Wrapped Tokens 🎁

Wrapped Tokens — What Are They?

Wrapped tokens are 1:1 representations of an asset that lives on another blockchain. They keep the same economic value as the original, but on a different network, so that value can move and be used where the apps you care about are (DEXs, lending, NFTs, etc.). Think of it as a crypto passport 🛂✨: the asset doesn’t change its economic “nationality,” it simply gets permission to circulate in another chain’s country. 🧳⚙️

🔹 Essential traits: (just what they are)

📏 1:1 parity (“peg”): the wrapped aims to trade at the same price as its reference asset.

🌍 Same value, new context: it doesn’t “create” new value; it moves the existing one to another network to leverage its ecosystem.

🔄 Redeemable/Reversible: designed so you can return to the original asset (detail we’ll cover in the How Do They Work? section).

🏷️ Clear labeling: you’ll see prefixes like wBTC, wETH, wLTC, which indicate it’s a representation, not the “native” asset of that chain.

🔹 What they are NOT: (concept boundaries)

- ❌ Not the original asset: it’s just a stand-in living on another network.

- ❌ Not a new cryptocurrency: wrapping doesn’t “mint” a brand-new coin with its own price; it mirrors the original’s value.

- ❌ Not a magic value multiplier: moving BTC to Ethereum as wBTC won’t make you richer; it only changes where you can use it.

- ❌ Not unbreakable: wrapped tokens depend on the bridge or mechanism that issues them, so trust and security still matter.

🔹 Vocabulary note: (without going into mechanics)

- 🔗 Wrapped cross-chain: 1:1 digital representation of an asset that lives on another blockchain.

🪄 Example: wBTC is Bitcoin “wrapped” to exist on the Ethereum network. This wBTC maintains the value of the original BTC but functions as an ERC-20 token, which allows it to be used in DeFi, DEXs, and other apps that only accept that standard. This is a true cross-chain move.

🪙 WETH (same chain): “Wrapping” ETH to the ERC-20 standard within its own network. This does not change blockchains, but it’s necessary because many DeFi apps only accept ERC-20 tokens, and native ETH isn’t an ERC-20. It’s like exchanging cash for chips inside the same casino so you can play at every table 🎰. (Key difference: ETH is the native coin that pays gas and lives at the protocol level—you can’t pay gas with wETH. WETH is a 1:1 ERC-20 version meant for smart contracts and DeFi. Same value, different roles.)

💭 WAFFT — Big Idea:

📖 From the WAFFT: The Path to Wealth guide, here’s the key idea: wrapped = same value, more places to put it to work for you.

💼✨ And you know: if you want to keep learning about finance while you browse your crush’s photos 😏, follow us on our socials (X, Telegram, Instagram) and jump aboard.

How Do Wrapped Tokens Work?

Wrapped tokens are 1:1 representations of an asset that lives on another blockchain. They keep the same economic value as the original, but on a different network, so that value can move and be used where the apps you care about are (DEXs, lending, NFTs, etc.). Think of it as a crypto passport 🛂✨: the asset doesn’t change its economic “nationality,” it simply gets permission to circulate in another chain’s country. 🧳⚙️

Core idea: you lock the original asset on its home chain and receive its 1:1 “mirror” on another. When you return, you burn the wrapped token and the original is released. Simple—but with important technical pieces. 🔒🪞🔥

🔹 Who does what (actors):

🔐 Custodian/validator:

holds the original asset (BTC, LTC, etc.). In practice, this role can be implemented in three main ways—each with different trust assumptions and examples:

1. Third-party custodian (centralized)

A regulated company (the custodian) safekeeps the originals and authorizes mint/burn on the destination chain.

• Example: WBTC on Ethereum—BitGo holds the BTC backing and mints/burns WBTC 1:1 via approved merchants.

(Sources: wbtc.network / Gate.com/es/learn

2. Validator/signers set (trust-minimized)

A decentralized network of signers collectively controls vaults via threshold signatures; no single entity can move funds.

💡 How it’s done: this is typically implemented with TSS (Threshold Signature Scheme), which differs from classic multisig.

