tBTC — Trust-Minimized Bitcoin on Ethereum

🧐 What it is:

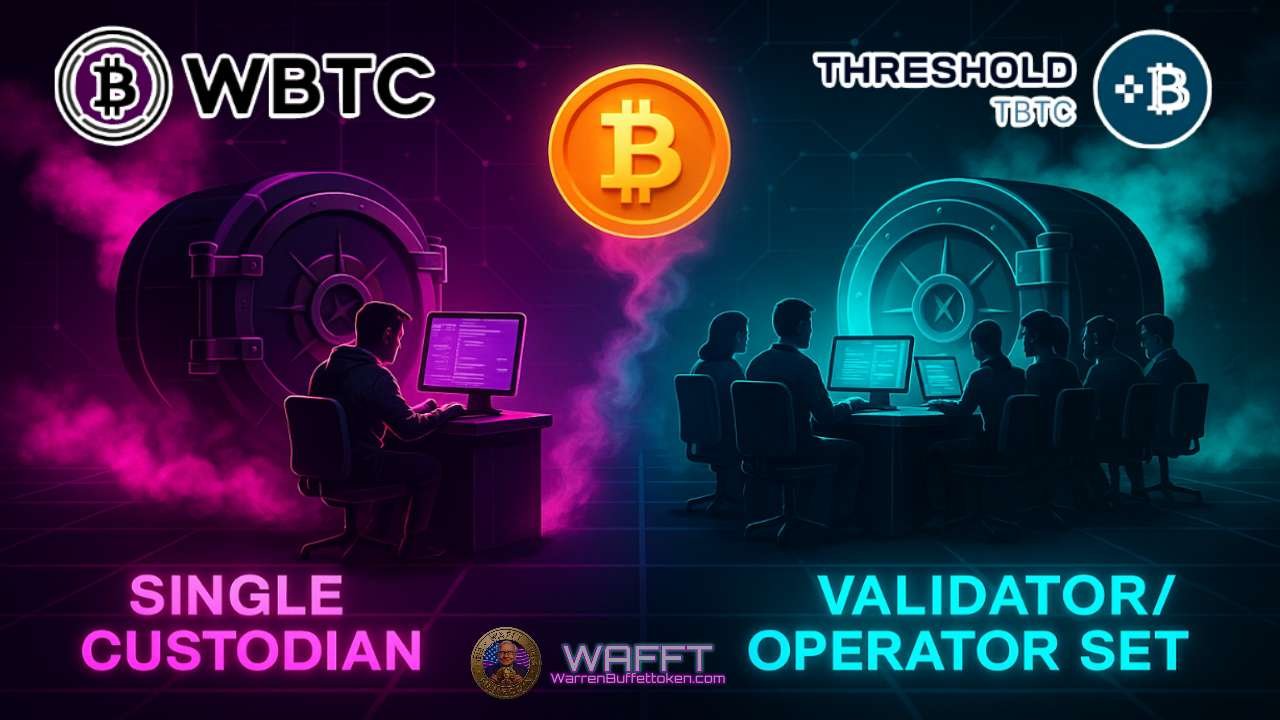

tBTC is a decentralized Bitcoin → Ethereum bridge that mints an ERC-20 1:1 with BTC, custodied by a distributed set of operators (no single custodian), using threshold cryptography (tECDSA): each operator holds only a key share and, when a quorum (M-of-N) is reached, they co-produce a standard ECDSA signature; the full private key never exists in one place.

🔑 Key facts:

🔢 Decimals: 18 (unlike WBTC, which uses 8).

🧾 Canonical contract (Ethereum):

0x18084fBA666a33d37592fA2633fD49a74DD93a88— (Always verify the full checksummed address on Etherscan or the official website before interacting).- 🔗 Refs: etherscan.io/tWBTC

📍 tBTC v2 only: Always use the v2 contract; v1 is deprecated.

🌐 Site & dashboard:

🔗 Official website (tBTC): tBTC

🔗 Docs (official, Threshold): Threshold Docs

🔗 Dashboard (official, Threshold): Threshold Dashboard (Check supply, TVL, metrics, and security model in real time.)

🛠️ How it works (short):

You deposit BTC into a distributed protocol vault; a quorum of operators signs with tECDSA to allow redemption. On Ethereum, tBTC is minted and burned 1:1 to maintain parity with the locked BTC. The operator set rotates, and there are time-bound limits to mitigate collusion/latency.

💡 Why it matters:

It reduces the single point of failure of custodial models by replacing one company holding the BTC keys with a distributed operator set: tBTC splits the key into shares and requires an M-of-N signature (tECDSA), so no single party can move funds alone and the full private key never exists in one place.

