI shows oversold when the price touches the VWAP, the buy signal is more reliable.

- Volume: If the price breaks the VWAP with high volume, the move is more significant.

Step 5: Practical example in action 🎯

1. Initial situation:

- Tesla opens at $200, and the VWAP begins to calculate.

- At 10:00 AM, the price rises to $210, but the VWAP remains at $205.

- This indicates that most of the volume has traded around $205, making it a key level.

2. Bounce in VWAP:

- At 11:30 AM, price pulls back from $210 toward the VWAP at $205.

- Right at the VWAP, the price starts to bounce upward.

- You decide to open a buy position, as the VWAP is acting as support.

3. Breakout of the VWAP:

- Later, at 2:00 PM, the price drops below the VWAP and reaches $202.

- This breakout, accompanied by an increase in volume, indicates that the uptrend is ending.

- You close your buy position and consider opening a short sale.

Advantages of the Intraday VWAP

1. Ease of Interpretation🤩:

Provides a clear and direct reference as to whether the current price is favorable to buy or sell.

2. Relevance for Intraday Trading🏆:

It is specifically designed for traders looking to optimize their intra-day trading.

3. Solid Basis for Algorithmic Strategies🦾:

Its simple yet powerful calculation makes it perfect for automated strategies.

Limitations of the Intraday VWAP

1. Only Relevant in the Short Term ⏳:

Since it resets every day, it is not useful for analyzing long-term trends.

2. Delay in Volatile Markets 🌪️:

During periods of high volatility, the VWAP may lag the current price due to accumulated volume.

3. Not Predictive 🔮:

While excellent as a benchmark, it does not predict future price movements.

🚀Final tips for using VWAP

1. Don't operate with VWAP alone: It is a powerful tool, but not infallible. Use it together with other indicators to confirm your decisions.

2. It works best in intraday: VWAP resets at the beginning of each day, so it is ideal for short-term trading.

3. Look for volume: Movements around the VWAP are most relevant when accompanied by high volume.

4. Avoid false signals in sideways markets: If the price is in a narrow range, the VWAP may generate less reliable signals.

Conclusion🏁

The intraday VWAP is a must-have tool for intraday traders looking for key levels in real time. It acts as a compass in the daily market chaos, helping you determine whether you are sailing with the current or against it. 🚤📊

If you're just starting out in the world of intraday trading, the intraday VWAP should be on your list of favorite indicators. Learn how to use it, understand its limitations and combine it with other tools to maximize its effectiveness. 🚀

Now you're ready to use VWAP like a pro! 🎉📈

Cumulative VWAP📈: A tool for the long term

Want to take your analysis to the next level? 🚀 Then pay attention to Cumulative VWAP, an indicator that does not reset every day like intraday, but accumulates data from a specific starting point to the end of a defined period. This makes it an essential tool for traders looking for a broader perspective of the market, such as swing traders or long-term investors. 😎📊

Let's break it down WAFFT style.

🧐What is cumulative VWAP?

Cumulative VWAP is a technical indicator that calculates the volume-weighted average price from a defined initial moment, such as the beginning of a specific period (month, quarter, year or even from the first day an asset started trading).

This indicator takes into account both price and trading volume at each moment 📈📉 but instead of restarting its calculation every day as the intraday VWAP does, it continues to accumulate the data from the chosen starting point. 🛠️ This allows for a broader, continuous view of how large trading volumes have influenced price over time.

Cumulative VWAP is useful for identifying key price levels where volume is concentrated over long periods, being especially valuable for assessing medium- and long-term trends.

🎯✨ It's like having a giant magnifying glass to see the big picture of the market! 🔍🔥

🤔How does the cumulative VWAP work?

Cumulative VWAP is based on a simple idea: calculating the volume-weighted average price, but with a big difference compared to intraday VWAP: it does not restart every day! 🚫🔄. Instead of starting from scratch every day, this indicator accumulates data from a specific point and keeps updating it over time.

Here I explain how it works step by step, without boring technicalities:

1. Selecting the starting point📅

First, you have to decide from which point in time you want the calculation to start. This is the starting point of your cumulative VWAP, and it depends entirely on what you are analyzing. For example:

- Start of the year: if you want to understand how the annual behavior of an asset has been. 🗓️✨

- Start of the quarter or month: Perfect if you prefer to analyze shorter periods. 📊

- From the first day of the asset: Ideal if you are looking for the full picture since it started trading. 🚀

This starting point is like telling the indicator, “Start working from here!”.

2. Continuous calculation🔄

Once the starting point is set, the cumulative VWAP gets to work. (it starts calculating the volume-weighted average price) As trades are made in the market, this indicator starts calculating:

- Price: the value at which each trade is executed. 💵

- Volume: The number of units traded in that trade. 📦

For each transaction, it multiplies the price by the volume (yes, math, but don't worry, this is all automatic 🖥️), and adds this to the accumulated total. Then, it divides everything by the total accumulated volume up to that point.

👉 What does this mean? Basically, the cumulative VWAP shows you the actual average price, but adjusted according to where the most volume was traded.

3. Update without reset🛠️

Unlike the intraday VWAP (which resets every day at the close of the market), the cumulative VWAP keeps calculating non-stop from the starting point. This means that each time there is a new transaction, the indicator is adjusted and updated to reflect the most recent data.

The result is a super-accurate representation of how large volumes of money 💰 have affected the price over an extended period, without the distractions of daily ups and downs. 🎢

4. Completion of the calculation⏳

The cumulative VWAP keeps running until you decide to stop the analysis. This could be when:

- A period is completed, such as a year or quarter. 🕒

- You want to compare one historical period to another. 🔍

- Or simply because you feel like closing the analysis. 🤷♂️

At the end, you'll get an indicator that shows how the volume-weighted average price has changed since the beginning, giving you a clearer and broader view of the market. It's as if you have a compass guiding you through large and significant trends. 🧭🔥

Now you know how this very useful indicator works! It's simple, logical and gives you the power to analyze the market with more perspective. 🚀

Why is cumulative VWAP useful?

