Liquidity:

What is Liquidity? 💧💸

Liquidity is one of the most important and versatile concepts in the financial and economic world. It represents the ability of an asset to be quickly converted into cash without losing value.

In other words, a liquid asset is one that can be easily sold, while an illiquid asset is more difficult to convert into cash, or takes longer and could lose value in the process. 💰🔄

Simple example:

High liquidity:

Cash or the balance in your bank account is fully liquid because you can use it instantly to buy or pay for whatever you want.

Low liquidity:

A house or a piece of art are assets that can be very valuable, but cannot be sold quickly. Selling a house can take weeks or months, and the final price might not be what you expected.

Types of assets according to their liquidity:

Liquid assets:

Those that can be easily converted into cash, such as money, bank accounts, stocks (in large markets), etc. ⚡

Less liquid assets:

Assets that are more difficult to sell quickly, such as property, cars, machinery, and works of art. 🏠🚗

Why is Liquidity Important? 🤔

Liquidity is key to maintaining solvency and daily operations in both personal and corporate finances. At the individual level, having quick access to cash allows people to cover unforeseen expenses, such as medical emergencies or home repairs. In businesses, liquidity is vital to cover operating expenses, pay salaries, settle short-term debts, and take advantage of investment opportunities. 🏦

Furthermore, liquidity has a profound impact on financial markets. In a liquid market, assets can be bought and sold easily without the price fluctuating too much. This is essential to maintaining stability and confidence in the financial system. On the other hand, a lack of liquidity can lead to serious problems, such as the inability to meet financial obligations or, in the worst case, bankruptcies and financial crises. 🚨

Types of Liquidity 🚰📊

There are several ways to understand and measure liquidity, depending on the context in which it is applied.

Below, we explore some of the most common types:

1. Asset Liquidity 🏠💵

This refers to the ease with which an asset can be converted into cash without losing value.

Here are some examples that show different levels of liquidity:

Cash and cash equivalents:

- This is the most liquid asset of all, as it is money itself and ready to be used in any transaction.

Stocks:

- These can be relatively liquid, as they can be sold quickly in open markets, although their value can fluctuate depending on market conditions.

Real estate:

- These are much less liquid than stocks or bonds, as selling a property can take time and prices can vary considerably.

Artwork or collectibles:

- These assets usually have a more limited market, and although they can be very valuable, they are difficult to sell quickly without incurring a loss.

2. Business Liquidity 📈

Liquidity in the business context refers to a company's ability to meet its short-term financial obligations using its liquid assets, such as cash, accounts receivable, or short-term investments.

Let's break down two of the most commonly used indicators to measure a company's liquidity: the current ratio and the acid test. These tools are essential to know if a company can pay its short-term debts. Let's get to it! 💪💸

1. Current Ratio 🏦💰

What is the current ratio?

It is a simple indicator that answers a key question: "Does the company have enough cash and assets to pay its short-term debts?" If the answer is "yes," great! If the answer is "no," it can bode ill for the company's stability.

Formula:

👉 Current assets are things that the company can turn into cash in less than a year, such as:

Cash 💵 (in box or bank).

Accounts receivable 🧾 (what customers still should).

Inventories 📦 (products that can be sold soon).

👉 Current liabilities are the debts that the company must pay for one year, such as:

Accounts payable 💸 (money that the company owes its suppliers).

Short -term bank loans 🏦.

Salaries and other payments 💼.

Interpretation of the result 🔍:

- Current reason> 1: Good! 😎 This means that the company has more active than short -term debts. You can pay without problems and, probably, on money for unforeseen events or new investments.

- Current reason <1: Be careful! ⚠️ The company has more debts than liquid assets. This is a sign that I could have problems paying your commitments.

- Current reason = 1: This means that the company has just what is necessary to pay its debts. It is not bad, but it is not ideal because if an unexpected expense arises, it could fall short. 😬

Simple example 🍕:

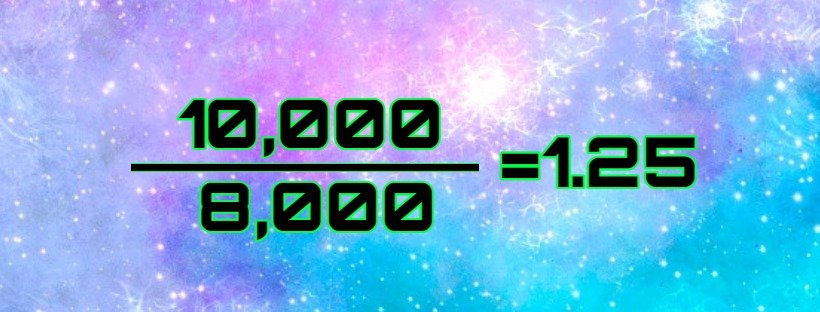

Imagine you have a pizzeria 🍕. If you add what you have in the box, the accounts receivable and the pizzas (inventories) and you get $ 10,000, but you must $ 8,000 between suppliers and invoices, your ordinary reason would be:

With a current ratio of 1.25, you're doing well! You could cover your debts and still have some margin left.