![]() Quick note (TSS vs. classic multisig): In a traditional N-of-M multisig, multiple signatures are visible on-chain. In TSS (Threshold Signature Scheme), nodes jointly produce a single aggregated signature, and a full private key never exists anywhere—each node holds only a key share. This shrinks the attack surface and keeps on-chain UX clean (you see one signature).

Quick note (TSS vs. classic multisig): In a traditional N-of-M multisig, multiple signatures are visible on-chain. In TSS (Threshold Signature Scheme), nodes jointly produce a single aggregated signature, and a full private key never exists anywhere—each node holds only a key share. This shrinks the attack surface and keeps on-chain UX clean (you see one signature).

• Example 1: tBTC v2: each wallet is backed by 100 signers; moving BTC requires a 51-of-100 threshold under tECDSA, with signers drawn pseudo-randomly from the node pool.

(Sources: Threshold Network | tbtc.network)

• Example 2: THORChain secures cross-chain vaults with TSS across a rotating validator set (“Asgard” vaults). In a Threshold Signature Scheme, no single private key ever exists; each node holds only a key share, and only a super-majority of shares can jointly produce a valid signature to move funds.

Under the hood: THORChain TSS

📦[WAFFT Explains]

How THORChain applies this trust-minimized model in practice:

– Rotating security (“churn”): roughly every ∼2–3 days the active validator set churns, fresh TSS keys are generated, a new Asgard vault is created, and funds are migrated from the retiring vault—this rotation reduces collusion risk over time. (timing can vary by network/params).

(Sources: THORChain: Docs | GitHub)

– Economic safety net (bond): node operators post a bond larger than the assets they can control (commonly ≥1.5×–2×; check current parameter). Any theft attempt would burn more bond value than could be stolen.

– Further reading & explainers: high-level walkthroughs of THORChain’s vaults/TSS and cross-chain design are available from Finematics and THORChain’s docs | community posts.

3. Non-custodial smart contracts (on-chain escrow)

Here “no company holds keys.” Instead, the protocol locks funds in an escrow account while a cross-chain proof is verified; only then does the destination chain mint (and on the way back, it burns before release).

How it works: escrow → proof → mint (IBC)

📦[WAFFT Explains]

1. You send tokens out of Chain A. The IBC Transfer (ICS-20) module on A escrows those tokens in a module account.

2. A light client on Chain B verifies a Merkle proof that “yes, A really escrowed them.”

3. Chain B mints the IBC voucher. Returning burns the voucher on B, and a proof lets A release from escrow.

(Sources: ibc.cosmos.network | tutorials.cosmos.network)

What’s a light client?

A tiny on-chain verifier that stores a trusted snapshot of the other chain and checks Merkle proofs of events (like “tokens escrowed”)—so B can verify A without trusting any custodian.

(Source: IBC Protocol)Practical limitation: the pure light-client model requires on-chain verified light clients on both ends. Many Cosmos chains support this today; outside Cosmos, not every L1/L2 ships a native light client yet—hence some bridges rely on external validators/oracles.

Concrete example (Cosmos IBC/ ICS-20):

• Escrow per channel: each ICS-20 channel has its own escrow bank account holding the originals while vouchers circulate on the counterparty chain. You can even query total escrow on a chain.

(Sources: ibc.cosmos.network — architecture• Dev/docs: ICS-20 token transfer tutorials and IBC-Go docs walk through the flow end-to-end.

(Sources: ibc.cosmos.network — ICS-20 (Transfer))

💡 Key idea: smart contracts + light-client proofs = assets locked by code, not a company—so the bridge can mint/burn safely with on-chain verification on both sides.

(Sources: ibc.cosmos.network)

TL;DR🚨: “Custodian/validator” can be 🏦 a single company (fast, simple), 👥 a distributed signer set (fewer trust assumptions), or 🔗 pure on-chain escrow verified by cross-chain proofs. Pick the model that matches your risk tolerance and compliance needs.

In practice, the user flow is similar across models: Chain B mints only after it sees acceptable evidence that funds were locked on Chain A. What counts as evidence depends on the model — 🏦 custodian attestation, 👥 threshold signature, or 🔗 light-client proof.