Cumulative VWAP has several advantages that make it perfect for those looking to understand the big picture and not just the daily market swings. Here's why it's so useful:

1. long-term analysis 📆

Intraday VWAP is great if you're a short-term trader, but if you want to see bigger trends, cumulative is your ally. Unlike intraday, which resets every day, cumulative gives you a continuous view that accumulates over time, helping you spot broad trends that you don't see in the short term. If you're interested in how an asset has been performing for weeks, months or longer, this is the perfect indicator. ⏳

2. Stable benchmark 📍

Institutional traders and fund managers love cumulative VWAP because it gives them a reliable benchmark to evaluate how they are managing their trades over time. 👨💼👩💼 While smaller traders may get lost in day-to-day fluctuations, larger market players use it to see overall performance over longer time frames. It's like having a map that tells you if you're heading in the right direction during a long journey. 🗺️

3. Improve swing trading strategies⚖️

If you're a swing trader, you know that the key is to identify the points where the market can change direction over days or weeks. This is where cumulative VWAP shines! ✨ You can use it to find support and resistance zones that are relevant for a good amount of time. It's like you have an indicator that helps you see the boundaries of the market, giving you a better approach to planning your medium-term trades. 📈📉

In short, the cumulative VWAP gives you a broader and more robust view of market movements, ideal for those who want to analyze large trends and are not satisfied with the details of a single day.

It's a powerful tool for traders with a long-term view! 🔮

🕹️Practical example: How to use the cumulative VWAP in your trading

Scenario:

- You are a swing trader analyzing the performance of Apple stock since the beginning of the year. You set the cumulative VWAP to start on January 1 and observe how the price behaves in relation to this key level.

First weeks:

- The cumulative VWAP begins to calculate and, after the first few weeks, you notice that Apple's price remains consistently above the VWAP. This indicates a solid uptrend, as most major transactions occur at prices higher than the weighted average.

Pullback to VWAP:

- In March, the price begins to pull back toward the cumulative VWAP level. If the price bounces off this level, it could be a buy signal, as the VWAP is acting as dynamic support.

Breakout of the VWAP:

- If price breaks below the VWAP with an increase in volume, it could be a sign that the uptrend is losing strength, indicating a possible opportunity to sell or even take short positions.

🌟Advantages of cumulative VWAP

Cumulative VWAP is like a long-range lens that allows you to analyze the market calmly and accurately. Here are its main advantages, explained clearly and concisely (as always😅):

1. Broader view of the market 🌎🔍

This indicator is perfect for those looking for a long-term perspective. Unlike the intraday VWAP, it doesn't reset every day, making it ideal for observing how the price is behaving over longer periods.

- Want to know how the price has evolved since the beginning of the year? Cumulative VWAP is your tool! 📅✨

- It is ideal for traders who are not in a hurry and prefer large-scale analysis.

2. Relevance over extended periods 📊⏳

Cumulative VWAP excels at keeping you focused on what really matters: the key areas that remain relevant for weeks or months.

- It's like having a map where important points don't disappear the next day. 🗺️🎯

- If you're a swing trader or a long-term investor, these support and resistance zones are your pure gold. 🪙💪

3. No intraday noise 🎢🚫

We know that intraday fluctuations can be a headache (they look like a meaningless roller coaster! 🎢). Cumulative VWAP helps you ignore those distractions and focus on the big picture.

- It's like muting the daily chaos to listen to the real symphony of the market. 🎶🎻

- It gives you a much more stable benchmark for analyzing trends and evaluating performance.

In short, the cumulative VWAP is that reliable tool that gives you clarity and stability in a financial world full of ups and downs. 🚀📈

Perfect for those who prefer more leisurely, but equally effective strategies! 💼✨

⚠️Limitations of Cumulative VWAP

Cumulative VWAP is a fantastic tool for analyzing trends and key levels in the market, but like any indicator, it is not perfect. Just as a sports car is not ideal for all types of terrain, cumulative VWAP has scenarios where it may not be the best choice. Here I tell you about its main limitations, so you can use it strategically and knowledgeably. 🚗💡

1. Less useful for intraday 🚀📉

If you are an intraday trader (one of those who seek to take advantage in the fast movements of the day), the cumulative VWAP will not be your best ally.

- Why? Its focus is on analyzing long trends, not capturing small daily peaks and valleys.

- It's like using a telescope to look at something right in front of you. 🔭❌

2. Dependence on the starting point 📅🤔

The cumulative VWAP needs a starting point to begin its calculation, and this decision can greatly influence the results.

- If you choose a bad starting point (e.g., a day of low activity or an unrepresentative period), your analysis may be biased. ⚠️

- It's like starting a story from the wrong chapter: the data may not have the context you need. 📖❓

3. Less sensitivity to recent changes ⏳❄️

Because it accumulates data over an extended period, cumulative VWAP tends to be less reactive to recent events in the market.

- This means that it may be slow to reflect abrupt changes, such as unexpected news or sudden price movements. 📰⚡

- It's like driving a giant truck: powerful, but not as agile. 🚛💨

In summary, while cumulative VWAP is great for seeing the big picture, it's not perfect for all types of strategies. If you're one of those looking for fast action or need high sensitivity to what's happening today, you may need to supplement it with other indicators 😉✨

Conclusion🏁

The cumulative VWAP is like that compass that guides you through the long tides of the market. 🌊📊 Whether you're a swing trader or a long-term investor, this indicator can be an incredibly valuable tool for analyzing key levels and trends more effectively.

Of course, like any indicator, it works best when combined with other tools and strategies. 🚀 So give cumulative VWAP a try and discover how it can transform the way you analyze the market.

Let's conquer those long-term trades! 💼📈

Interval VWAP🔍: Your precision trading ally

Looking to sharpen your market insights? ⚡ Interval VWAP is here to guide you. Unlike traditional VWAP, which resets daily, this version focuses on calculating the volume-weighted average price over specific time intervals—whether it’s hourly, weekly, or custom periods. Perfect for traders who thrive on tailored strategies, it helps you spot key price levels and market trends with laser focus. 🎯📈

Let’s dive deeper and explore how Interval VWAP can give you the edge you need! 🚀

What is the VWAP by specific intervals?