Advantages of the current ratio 🌟:

It's super easy to calculate: Just add up current assets and liabilities and that's it. Any manager or entrepreneur can quickly figure it out.

It gives a general idea of short-term financial health: It's useful for knowing if a company is prepared to survive without immediate problems.

Limitations of the current ratio 🚧:

It doesn't tell the whole story: Even though it may seem like everything is going well with a high current ratio, it doesn't distinguish between types of assets. For example, you might have a ton of inventory (pizzas you haven't sold yet), but if you don't sell them quickly, you could be in trouble! 🍕🤯

2. Acid Test (Quick Ratio) 🍋💸

What is the acid test?

The acid test is like the current ratio, but stricter and more realistic. Instead of counting everything, it excludes inventory (because, let's be honest, you can't always sell what you have in stock quickly).

So it only considers assets that are easier to convert into cash, such as:

- Cash 💵.

- Accounts receivable 🧾.

- Short-term investments 📈.

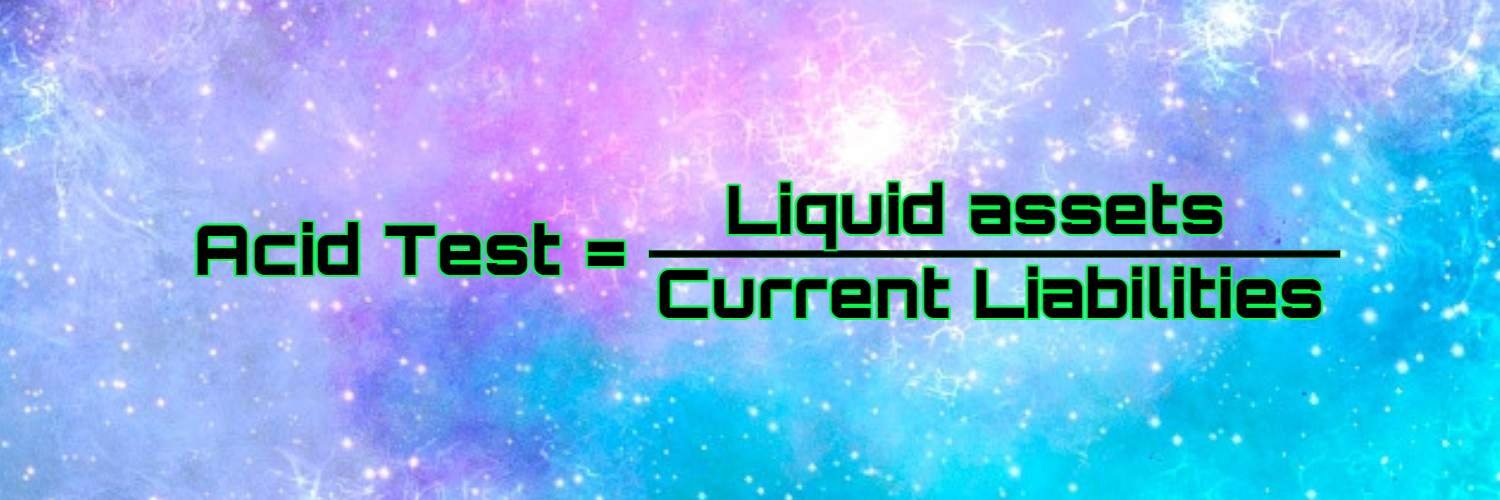

Formula:

Liquid assets are anything you can turn into cash quickly (not counting inventory!).

Interpretation of the result 🔍:

- Acid test > 1: Great! 🎉 The company can cover its short-term debts with assets it can turn into cash quickly, not counting inventory.

- Acid test < 1: Not so good... 😟 The company might have trouble paying if it relies only on its liquid assets.