🌉 Bridge contract: the on-chain “gatekeeper” that mints the wrapped token on Chain B only after verifying accepted evidence that funds were locked on Chain A; on the way back, it burns the wrapped token before the original is unlocked on Chain A.(Think: verify event → mint; burn first → then unlock.)

💡 (Model mapping: 1 = custodian attestation; 2 = threshold signature; 3 = light-client proof.)

👤 User: you deposit/lock the original on the source chain (A) → receive the wrapped on the destination (B); to return, you send the wrapped to the bridge to burn → the original is unlocked back to your address on Chain A. (You’ll pay gas on both chains, and timing depends on required confirmations.)

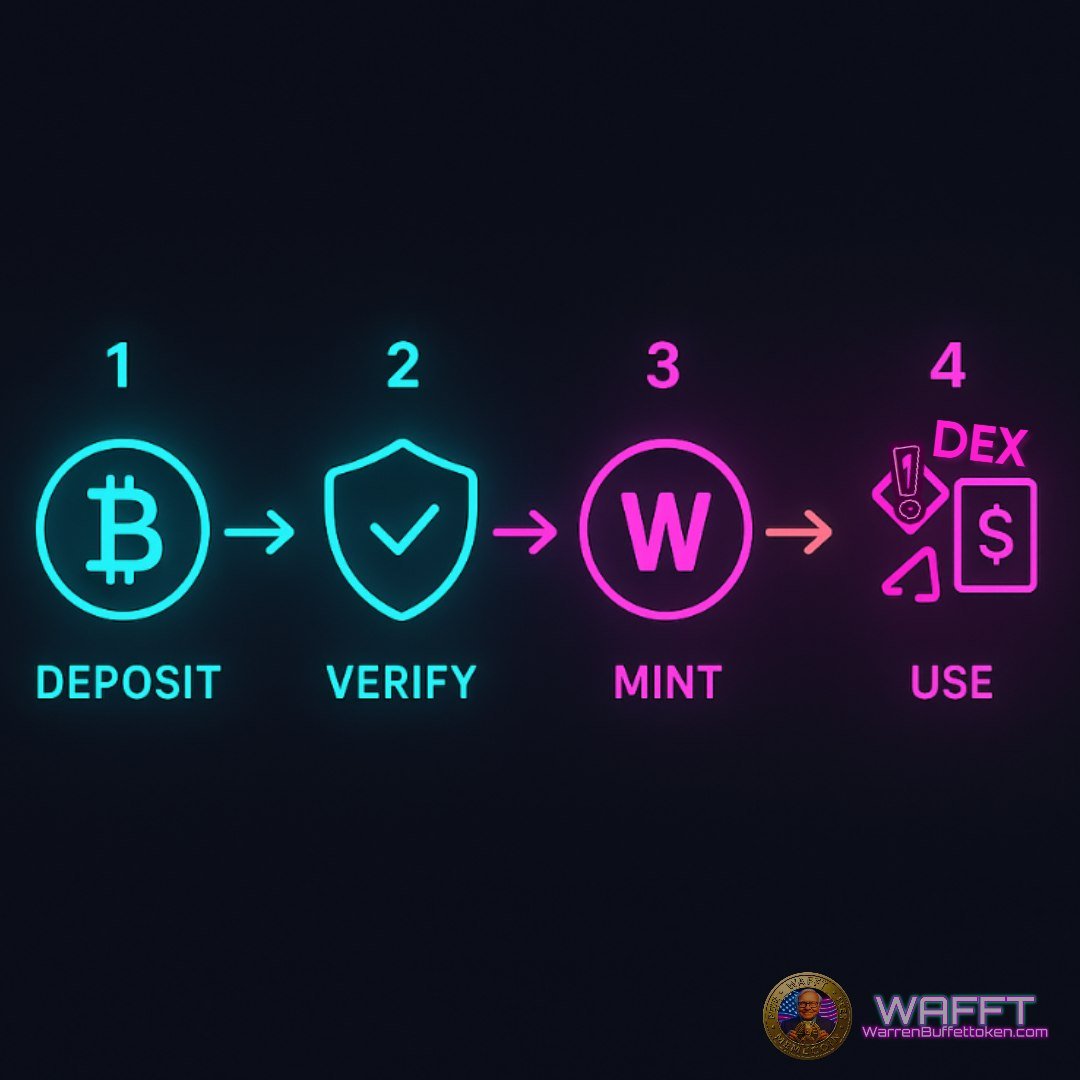

🔹 Basic flow (deposit → wrapped):

1️⃣ You deposit the asset on the source chain (e.g., BTC).