The VWAP by specific intervals is a variant of the VWAP indicator that is adjusted to analyze shorter time periods within a trading session. Instead of being calculated for the whole day, this VWAP is applied only to a defined interval, such as an hour, the open, the close, or any relevant time frame.

This approach allows traders to gain a more detailed and accurate perspective on how price and volume behave at key times, especially in markets with volatility concentrated in certain hours. It is ideal for those looking for a more focused analysis rather than an overview of the entire day.

🤔Interval VWAP: How does it work?

Interval VWAP is based on calculating the volume-weighted average price, but limited to a specific time period. Here is a simple explanation of how it works:

1. Selecting the Time Interval (review)⏳

First, you decide the period you want to analyze, such as:

- One hour, one day or one week.

- A custom period related to a market event (such as earnings announcements or technical breakouts).

The interval acts as the framework where the indicator performs the calculations.

2. Calculation of the VWAP📊

During the defined interval, the VWAP is calculated as follows:

1. Multiply the price of each transaction by the traded volume.

2. Sum all the values obtained in the previous step.

3. Divide the sum by the total volume traded in that interval.

Basic formula:

VWAP = (Price × Volume) cumulative ÷ Cumulative volume

3. Continuous Update🔄

As new transactions occur within the selected interval, the VWAP is adjusted in real time. This means that the indicator always reflects the most recent data during the selected period.

🎯What does the VWAP by Intervals represent?

This indicator shows the volume-weighted average price over a specific time frame, helping you to:

- Identify key levels where buyers or sellers have concentrated their activity.

- Determine whether the current price is above or below the average for that period, which can indicate bullish or bearish trends.

It is an ideal tool for traders looking for accurate analysis within well-defined periods. 🚀

⏰📝Practical example: Using the VWAP for specific intervals

Imagine you are trading in the foreign exchange (Forex) market and you want to analyze how the EUR/USD price behaves during the first two hours of the European session. Here I explain step by step how to set up and use the VWAP for specific intervals to make the most of this key time frame.

Step 1: Set up the VWAP in your trading platform🛠️

1. Open your favorite trading platform (e.g. TradingView).

2. Go to the indicators section and search for “VWAP”.

3. Add the indicator to your chart and adjust its settings so that it applies only to the desired interval, in this case, 9:00 AM to 11:00 AM.

Step 2: Interpret the VWAP during the specific interval📊

Let's assume that at 9:00 AM the price of EUR/USD is at 1.1000.

- During the first hour, the price rises to 1.1050, but the VWAP for this interval remains at 1.1025.

- This means that, although the price rose, most of the volume trading occurred near the 1.1025 level, making it a key reference point.

Step 3: Identify signals with the VWAP🔍

Scenario 1: Rebound on the VWAP (buy signal) 💹

- At 10:00 AM, the price starts to pull back from 1.1050 towards the VWAP level at 1.1025.

- If the price touches the VWAP and starts to rise again, it could indicate that the level is acting as dynamic support.

- In this case, you decide to open a buy position, hoping that the price will resume its uptrend.

Scenario 2: Breakout of the VWAP (weakness signal) 📉

- At 10:45 AM, the price breaks the VWAP and falls to 1.1000 with an increase in volume.

- This indicates that sellers are gaining strength, and you might consider closing your long positions or opening a short position to take advantage of the drop.

Step 4: Confirm your signals with other indicators🔗

Although VWAP is a powerful tool, it works best in combination with other technical indicators. For example:

- RSI (Relative Strength Index): if the RSI shows oversold when the price touches the VWAP, the buy signal is more reliable.

- Volume: If the price breaks the VWAP with high volume, the move is more significant.

Practical example in action🎯

1. Initial situation:

- EUR/USD price opens at 1.1000.

- During the first hour, it rises to 1.1050, but the VWAP settles at 1.1025, signaling a key level.

2. Bounce in the VWAP:

- At 10:15 AM, price pulls back toward the VWAP (1.1025) and bounces.

- You open a buy position expecting the price to rise again.

3. Breakout of the VWAP:

- Later, at 10:45 AM, the price drops below the VWAP and reaches 1.1000.

- You close your buy position and consider opening a short position, as the trend seems to have changed.

Conclusion🏁

The VWAP by specific intervals allows you to focus on the most relevant moments in the market, providing key information on support and resistance levels in short time periods. It is ideal for traders looking to take advantage of concentrated moves at defined times, such as market openings or important economic announcements.💡📉📈

Advantages of VWAP at specific intervals✅

🌟**What is VWAP (Review)**

VWAP (Volume Weighted Average Price) is a tool that combines price and volume to show the average price at which assets have traded over a period of time. Ideal for understanding the “right price” and making informed decisions - a must-have for traders of all levels!🚀

🎯Easy to interpret:

The VWAP is like a compass on your charts. If the price is above the VWAP, buyers are in control, and if it is below, sellers dominate. A clear and simple reference for any interval!🧭

📈Works in any market:

Whether you trade stocks, cryptocurrencies, futures or forex, the VWAP is perfectly suited. Plus, you can apply it at specific intervals such as 1 hour, 4 hours or even daily, depending on your strategy.🌐

⏳Ideal for evaluating trends:

At longer intervals, the VWAP helps confirm whether a move is legitimate or if there could be a pullback soon. Perfect for traders looking for greater accuracy.🚦

📉Key tool for identifying reversals:

When price crosses the VWAP from down to up (or vice versa) in a specific interval, it could be a signal of a change in market direction.Opportunity alert!🚨

🔍Useful for institutional and retail traders:

Institutions use VWAP to avoid moving the market too much when buying or selling in large volumes. As a retailer, you can take advantage of it to trade smarter and align yourself with the “strong hand.” (The smart money)🤝

⚡Configurable to your strategy:

Although the VWAP is a standard indicator, you can customize the intervals to adapt it to your objectives: intraday analysis, swing trading or long term. Flexibility to the max!🔧

👀Clear visual signals:

The VWAP is plotted as a continuous line on your charts. If price is touching or bouncing off the VWAP at key intervals, it's a signal you can't ignore.📊

🛠️Complemento perfect for other indicators:

The VWAP works very well alongside indicators such as RSI, MACD or supports and resistances. Use it to confirm your analysis and avoid false signals.🔗

📊Evaluate the buying/selling pressure:

With VWAP, you can tell if the market is buying above or selling below the weighted average price. This gives you an edge when deciding your entries and exits.📉

Another practical example:

1️⃣If the price is consistently above the VWAP on a 1-hour interval, it could be a sign of a healthy uptrend.

