Savings Rate:

Basis for economic growth and financial stability💰⚖️

Have you ever wondered how important saving is, not just for yourself, but for a country's economy? 🧐

While many think of saving as a personal thing, there is a fundamental concept in the financial world called the savings rate, which has enormous implications at both the individual and macroeconomic level.

In this article, we will explain what the savings rate is, how it is calculated, its importance in the economy, how it influences your daily life and the financial stability of countries, and the factors that affect it. Let's break it down! 🚀

What is the Savings Rate? 🤔

The savings rate is the proportion of disposable income that a person, company or country chooses to save rather than spend. It is a key indicator that reflects how much money is being put aside for the future, rather than being used for immediate consumption. In other words, the savings rate measures how much we are saving for future times.

For example, if a family earns $1000 a month and saves $200, their savings rate is 20%.

How is the savings rate calculated? 📊

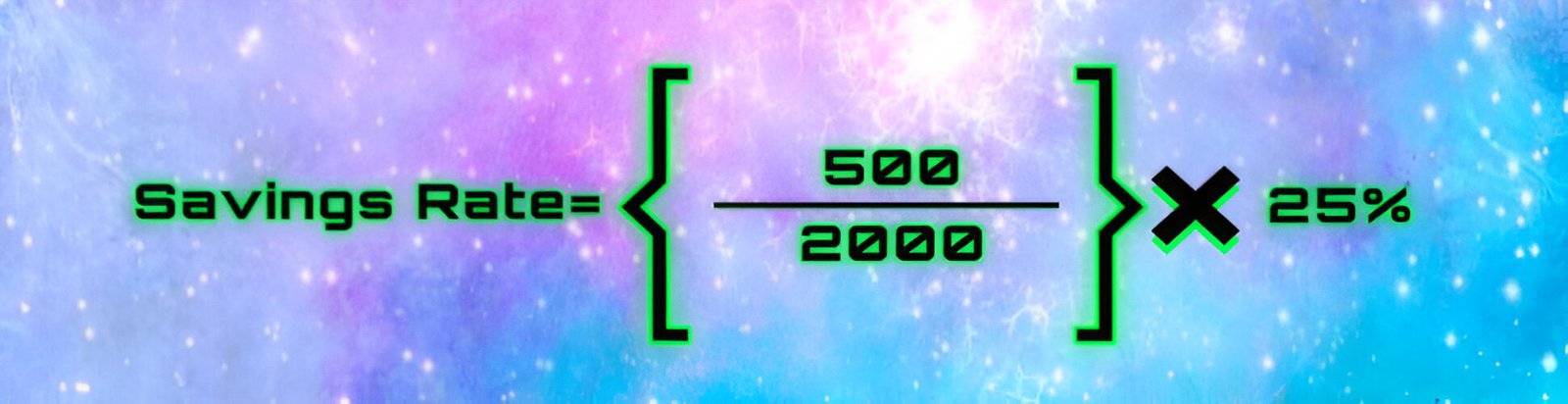

The savings rate is calculated by dividing the amount saved by the disposable income and multiplying by 100 to get a percentage.

Here is the basic formula:

Practical example:

Let's say you have a monthly income of $2000 and you decide to save $500 each month.

Then your savings rate would be:

-This means you are saving 25% of your income for the future, which is a pretty healthy savings rate.

-At the national level, the savings rate is calculated by adding up the savings of individuals, businesses and governments, and then dividing that figure by the country's gross domestic product (GDP).

Types of Savings Rate 💼

There are different ways to measure the savings rate, depending on the level of analysis.

Here are the main types:

1. Personal Savings Rate 👨👩👦👦

This is the percentage of household disposable income that is saved rather than spent. It includes money that individuals or families keep in bank accounts, investments, or even use to pay off debts.

2. Business Savings Rate 🏢

Businesses can also save. In this case, the business savings rate is the money that businesses retain (rather than giving out as dividends or reinvesting) for future uses, such as expansion or financial emergencies.

3. National Savings Rate 🌍

At the country level, the national

is calculated by adding up the savings of households, businesses, and the government. This indicator is essential to understand the economic strength of a country and its capacity to invest in the future.

Importance of the savings rate in the economy 🌱💸

The savings rate is not just a matter of personal finance; it has profound implications for the global economy.

Here are a few reasons why it is so important:

1. It drives investment and economic growth 🚀

When people and businesses save more, more resources are available to be borrowed or invested in productive projects. This can fund the growth of new businesses, job creation, and infrastructure development, leading to greater long-term economic growth.

2. Financial stability 🛡️

A high savings rate is a sign of financial stability for both individuals and economies. People who save have a safety net for emergencies (such as illness or job loss), while countries with strong savings rates are better able to finance projects and avoid debt crises.

3. Protection against economic crises 🌪️

Having a solid savings rate can act as a buffer in times of recession. When economies enter into crisis and incomes fall, accumulated savings make it possible to maintain consumption and prevent people from falling into poverty or companies from going bankrupt.

4. Influence on the interest rate 📉

The relationship between the savings rate and the interest rate is close. If the savings rate in an economy is high, there will be more money available for loans, which can cause interest rates to fall. This, in turn, encourages investment and spending, creating a cycle of economic growth.

5. Sustainability of pensions 👴👵

The savings rate is also crucial for the sustainability of pension systems. If people save enough for their retirement, governments and companies face less pressure to fund pensions. This is particularly important in societies with ageing populations, where pension systems may be at risk.

Factors Affecting the Savings Rate ⚠️

The savings rate is not static. There are many factors that influence whether people and economies save more or less.