2️⃣ The bridge verifies that deposit (cryptographic proofs or block confirmations).

3️⃣ It mints the wrapped token on the destination chain (e.g., WBTC on Ethereum) and sends it to you.

4️⃣ You can now use it in DeFi: DEXs, lending, farming, etc.

🔹 Reverse flow (redeem → burn):

1️⃣ You send the wrapped token to the bridge contract on the destination chain.

2️⃣ The bridge burns that wrapped token.

3️⃣ The custodian releases the original asset on the source chain to your address.

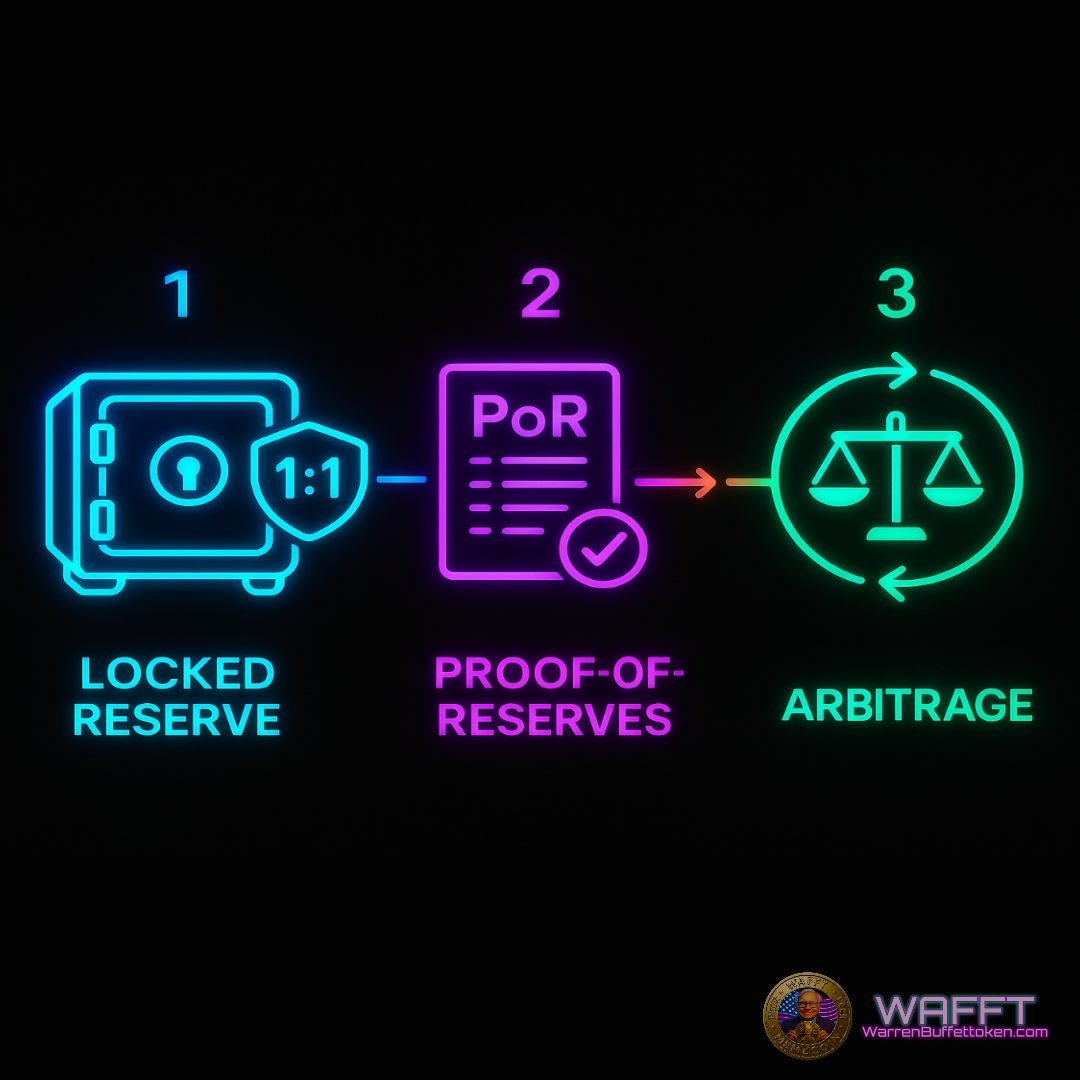

🔹 How the 1:1 (peg) is maintained:

🏦 Locked reserve: for every wrapped token in circulation, there is 1 original immobilized.

📜 Proof-of-reserves (PoR): on-chain or third-party attestations to show the reserve exists.

🔁 Arbitrage: if the wrapped drifts ($0.99/$1.01), traders arbitrage it back to 1:1.

💡 When the peg stretches: bridge pauses, high fees, or slow redemption windows can create temporary discounts/premiums. If arbitrage costs exceed the spread, returning to 1:1 can take longer.

🔹 How “trust-minimized” is achieved (by model):

Each model gives the bridge a different kind of “evidence” that funds were locked on the source chain.

- 🏢 Custodial (centralized):

Evidence → a custodian/oracle attestation (see glossary below).

A single entity holds the originals and vouches to mint/burn. Simple and fast, but you depend on that actor. - 👥 Distributed signer set (TSS / threshold multisig):

Evidence → a threshold signature (several parties sign, or co-produce a single signature with TSS).

There is no single “master” key; no party can move funds alone. You still assume a supermajority is honest (this is not an on-chain proof of the deposit). - 🔗 Pure on-chain escrow (light-client proofs):

Evidence → a proof verified by a light client and smart contracts.

The light client keeps a verified view of the other chain (block headers) and checks Merkle proofs of events (e.g., “tokens locked in escrow”).