2️⃣If it breaks down on a 15-minute interval, there may be a correction on the way.

⚠️Always remember to analyze the market context and use other indicators for support before acting.

WAFFT Conclusion🏁:

The VWAP is like that friend that gives you the “real” average price to make informed decisions. It is clear, versatile and adaptable to any time interval. Use it wisely and combine it with other analytics to maximize your results.

You control the strategy.🌟

Limitations of VWAP at specific intervals❌

⏳Sensitivity to short intervals:

Over very short periods, VWAP can become unreliable due to insufficient data to reflect actual market volume. This can generate false signals.⚠️

📉It does not predict the future:

VWAP only shows the average of the past. While it is useful for evaluating the current price, it does not tell you where the market will move.🔮

🔍Less useful in markets without significant volume:

In assets with low trading volume, the VWAP loses relevance, as it does not accurately reflect price action.💤

⚡It can lag in rapid movements:

When the market moves explosively, the VWAP tends to react slowly, which could make you late entering a trade.🐌

📊Difficult to use in extended trends:

In strong, extended trends, the price may stay away from the VWAP for long periods, making it less useful as an immediate reference.📉

🔗Requires support from other indicators:

VWAP is not a stand-alone tool. It needs to be combined with other signals, such as supports, resistances or technical indicators, to avoid interpretation errors.👀

🛠️No always works in all markets:

Although versatile, some markets or specific intervals (such as 1 minute) may be too volatile for VWAP to be effective.🎢

WAFFT Conclusion🏁:

VWAP is useful, but not perfect. Its effectiveness depends on the context, the interval and the asset you trade. Understanding its limitations will help you use it more accurately and avoid relying on it alone to make decisions.

Always complement it with other analysis!🌟

🔧Strategies for Using VWAP: The Ultimate Guide to VWAP in Specific Intervals

The VWAP (Volume Weighted Average Price) is an essential tool for traders looking to optimize their market decisions. Easy to understand, extremely useful, and perfect for those who want to get the most out of technical analysis.

Here’s everything you need to know to use VWAP in specific intervals like a pro.🚀

💡Quick Overview! What is VWAP?

VWAP measures the volume-weighted average price of an asset over a specific time interval. It’s a line drawn on the chart that helps determine whether a price is above or below the average value.

Why does it matter?

Above VWAP: Indicates bullish pressure; might be a good zone to sell.

Below VWAP: Indicates bearish pressure; might be a good zone to buy.

✨Fun Fact! Large traders and algorithms use it to evaluate fair prices throughout the day.

📊Basic Strategy: VWAP and Price Levels

Ideal for beginners, this strategy uses VWAP as a key reference for entries and exits.

How to apply it?

1. Buy: When the price is below VWAP and shows signs of reversing upwards.🟢

2. Sell: When the price is above VWAP and begins to reverse downwards.🔴

Practical Example:

You observe Apple’s chart, and the price is below VWAP at $140.

The price starts rising towards VWAP and crosses it upwards.

You decide to buy at $142 and later sell at $150 when it’s clearly above VWAP.

Result: You earned $8 per share.

🔀VWAP in Specific Intervals: Adjust Your Strategy!

VWAP can be applied in daily, weekly, or even monthly intervals, depending on your trading style.

Daily VWAP: Ideal for intraday traders. Evaluates price movements in a single day.

Weekly VWAP: Better for swing traders looking for trends over broader periods.

Monthly VWAP: Excellent for identifying key levels in long-term trading.

Intraday Example:

You’re observing Tesla’s chart. The price falls below the daily VWAP in the morning.

You decide to wait until the price retouches the VWAP and crosses it upwards.

You take a long position and sell at the end of the day when the price is clearly above VWAP.

Result: A quick and effective trade based on price action.

📊Divergences Between Price and VWAP

VWAP can also help you identify important divergences that signal trend changes.

1. Bullish Divergence: Price makes lower lows, but VWAP starts to rise.

2. Bearish Divergence: Price makes higher highs, but VWAP begins to fall.

Practical Example:

On Bitcoin’s chart, the price drops to $95,000, but the daily VWAP rises.

This indicates a potential reversal. You take a long position.

Later, the price rises to $97,000, confirming your analysis.

Result: You earned $2,000 per BTC.

🔹Combine VWAP with Other Indicators

VWAP becomes even more powerful when combined with tools like RSI or Bollinger Bands.

VWAP + RSI: Buy when the price is below VWAP, and RSI indicates oversold (<30).

VWAP + Bollinger Bands: Buy when the price touches the lower band and is below VWAP.

Practical Example:

On Amazon’s chart, the price touches the lower Bollinger band at $110 and is below VWAP.

You take a long position and sell at $120 when the price rises above VWAP.

Result: Secured $10 per share.

🚀Extra Tips for Using VWAP Like a Pro:

1. Avoid Sideways Markets: VWAP can give false signals in such cases.

2. Configure It to Match Your Style: Experiment with daily, weekly, or custom intervals.

3. Confirm It with Other Analyses: Use supports, resistances, and candlestick patterns.

4. Practice Before Trading: Test these strategies on a demo account before using real money.🎮

VWAP is a powerful tool that allows you to identify key entry and exit points. With these strategies and practical examples, you’re ready to master it and take your investments to the next level. 🚀

Standard vs. event-adjusted VWAP🔍: which one do you need?

VWAP (Volume Weighted Average Price) is like that multitasking friend that mixes the best of price and volume to give you a key benchmark in the markets. 📊 But did you know there are different ways to calculate it? Now we're talking about standard VWAP and event-adjusted VWAP. Let's break these concepts down so you understand which to use and when.🚀

🧭Standard VWAP: the classic reliable one

Standard VWAP is simply calculated by considering all transaction prices and volumes within a defined time period (usually intraday). This includes:

- The trades during the entire trading day.

- Every price movement, large or small, without filters.