Simple example 🍋:

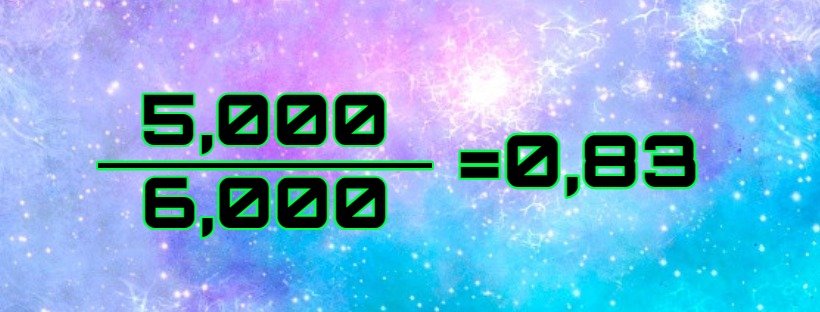

Going back to your pizza shop 🍕, let's say you have $5,000 in cash and accounts receivable, but $3,000 in inventory (pizzas and flour). You owe $6,000 in short-term debts.

The formula would be:

With a ratio of 0.83, watch out! If you can't sell your pizzas fast, you're in trouble.

Why "acid"? 🍋:

The term comes from the idea of a "hard" or "harder" test. So if a company passes this test, it means it has solid liquidity and isn't dependent on selling things that may take longer.

Advantages of the acid test ✅:

More realistic: By excluding inventories, it gives a more accurate view of how easy it is for a company to cover its immediate debts.

Less risk: It assesses liquidity with the safest assets, such as cash and accounts receivable.

Limitations of the acid test 🚫:

Doesn't include inventories: Sometimes, excluding inventories can give an overly pessimistic picture, especially if the company has products that sell quickly and predictably (like hot pizzas, which you sell daily! 🍕🔥).

Conclusion 🎯

Both current ratios and acid test are super useful tools to measure the short-term financial health of a company. The current ratio is more general, including all types of assets, while the acid test is more strict and excludes inventories.

In summary:

- Current ratio > 1 = The company has enough assets to pay its short-term debts. 💸💪

- Acid test > 1 = The company can cover its debts with assets that are easy to convert into cash (without relying on selling products slowly!). 💵💼

So now you know: if you want to have peace of mind with your company (or pizzeria 😉), keep these liquidity indicators in good shape!

3. Market Liquidity 📉🌍

A liquid market is one in which assets can be bought and sold quickly without major price fluctuations.

For example, stock and currency markets are typically very liquid, as there are many buyers and sellers actively participating.

In contrast, in an illiquid market, transactions are less frequent, and selling an asset may require a significant reduction in its price to attract buyers.

Factors Affecting Liquidity 🌐🔍

The liquidity of assets or markets can vary depending on several factors:

1. Monetary Policy 🏦

Central banks, such as the Federal Reserve or the European Central Bank, play a crucial role in managing the liquidity of an economy.

Through tools such as interest rates and open market operations, central banks can increase or decrease the amount of money in circulation, which in turn affects the liquidity available in financial markets.

- Low interest rates: Incentivize borrowing and spending, increasing liquidity in the economy.

- High interest rates: Tend to restrict access to credit, decreasing liquidity.

2. Market Conditions 📉📈

In times of economic uncertainty or financial crisis, liquidity can dry up quickly. During the 2008 financial crisis, for example, many assets that were previously considered liquid, such as mortgage-backed securities, became nearly impossible to sell at reasonable prices. This created a ripple effect that further exacerbated the crisis.

3. Investor Confidence 💡

Confidence in markets is an essential component of liquidity.

During times of high confidence, investors are more willing to buy and sell assets. However, in periods of uncertainty or panic, such as during a recession, investors tend to be more cautious, which can reduce liquidity and increase market volatility.

Liquidity in the Global Economy 🌍🚰

Liquidity is not only important at the level of individuals or companies, but also in the global economy. International foreign exchange (Forex) markets, for example, are extremely liquid due to the daily volume of transactions involving various currencies. However, some countries may experience liquidity problems due to capital flight, political crises, or drastic changes in monetary policies.

Furthermore, liquidity crises are a recurring phenomenon in the global economy. In these cases, banks or financial institutions face difficulties in accessing cash or liquid assets, which can trigger a broader recession.

A historical example is the 2008 credit crisis,

when large financial institutions, which relied on supposedly liquid assets such as subprime mortgages, found themselves unable to sell these assets at reasonable prices, triggering a global crisis.

Key Figures and Theories of Liquidity 🧠📚

Liquidity is a fundamental concept in economics and finance, which refers to the ease with which assets can be converted into cash without losing value.

Throughout history, various economists have delved into this topic, developing theories that help us understand how liquidity affects markets, investment decisions, and monetary policies.

Here are some of the most influential figures and key theories that have shaped our understanding of liquidity.