The smart contract mints/burns only if the proof validates—no human or custodian decides; cryptography + consensus do.

🪄 Model trade-offs

■ 🏢 Custodial — Trade-off: highest trust in a third party, lowest complexity.

■ 👥 TSS — Trade-off: reduced single-point risk; still need a super-majority honest; medium complexity.

■ 🔗 Light-client — Trade-off: minimal third-party trust (proof-based); highest complexity and setup requirements.

⚡️ Quick analogies (for TSS & light-client)

TSS/multisig: a safe with several locks; several keys are required. 🔑🔑🔑

Light client + Merkle proof: an official seal + a verifiable summary proving authenticity without reading the entire file. 🧰📜

Mini quick glossary

📦[WAFFT Explains]

- Smart contract: a program on-chain that runs automatically, without manual signatures.

- Validator: a node that participates in consensus and verifies rules/blocks.

- Light client: a lightweight viewer of another chain; stores headers and verifies proofs without downloading the whole chain.

- Block header: a block summary (who signed it, Merkle root, etc.).

- Merkle proof: a cryptographic receipt proving that some data/event was included in a specific block.

- On-chain escrow: funds locked by a contract until a verifiable condition is met.

- Threshold multisig / TSS: approval requires a threshold of keys (e.g., 3-of-5); with TSS, parties co-produce a single signature (no full private key exists in one place).

- Attestation: a signed statement by a third party (custodian/oracle) asserting that something happened.

🔹 Finality & confirmations:

⏳ A bridge usually requires N confirmations on the source chain before minting on the destination (more confirmations = more security, but more wait).

✺ N = number of blocks on top of your tx.

⭐️ Bitcoin: bridges often wait 3–6 confirmations (≈ 30–60 min).

⭐️ Ethereum (PoS): two common policies:

— Quick checks: ~12 blocks (≈ 2–3 min).