🔑Advantage: It is straightforward and gives you an overview of the market as it is, without manipulations or exclusions.

⚠️Disadvantage: It can be influenced by abnormal transactions, such as giant blocks of buying or selling that distort the average.

🎛️Event-driven VWAP: eliminating noise

Event-adjusted VWAP goes a step further and removes data that might not be representative of actual market activity, such as:

- Unusual transactions: those giant purchases or sales that can skew the calculation.

- Periods of low activity: pre-opening, after-hours or even certain days with lower volume (such as holidays).

🔧How to adjust:

Manual exclusion: analysts identify and eliminate outlier transactions.

- Automatic filters: Software that detects and discards irrelevant data.

🔑 Advantage: Gives you a “cleaner” average that is more representative of typical market behavior. Ideal for situations where you are looking for accuracy and consistency.

⚠️ Disadvantage: You may miss valuable details in highly dynamic markets or if the filter excludes important data by mistake.

🤔Which to choose

The choice between standard and adjusted VWAP depends on your strategy:

1. Intraday traders: if you trade fast and need to catch every move, the standard VWAP is your best ally.

2. Institutions or long term analysis: If you are looking to evaluate behavior without distortions, the adjusted VWAP is ideal to avoid market noise.

Bottom line

The standard VWAP is like your panoramic view of the market, while the adjusted VWAP is the precision lens that eliminates distracting elements. Both are powerful tools, but choosing the right one can make all the difference in your analysis and results. 📈💡

Now you have a new tool for your trading box! 🎒 Ready to try them in action? 🚀✨

Static vs. dynamic VWAP🎯: What's your style?

VWAP (Volume Weighted Average Price) not only has event-adjusted variants, as we saw above, but also changes its dynamics depending on how it is calculated and updated. Today we talk about static VWAP and dynamic VWAP, and how to choose the one that best suits your strategy.🕹️📊

🔄Dynamic VWAP: always on the move

Dynamic VWAP is a favorite of traders who need to react quickly to market conditions. This indicator is constantly updated during the session, incorporating each new transaction in its calculation. It is an essential tool for those who trade in real time, offering a fluid and adaptable perspective.

🔑Key features:

Immediate reaction: every trade directly impacts the calculation, meaning it always reflects the latest state of the market.- Continuous update: Offers a dynamic view that changes second by second, helping to identify key price levels in real time.

- Ideal for scalping and day trading: If your strategy depends on making quick decisions based on market changes, this VWAP is your best choice.

⚠️Warning:

- Market noise: It can be affected by unusual transactions, such as large orders or high volatility events. This can generate less clear signals if not properly filtered.

- Technical learning: Requires a deeper understanding of the market and experience to correctly interpret fast movements.

⏳Static VWAP: stability as a benchmark

Static VWAP, on the other hand, offers a much more stable and predictable view. This indicator is calculated only once at the start of the session (or at any specific predefined time) and remains constant throughout the day. It is the ideal tool for those looking for a fixed benchmark that allows them to evaluate their performance against a set average.

🔧How it works:

Single calculation: the volume-weighted average price at the beginning of the analysis period is taken.- No subsequent updates: The value obtained is used as an immutable guide for the entire trading day.

🔑Advantages:

- Easy interpretation: Being constant, you don't need to worry about fluctuations in the calculation.

- Ideal for institutions: Many institutional traders and funds use this VWAP as a benchmark to measure the quality of their executions throughout the day.

- (if you want to know what a “benchmark” is, don't worry, take a look at the cube below, WAFFT explains it.)

- (if you want to know what a “benchmark” is, don't worry, take a look at the cube below, WAFFT explains it.)

- Lower sensitivity: Avoids the impact of intraday fluctuations or isolated transactions that could skew the market reading.

What is a Benchmark?🧐

A benchmark is a reference or point of comparison used to evaluate the performance of something.🌟 In the context of investing and trading, the benchmark serves to measure whether a strategy, fund or asset is performing better, worse or the same as a pre-established standard.

Practical examples of benchmarks:💡

1. In mutual funds:

If you invest in a stock fund and its benchmark is the S&P 500, it means that the fund should be evaluated against the performance of this index.

If the fund is up 12% and the S&P 500 is up 10%: the fund did better than its benchmark!🚀

- If the fund is up 8% and the S&P 500 is up 10%: The fund did not meet the standard.❌

2. In trading with VWAP:

Institutional traders use the VWAP as a benchmark to assess whether they executed their orders at an efficient price.

- If you bought below the VWAP: Good job! Your purchase was efficient.✅

- If you bought above the VWAP: Maybe you paid more than you should.❌

Why is a benchmark important?

1. Evaluates performance: Without a benchmark, you can't know if your decisions were good or bad.

2. Sets clear goals: It gives you a measurable target to beat.

3. Helps you make decisions: If your performance is consistently below the benchmark, it's a sign that you need to adjust your strategy.

So, in a nutshell, a benchmark is like the “minimum floor” or the standard against which you measure success.😉

Let's continue with the disadvantages of static VWAP.

⚠️Disadvantage:

- Out-of-date: Does not reflect dynamic market changes, which can be a problem in volatile sessions or in the face of important news.

🤔Which to use

1. Dynamic VWAP: Perfect for traders who need real-time information and trade quickly in active markets.

2. Static VWAP: Ideal for strategies that require stability and a fixed benchmark to evaluate performance or execute trades calmly.

🧭Summary: your compass in trading

1. Dynamic VWAP: To follow live market action, updated with each transaction.

2. Static VWAP: A solid, fixed benchmark to gauge performance and calmly make informed decisions.

Both have their place in a trader's arsenal of tools. Choose according to your style and goals, and remember that we at WAFFTlabs are here to help you understand and use these indicators like a pro.🚀📊

🌎All the types we have analyzed of the VWAP indicator

At WAFFTlabs we have analyzed the following VWAP types so that you have a complete guide (if you want to visit any variant of the VWAP indicator click on the name ↙️):

- Intraday VWAP: A day trader's favorite.

- Cumulative VWAP: A long-term tool.

- VWAP by specific intervals: For key moment strategies.

- Standard VWAP vs. Event Adjusted VWAP: The classic calculation for intraday traders; And the market noise cleaner.