You keep BTC exposure while accessing EVM tools (DEXs, lending, derivatives, vaults)

💼 Use it for:

- 🏦 Collateral: Borrow stablecoins/ETH on lending markets (e.g., Aave —— Ethereum mainnet only; double-check listings if you’re on other chains). Keep your LTV low (= debt ÷ collateral value). For example: deposit $10k tBTC, borrow $3k USDC → LTV 30%. If liquidation is at 75%, staying ≤50% leaves room for price swings and keeps your Health Factor high. Keep monitoring it—rates are variable. Set price alerts and be mindful of oracle/liquidity stress during volatile moves.

👉 Liquidation thresholds differ from one protocol to another—always double-check the docs.

💧 Liquidity: Provide tBTC to AMM/DEX pools (Curve, Uniswap) with sufficient TVL and liquidity depth. If using concentrated liquidity (Uniswap v3–style), choose ranges carefully (or use an auto-manager) and pick an appropriatefee tier (e.g., 0.05% / 0.3% / 1%) for the pair’s volatility and volume. If price leaves your range, you stop earning fees until you rebalance. Fees may offset impermanent loss, but not always—check slippage, pool addresses, and decimals (tBTC uses 18). Incentives may change over time.

- 📈 Derivatives: Post tBTC as collateral to hedge downside or add exposure on derivatives venues.

Perpetuals (perps): periodic funding (you pay/receive); no expiry.

Options: upfront premium; expiry; non-linear payoffs (calls/puts).

Futures: fixed expiry; basis (futures − spot).

👍 Good practice: use isolated margin, keep leverage modest, and monitor maintenance margin, funding, fees, and your liquidation price. Many venues are stablecoin-margined—check collateral rules.

💼 Payments & treasury: As an ERC-20 token with 18 decimals, tBTC seamlessly integrates with DeFi and Web3 tooling, enabling on-chain operations while maintaining exposure to BTC’s price. Common uses include:

🔐 Multisig wallets / TSS (Threshold Signature Schemes):

Custody tBTC in multisig or TSS-based setups where multiple parties must co-approve transactions—ideal for organizations and decentralized autonomous organizations (DAOs).📊 Accounting tools:

Software designed to track income, expenses, and balances, with on-chain auditability and reporting for transparent, real-time finance—especially for DAOs and open-governance projects.👩💻 On-chain payroll & grants:

Use smart contracts to pay salaries, contractors, or distribute grants; automate recurring payouts without intermediaries and with full transparency.📜 Custom smart-contract flows:

Vesting: Time-based token unlocks.

Streaming: Continuous, pro-rata payments (e.g., per second or per block), useful for dynamic compensation.

฿ BTC exposure:

tBTC runs on Ethereum while mirroring Bitcoin’s value, enabling DeFi access with BTC-denominated exposure — via a non-custodial, threshold-signing design that’s more decentralized than WBTC.

🌉 L2s & cross-chain: Bridge tBTC to Arbitrum, Optimism, Base, or Polygon for lower fees and a faster UX (Check the official Threshold Bridge for current support—some L2s might not be available all the time).

👉 Always use the official Threshold bridge, verify the token contract address, and confirm the destination token uses 18 decimals.

📌 Quick notes :

✅ Why L2s: Cheaper transactions and quicker confirmations vs. Ethereum L1.

🔗 Official bridge: Ensures the correct token mapping and security assumptions.

🧾 Contract check: Match the exact contract address from official docs; avoid look-alikes.

🔢 18 decimals: Mismatches can break balances/UI in apps.

⛽ Gas on destination: Bring a small amount of the destination chain’s native gas token to transact after bridging.

⏳ Withdrawals: Moving funds back to L1 can involve delays (e.g., optimistic rollup challenge periods).

🦾 PoR / transparency:

- 🛡️ Security model (official docs): tBTC Security Model

⚙️ Technical overview (official docs): tBTC Technical System Overview

⚠️ Watch out for…

Protocol/bridge risk: Bugs, pauses, unaudited upgrades.

Lower liquidity than WBTC on some DEXs/chains.

Peg/market risk: In panic or high volatility, tBTC may trade at a premium/discount vs. BTC. Never buy on a DEX without checking the real BTC price.

Operational: On new routes, test with a small amount first. Confirm network, contract, and decimals before using full size.

✅ Quick verification: 1) Correct network · 2) Canonical token contract (via official sources) · 3) 18 decimals · 4) Small test first · 5) Only official interfaces or reputable DEXs.

📝 Final note:

tBTC is a solid option for users who prioritize decentralization, but it requires more active verification than custodial alternatives like WBTC. Security depends on your diligence. 🛡️

✩ WAFFT take:

tBTC offers true decentralization—with trade-offs: lower liquidity than WBTC and greater technical complexity.

It’s ideal for advanced users who value trust-minimization.

Always: verify the contract address, use the official bridge, start with a small test transaction, and monitor the peg.

If you prioritize liquidity and simplicity, WBTC remains the go-to option. 🧠⚖️

👉 Up next: explore renBTC — Bitcoin via Ren Protocol (Historical Risk) and learn how one of the first decentralized bridges faced governance, custody, and shutdown challenges — and what lessons it left for DeFi builders. ⚙️💥