1. John Maynard Keynes 🧠💼

Context and key work📖:

Place and time:

Keynes was a British economist who developed much of his work in the first half of the 20th century, in a context marked by the Great Depression of 1929 and the emergence of new ideas about state intervention in the economy.

Key work:

His masterpiece, "General Theory of Employment, Interest and Money" (1936), is a turning point in the history of economic thought.

Liquidity preference 💵:

Keynes introduced the concept of liquidity preference, arguing that in times of economic uncertainty, individuals and companies prefer to hold liquid assets (such as cash or easy-to-sell financial instruments) rather than invest in long-term assets.

Why it matters:

In times of crisis, investors tend to become more conservative, which can lead to a lack of productive investment and worsen the economic situation. Liquidity preference may explain "stagnation" in economies in recession.

The role of the State:

According to Keynes, during periods of high uncertainty, the State should intervene, providing liquidity to the markets and encouraging public investment to revive the economy.

This approach was influential in creating public spending policies and fiscal stimuli in many developed economies after the Great Depression.

2. Milton Friedman 💡📊

Context and key work📖:

Place and time:

Milton Friedman was an American economist, leader of monetarism, a school of thought that gained prominence in the 1960s and 1970s. Friedman opposed many of the Keynesian postulates and emphasized the importance of money control.

Key work:

His book "A Monetary History of the United States" (1963), co-written with Anna Schwartz, is one of his most influential contributions, where he analyzes the relationship between the money supply and business cycles.

Monetarist theory and liquidity 💰:

Friedman argued that liquidity in an economy is directly related to the amount of money in circulation.

For him, economic stability depends on the control of the money supply by central banks.

Importance of the money supply:

If there is too much liquidity in the economy, the result is inflation (higher prices). If there is too little liquidity, economies go into recession due to a lack of money to consume and invest.

Monetary policies:

Unlike Keynes, Friedman believed that the best way to maintain economic stability was to ensure a constant and predictable growth of the money supply, rather than resorting to government spending measures.

This idea strongly influenced central bank policies, especially in the 1980s and 1990s.

3. Ben Bernanke 🏦📉

Context and key work📖:

Place and time:

Ben Bernanke was chairman of the US Federal Reserve from 2006 to 2014, a period marked by the 2008 global financial crisis, one of the most severe recessions since the Great Depression.

Key work:

Although not known for a specific book, Bernanke published numerous academic studies on the Great Depression, which prepared him to lead the Federal Reserve in times of crisis.

2008 crisis and liquidity policies 💣💸:

In 2008, the collapse of banks such as Lehman Brothers and the freezing of financial markets put the world on the brink of a catastrophic economic crisis. The lack of liquidity in the markets (i.e. the inability of institutions to access money easily) made the situation worse.

Bernanke's Intervention:

To stabilize the financial system, Bernanke implemented massive liquidity injection measures through programs such as Quantitative Easing.

This involved the Federal Reserve purchasing large amounts of financial assets to provide liquidity to markets and keep interest rates low.

Significance:

The quick response by Bernanke and the Federal Reserve helped prevent an even larger financial collapse, and although recovery was slow, their policies marked a shift in how central banks handle liquidity crises in modern times.

Other Important Figures and Theories 🔎📘

Irving Fisher 📐🔢

American economist who, in the 1930s, developed the theory of "debt deflation," arguing that in times of crisis, the liquidation of debts causes a fall in prices and liquidity in the market. This can trigger a deflationary spiral that worsens recessions.

Hyman Minsky 📉🧠

Post-Keynesian economist known for his theory of "financial instability." Minsky argued that in times of prosperity, investors become excessively optimistic, leading to increased leverage and risk taking. This overconfidence can create bubbles that, when they burst, cause liquidity crises.

Place and Time of Liquidity Ideas 🌍📅

- Great Depression (1929-1939): This was a critical period in world economic history, which highlighted the importance of liquidity in markets and led to an increased focus on state policies to provide liquidity in times of crisis.

- 2008 Financial Crisis: The collapse of global financial markets once again highlighted the need for strong government intervention to ensure liquidity and prevent the collapse of the global economic system.

Conclusion 🎯

Liquidity is an essential concept in finance that affects all levels of the economy. From individuals who need access to cash, to large companies that manage their assets to maintain solvency, liquidity is the key to ensuring that resources are available when needed. A more liquid market or asset offers greater flexibility, while a lack of liquidity can lead to serious financial problems.

Managing liquidity properly is crucial to avoid financial crises, take advantage of investment opportunities and ensure long-term stability, both at a personal, business and global level. 🌍💼