- Static VWAP vs. Dynamic VWAP: A fixed point of reference; and updated in real time.

WAFFTlabs, simplifying finance🎓💲

Our goal is to democratize financial knowledge and give you the tools to trade like a pro. 📈🎓 If you want to learn more about indicators and how to apply them, follow us on our networks and become part of this community. Let's transform the trading world together! 🚀💰

Advantages of VWAP (in general)✅

🎯Easy and straightforward:

VWAP is very intuitive, even if you are just starting out in trading. It shows you the volume-weighted average price, helping you identify whether the current price is above (buying pressure) or below (selling pressure). ideal for quick and well-informed decisions!😊

🌐Works on any market:

Whether you trade stocks, cryptocurrencies, currencies or futures, the VWAP is a versatile tool that adapts perfectly. Moreover, you can use it on different time frames, from minutes to full days.🔀

📊Fair price reference:

VWAP helps you assess whether an asset is overvalued or undervalued compared to trading volume. It's like a reliable “midpoint” for your analyses.📈

🚦Identify entry and exit opportunities:

If price crosses the VWAP to the upside, it could signal bullish strength. If it crosses it downwards, it may indicate weakness.A key ally for spotting important moves!📉

🔍Popular tool among professionals:

Major investors and institutions use it to buy or sell without distorting the market too much. If you follow it, you could align your trades with the “strong hand.”🚨

⚙️Configurable according to your style:

You can adjust the VWAP interval (intraday, weekly, etc.) to suit your strategy, whether you prefer to trade short or long.🔧

🤝Compatible with other indicators:

VWAP works very well alongside supports, resistances, RSI or moving averages. Use it as an additional filter to confirm your entries and minimize risks.🔗

👀Visually clear:

It is represented as a line on your chart that tracks the weighted average price. Its visual simplicity helps you maintain focus without overloading your analysis.📊

⚡Evaluate volume pressure:

It considers not only price, but also volume, making it more effective for interpreting market dynamics and making more accurate decisions.🏋️

🔄Variety of options and customization:

VWAP has useful variants such as intraday VWAP, ideal for quick trades, or interval-specific VWAP, perfect for more detailed analysis. In addition, you can customize it with modifications such as applying multiple VWAPs on the same chart or adjusting the periods according to your strategy. This flexibility makes it an adaptable tool for any trading style.🛠️

⚠️Always remember to analyze the market context and combine the VWAP with other indicators to increase the accuracy of your trades.

WAFFT Conclusion🏁:

The VWAP is like that reliable friend that gives you a clear perspective of the market based on price and volume. It is versatile, easy to use and very effective when you combine it with other tools. Plus, its variants and customization make it even more powerful to adapt to any strategy - use it wisely and you'll have a competitive edge in your trading!🌟

Limitations of VWAP (in general)❌

⏳Reluctance in volatile markets:

VWAP relies on cumulative price and volume data, causing it to be slow to adapt to rapid or sudden market movements. This makes it less useful in times of high volatility.🐌

📉It does not predict the future:

VWAP only analyzes historical data, which means it does not give clear signals about future price movements. It is not a predictive tool, but rather a descriptive one.🔮

🔍Less useful in assets with low volume:

In markets or assets with low liquidity, VWAP loses accuracy, as it relies heavily on volume to correctly reflect price action.💤

⚡Difficulty in prolonged trends:

In markets with a strong trend, the price may stay away from the VWAP for long periods, making it less relevant as an immediate reference for making decisions.📈

🔗Dependence on other indicators:

VWAP does not provide enough signals on its own. It needs to be combined with other technical indicators, such as RSI, moving averages or supports and resistances, to improve its effectiveness.👀

👨💻Curva learning for beginners:

Although it seems easy to interpret, understanding its real-time behavior and applying it in different market contexts can be complicated for novice traders.😵

📊Bias towards intraday:

The VWAP was designed primarily for intraday trading. Although it can be adjusted for other periods, its effectiveness decreases in longer-term trading.🔀

🛠️Lack of advanced flexibility:

Although you can change the VWAP interval, it does not have advanced customization options that some more experienced traders might need for complex strategies.🔧

🌐Does not consider external factors:

VWAP only uses price and volume data, but does not take into account external factors such as news, economic events or sudden changes in supply and demand. This can limit its effectiveness in unexpected contexts.🌍

📉Problems in wide ranges:

In markets with very wide price ranges, VWAP can become less accurate as a benchmark, as it does not capture fluctuations within those ranges well.🎢

⚙️Dificultad during extended hours:

During trading outside of normal market hours (pre-market or after-hours), volume is often lower, which can distort VWAP readings.🕒

WAFFT Conclusion🏁:

VWAP is useful, but it is not without its faults. It is important to understand its limitations to avoid relying solely on it in your strategies. Combine it with other tools, analyze the market context and use it as a complement, not as a sole solution. This way you will maximize its potential!🌟

📈Basic strategies for use with VWAP

1. Intraday strategy: Buy and sell based on VWAP

Ideal for traders who trade within the same day.

How to apply it:

1. Buy: when the price is below the VWAP and starts to cross it upwards.🟢

2. Sell: When the price is above the VWAP and starts crossing it downwards.🔴

Practical example:

You are looking at a chart of Apple and notice that the price drops to $140, well below the VWAP. Shortly after, it starts to rise and crosses the VWAP upwards.

- Entry: You buy at $140.

Later, the price rises to $150 and crosses the VWAP downward. - Exit: Sell at $150, locking in a profit of $10 per share.

2. VWAP as Dynamic Support and Resistance

The VWAP can act as a dynamic line of support or resistance.

How to apply it:

1. Support: when the price touches the VWAP from above and bounces, consider buying.

2. Resistance: when the price touches the VWAP from below and pulls back, consider selling.

Practical example:

On a chart of Tesla, the price rises to $210, but pulls back towards the VWAP at $200. This level acts as support and the price bounces.

- You take a long position (buy) at $200.

The price rises again to $220. - You close the position and secure $20 per share.

🔄Advanced VWAP types

1. Cumulative VWAP

Used for long-term analysis, accumulating data for several days or weeks.