Here are some of the most important ones:

1. Income level and inequality 📈

- A person's income level has a direct impact on their ability to save. Generally speaking, people with higher incomes tend to save a larger proportion of their money, since after covering their basic needs they have a larger surplus left. However, people with low incomes often spend most of their money on essential consumption (food, housing, transportation), leaving little room for savings.

In addition, income inequality can also influence the savings rate. In societies with high inequality, a significant portion of the population does not have the ability to save, which reduces the country's overall savings rate.

2. Interest rates and monetary policies 💹

- Interest rates have a direct relationship with savings. When interest rates are high, people are more inclined to save because bank deposits generate higher returns. In contrast, in low-rate environments, people may choose to spend or invest their money instead of saving it, since the returns on savings will be lower.

Expansionary monetary policies, such as those implemented after the 2008 financial crisis, which reduced interest rates to historically low levels, encouraged consumption and investment in assets such as real estate, but reduced savings rates in many developed countries.

3. Culture and social habits 🌍

- A country's culture plays a fundamental role in people's propensity to save. For example, in countries such as China or Japan, saving is a deeply rooted value in the culture, which is reflected in extremely high savings rates. In contrast, countries like the United States have developed a consumer culture in which spending, rather than saving, is socially encouraged.

4. Age and life cycle 👵🧒

- People's life cycles also influence their savings rate. Young people generally tend to save less because they are starting their careers and tend to have lower incomes. In middle age, people tend to save more, mainly with a view to retirement. Finally, in the retirement stage, individuals tend to spend their accumulated savings, which decreases the savings rate.

5. Economic expectations and crises 📉

- In times of economic uncertainty, people tend to increase their savings rate as a precautionary measure. This phenomenon is visible during economic crises, where consumption decreases and savings increase as a defensive mechanism against job insecurity and the possibility of loss of income.

The National Savings Rate: Engine of Economic Growth 🚀

The national savings rate is a critical indicator that reflects a country's economic strength. The higher a nation's savings rate, the more funds are available for productive investment in infrastructure, innovative industries and technologies. This is a crucial element for sustainable economic growth, as countries that invest more in their future usually enjoy greater financial stability and development capacity.

The experience of the Asian tigers 🐯

An iconic example of how the savings rate drives economic growth is the case of the "Asian tigers": South Korea, Hong Kong, Singapore and Taiwan. During the 20th century, these countries experienced rapid economic growth thanks, in large part, to their high national savings rates.

These economies allocated a significant part of their income to savings, which allowed them to finance investments in education, infrastructure and technology, catapulting their industrial and economic development.

The challenges of low savings rates in the West 🌍

On the other hand, economies such as the United States or the United Kingdom, known for their low savings rates, have faced challenges related to high consumption and dependence on credit.

In particular, the United States has historically been a country with a low personal savings rate, where much of the wealth has been built through borrowing rather than saving. Although this has allowed for rapid growth at times, it has also increased the risk of financial crises, such as the one experienced in 2008.

Impact of Savings Rate on Financial Stability 🛡️

A high savings rate not only allows for financing productive investments, but also acts as a safety net in times of crisis. When savings are robust, both at the personal and government level, countries are better prepared to face unforeseen economic challenges.

Success stories: Norway and the sovereign oil fund 🇳🇴

A notable example of how savings can provide financial stability is Norway. This country has managed to maintain a high national savings rate thanks to oil revenues. Instead of spending all the revenues obtained by its oil industry, Norway has invested a large part of them in its Global Government Pension Fund, popularly known as the sovereign oil fund. This fund acts as a financial cushion for future generations and has allowed Norway to face global economic crises with greater stability.

Savings Rate in History: Changes and Trends 📜

Throughout history, the savings rate has fluctuated according to economic, political, and social conditions. From the Great Depression to the era of "economic miracles," savings have played different roles in the evolution of global economies.

The Great Depression and the rise of savings 💡

During the Great Depression of the 1930s, many individuals and businesses began saving as a response to economic collapse and financial instability. Fear of job loss and bank failure led to a decline in consumption and an increase in the savings rate.

Postwar and the construction of well-being 🏗️

After World War II, the world entered a period of accelerated economic growth, largely driven by savings and investment in infrastructure and technology. War-ravaged countries like Germany and Japan used high national savings rates to finance their reconstruction and emerge as industrial powers in the decades that followed.

Influential figures in the study of savings 👤

- Adam Smith, the famous author of The Wealth of Nations (1776), was one of the first to highlight the importance of savings as a driver of economic growth. Smith argued that savings are transformed into investment when they are used to finance businesses, construction and infrastructure.

- John Maynard Keynes, one of the most influential economists of the 20th century, introduced the concept of the "paradox of thrift", according to which excessive savings at the individual level can, paradoxically, generate problems at the macroeconomic level, such as deflation or recession.According to Keynes, if everyone saves and no one spends, the aggregate demand of an economy collapses, which can lead to a decrease in production and employment.

Conclusion 🎓💡

The savings rate is much more than just a statistic; it is a reflection of financial prudence, a driver of economic growth, and a pillar for long-term stability. Savings not only enable individuals and economies to cope with emergencies and crises, but they are also the foundation on which productive investments are built that generate jobs, innovation, and long-term prosperity.

Saving is not simply about not spending; it is about investing in the future. And while each country has its own way of approaching saving, the importance of having a healthy savings rate is universal, as it is directly linked to the ability to face tomorrow's challenges with strength and resilience. 💪💼🌍