How to apply it:

- Use it to identify general trends in the market.

- Ideal for traders with long positions.

2. VWAP by specific intervals

Divide the day into segments (e.g., open, mid-day, close) for more detailed strategies.

Practical example:

On the Microsoft chart, you notice that the opening VWAP is at $300, while the closing session VWAP rises to $310. This indicates buying pressure in the market.

⚙️How to set the VWAP on your charts

Adding VWAP to your charting platform is very simple. Here are the basic steps:

1. Open your charting platform (such as TradingView, MetaTrader, or ThinkorSwim).

2. Look for the “Indicators” or “Analysis Tools” option.

3. Type “VWAP” in the search engine and select the indicator.

4. Adjust the parameters according to your strategy (if necessary).

5. That's it! The VWAPwill appear as a dynamic line on your chart.

🧩VWAP + other indicators

VWAP + RSI:

- Buy: when the price is below the VWAP and the RSI indicates oversold (<30).

- Sell: When the price is above the VWAP and the RSI indicates overbought (>70).

VWAP + Bollinger Bands:

- Buy: When the price is below the VWAP and touches the lower band.

- Sell: When the price is above the VWAP and touches the upper band.

⚡Tips for using the VWAP successfully

1. Avoid using it in sideways markets: In narrow ranges, the VWAP can generate false signals.

2. Use it as confirmation: Combine it with candlestick patterns, supports and resistances.

3. Test before you trade: Practice these strategies on a demo account before risking real money. 🎮

VWAP is a powerful tool that can take your trading to the next level. With these strategies and practical examples, you'll be ready to make the most of this indicator - start using it today and make better trading decisions! 🚀

Conclusion on the VWAP🏁:

The VWAP is much more than just a line on a chart. This indicator combines price and volume to provide a solid perspective on the break-even point in financial markets. Its usefulness is especially relevant for intraday traders and fund managers, as it allows:

1. Assess fair prices: By reflecting the volume-weighted average price, the VWAP acts as a benchmark to identify whether current prices are overvalued (above the VWAP) or undervalued (below the VWAP).

2. Make informed decisions: Institutional traders use it to execute orders without distorting the market, while retail traders can integrate it into strategies as entry or exit points in trades.

3. Filter market noise: Unlike other more volatile indicators, VWAP offers a clear view and is less susceptible to false positives, helping traders avoid impulsive decisions.

4. Easy integration with other tools: Combined with supports, resistances and other indicators such as RSI or MACD, the VWAP strengthens any technical analysis.

Key points for optimal use:

Limited time: It resets daily, so it is not useful on charts longer than one day.

- Volume context: Its effectiveness depends on liquid markets, where volume is representative.

- Complement, not substitute: It is not a magic solution, but in skilled hands it is a powerful weapon.

In short, the VWAP is ideal for those seeking clarity in the chaos of the market, as long as it is used with a well-structured plan.

And speaking of clarity in the chaos... WAFFT is your ally in taking investments to the next level 🌟. Just as VWAP simplifies technical analysis, WAFFT democratizes investing, teaching you from the ground up how to master finance in an easy and accessible way. 🚀 The financial future is for everyone, and you can be part of the change!

The last types of indicators collected in the WAFFT laboratory are the following:

4. Volatility indicators 🌪️:

They tell you how much the price is varying over a period of time.

In our WAFFT Indicator Guide, we have carefully selected those that we consider most useful to enhance your strategies. However, the universe of indicators is vast and full of possibilities to be explored🤯

Bollinger Bands: Key Tools in Technical Analysis 🌊📊

Bollinger Bands are a technical indicator developed by John Bollinger in the 1980s (yes, the same era of high hairdos and walkmans 🎧). Designed to analyze price movements in financial markets, this indicator is especially valuable for assessing volatility and detecting potential trend changes. Its design is based on three fundamental elements that provide a dynamic visual framework for interpreting price behavior.

These bands have established themselves as an essential tool for traders and investors around the world, including those trading emerging assets such as WAFFT.🐶💰

What are Bollinger Bands?🤔 The Definitive Guide to Using Them Like a Pro 🚀

Bollinger Bands are a technical indicator consisting of three magic lines that wrap around the price on a chart:

1. Midline:

- A simple moving average (SMA), usually calculated over 20 periods.

- It represents the average of prices over a defined interval, providing a central reference point.

Too technical? As always, don't worry, WAFFT makes it easy for you:

Okay, imagine you're keeping track of your academic grades for 20 days in a row 📚. Every day, you have an assessment, assignment or exam, and you get a grade. The simple moving average is like you want to know what your grade point average is, but only considering the grades for the last 20 days.

It's like you do this:

- You write down the grades you get each day in a list 📝.

- When you get to day 20, you add up all those grades 🧮.

- You divide the total by 20 (because it's 20 days) 🔢.

The number you get is your “grade point average” or your SMA. It's like your usual level on assessments, without focusing too much on a super good test or a super bad assignment.

Now, the interesting thing is that, each new day, you add the new grade and remove the oldest one. So, you always have the average of the last 20 days' grades. It's as if your academic performance is being updated little by little 📈.

In the financial analysis world, instead of academic grades, they use prices. But the idea is the same: see how your performance is doing overall, without worrying too much about a spectacular day or a disastrous one.

2. Upper band:

- Calculated by adding two standard deviations to the SMA.

- It indicates a “high” price level based on recent volatility.

Easy my friend, I'll explain:

Okay, imagine you're analyzing your academic grades and you want to understand not only your average, but also how far your grades tend to be from that average. This is where the “upper band” comes in, which is like taking your average (SMA) and adding to it twice the measure of how much your grades vary (the standard deviation).

It's like you do this:

1. You calculate your SMA (the average of your grades over the last 20 days) 🧮.

2. You measure how far your average grades deviate from most other grades using something called standard deviation. It's like calculating how much your grades typically deviate from the average (If you sometimes get much higher or lower grades, that “standard deviation” will be larger) 🧮.

3. You take that standard deviation and multiply it by 2 (this amplifies the normal variation in your grades) 🔢.

4. Finally, you add this value to the average (SMA).

The result is the “upper band.” It represents a high range of what you might expect in your grades, taking into account your good days but without exaggerating 📈.

For example, if your mean (SMA) is 8 and your standard deviation is 1, the upper band would be:

8 (SMA) + 2 × 1 (standard deviation) = 10.

This means that, even if your average is 8, it would not be unusual to score close to 10 on a particularly good day.

In the world of financial analysis, they do the same thing, but with prices instead of grades. The upper band helps them understand when a price is high, but still within reason, based on the usual variations.

3. Lower band:

- Obtained by subtracting two standard deviations from the SMA.

- It marks a “low” price level relative to recent movements.

WAFFT-style explanation:

Okay, imagine you are reviewing your academic grades and you want to know how low your lowest grades can normally go. This is where the “lower band” comes in, which is like taking your average (SMA) and subtracting twice how much your grades usually vary (standard deviation).

It's like you do this:

1. You calculate your average for the last 20 days 🧮.

- For example, if your grades are usually 7, 8, and 9, the average will be 8.

2. You measure how much your grades usually vary. Sometimes you get a little bit higher (9) or a little bit lower (7). That “variation” is called standard deviation (SD) 📏.

3. You take that standard deviation, multiply it by 2, and subtract it from your average.

This gives you the bottom band: a number that shows how far your “normal” grades can go on a bad day, not counting things out of the ordinary.🙈

Example:

- Average (SMA) = 8 🎯

- Variance (SD) = 1 📏

- Lower band =8 (average) - 2 × 1 (variance) = 6.

This tells you that even if your average is 8, it's not uncommon on a bad day to score as low as 6. So you know what to expect and don't worry too much if you have a little dip! 📝😊

These bands adjust dynamically based on market volatility. When volatility increases, the bands expand; when it decreases, they contract. This behavior allows traders to quickly identify changes in market dynamics.

Did you know that WAFFT could be using Bollinger Bands to predict its next moves? 🚀🙊

Interpretation in Technical Analysis with Bollinger Bands🔍

Bollinger Bands offer multiple practical applications:

1. Market Volatility🌊

- Wide Bands: Indicate high volatility, suggesting significant price movements.

- Narrow Bands: Signal low volatility, indicating market consolidation.

It's like the market is breathing: when it's choppy, the bands expand; when it's quiet, they contract. It's not magic, it's math! 🧮✨

2. Trend Identification📈

When the price consistently stays close to one of the bands, it may indicate a strong trend in that direction. For example:

- Close to the Upper Band: Potential uptrend.

- Close to the Lower Band: Potential downtrend.

3. Price Reversals🔄

Prices tend to bounce between the upper and lower bands, which can signal potential entry and exit points. This property is useful for identifying overbought or oversold situations.

Remember, it is not recommended to bounce like a ball in a hallway, although it would be fun to watch that bounce in WAFFT! 🏓🤑

4. Breakouts💥

When the price breaks out of the bands, it may indicate the start of a new significant move. However, it is crucial to confirm these breakouts with other indicators to avoid false signals.

5. Detect “Expensive” or “Cheap” Prices🧐

One of the key functions of Bollinger Bands is to assess whether an asset is overbought or oversold:

1. Overbought:

If the price is near the upper band, the asset could be overbought and susceptible to a correction.

2. Oversold:

When the price is near the lower band, it could be oversold and preparing for a bounce.

A breakout can be as exciting as watching WAFFT land on the moon, but it's always best to have a backup plan! 🚀🐸

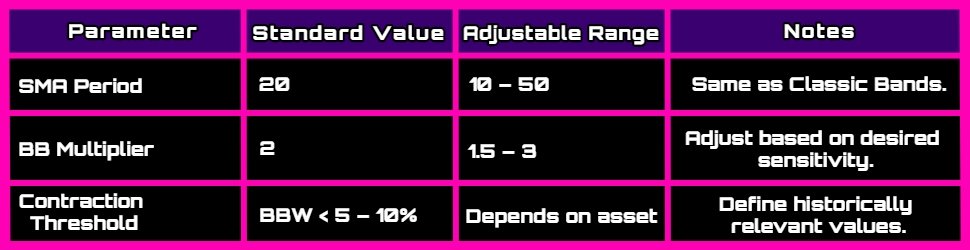

Important Considerations ⚠️

Although Bollinger Bands are a powerful tool, it is crucial to use them in a complementary manner with other indicators and analysis:

1. Additional Indicators: use RSI, MACD or others to confirm signals.

2. Fundamental Analysis: Consider news and economic context that can affect prices.

- Just like any tool in technical analysis, Bollinger Bands depend on market context. Without fundamental analysis to back up the technical signals, decisions based solely on the bands can be risky.

3. Parameter Setting: Standard parameters (20 periods and 2 standard deviations) may need adjustment depending on the asset and its specific volatility.

- For example, memecoins such as WAFFT often require more adaptive settings to optimize results due to their highly volatile nature.

📌 Note: Although they can't predict the future, Bollinger Bands are like warning lights on a car: they alert you when something might be out of the ordinary.

Conclusion🏁: A Versatile and Essential Tool

Bollinger Bands are an indicator that combines visual simplicity with the ability to provide complex and valuable information, they are the treasure map you need to navigate the financial markets.🗺️ They allow traders to identify key price levels, assess market volatility, anticipate trend changes and potential entry/exit points.

Whether you're trading stocks, Forex or cryptocurrencies, mastering Bollinger Bands can make a big difference in your technical analysis and decision making. 🛠️

Mind you, practice makes perfect! ⚡ Play with them on a demo account before you go for the real thing. And who knows, maybe soon you'll be the one lecturing on trading as you watch WAFFT take off! 🚀💎

What are Bollinger Bands used for?🤔

Imagine you're on a beach and you want to predict how far the next wave will go. Bollinger Bands are like those buoys that mark the boundaries: they show you how far the price could go up or down according to its volatility.Cool, isn't it? 😎

In this section, I'll tell you what these bands are for, how you can use them to identify opportunities in the market and how to make the most of them in your trading strategy. Let's get to it! 🚀

As you may already know, Bollinger Bands are used to analyze the volatility of a financial asset and detect possible entry or exit points in the market. These bands help to identify:

1. overbought or oversold levels