— Finalized: wait until the block is finalized (≈ 2 epochs ≈ 12.8 min).

Since the Merge (Sep 2022), Ethereum finality is defined by epochs and slots, not PoW-style “confirmations.” Under normal participation (>2/3 validators), finality arrives in ∼2 epochs. Many guides still say “ ∼12 confirmations” informally, but technically finality ≠ confirmations.

👉 Ethereum timekeeping: 1 slot = 12 s; 1 epoch = 32 slots = 32×12 s = 384 s ≈ 6.4 min → 2 epochs ≈ 12.8 min.

(Sources: en.bitcoin.it | ethereum.org | ethos.dev)

✅ On redeem, burn first, release after: prevents two representations of the same asset from existing.

(Further reading on bridging patterns: ethereum.org)

🔹 Fees and slippage:

💸 What you pay

• ⛽ You pay gas on both chains and, sometimes, a bridge fee.

• You’ll typically pay: (1) source gas, (2) destination gas, (3) bridge fee (fixed or %).

Some L2s add message fees on top of gas, and some bridges charge an explicit relayer/oracle fee. Compare these—they meaningfully change the all-in effective cost across routes.

🧮 Gas math (ETH):

Formula: cost (USD) ≈ gas used × gas price gwei × 1e-9 × ETH price

🔸“1e-9” means 10^-9 (one-billionth). We use it to convert gwei → ETH because 1 gwei = 10^-9 ETH (gwei = giga-wei). 📐

• Example: a transaction uses 21,000 gas and the price is 30 gwei →

21,000 × 30 = 630,000 gwei = 0.00063 ETH. (≈ $1.89 @ $3,000/ETH).

(To see it in USD/EUR, multiply by ETH’s price.)

📡 Jargon decoder + tips

🔸 gas used ⚙️: units of gas your transaction consumed (e.g., 21,000 (gas units) to send ETH, ~100,000–200,000 (gas units) for many contract calls).

🔸Typical idea: more complex contracts = more gas used. This multiplies directly into cost. 📈

🔸 gas price gwei ⛽: what you pay per unit of gas, measured in gwei (gwei per gas).

Total fee = gas used × gas price (gwei per gas).

🔸 If the gas price doubles, the fee doubles (assuming the gas used doesn’t change).🔁

🔸 Official note 🏷️: fees are denominated in gwei (a denomination of ETH), and the total cost is “gas used × gas price.” On other networks the names differ (e.g., sat/vB on Bitcoin, lamports + compute units on Solana), but the idea is the same: cost = resource used × price per unit.

EIP-1559: how the gas price is set

📦[WAFFT Explains]

⛽️ EIP-1559: where the gas price comes from

Where does that “gas price” come from on Ethereum? (EIP-1559)

The “gas price” you plug into the formula isn’t arbitrary. On Ethereum, EIP-1559 determines the per-gas price (it does not decide how many gas units your transaction uses).

(Context: basefee targets ∼50% block fullness and can adjust up to ±12.5% per block-fuller bloks → rises; emptier → it falls.)

The network sets a base fee (burned 🔥) and you add a tip/priority fee (goes to the validator 🎩).

You also set a max fee per gas.

What you actually pay per gas = the smaller of these two:

maxFeePerGasvsbaseFee + tip.Total cost =

gas_used × (actual fee per gas).

Walkthrough + pocket rules 🧮

👣 Step-by-step example:

Assume gas_used = 100,000, gas price = 15 gwei, and ETH price = $3,000 (per 1 ETH).

1. Per-gas price: 15 gwei.

2. Total in gwei: 100,000 × 15 = 1,500,000 gwei.

3. To ETH: move the decimal 9 places (gwei → ETH): 1,500,000 gwei = 0.0015 ETH.

4. To USD: 0.0015 ETH × $3,000 = $4.50.

📊 Pocket rules:

- For 100k gas: cost in ETH ≈

gas_price_gwei × 1e-4. - In USD: ≈

gas_price_gwei × ETH_price / 10,000.

🛡️ UX tip:

During demand spikes, raise maxPriorityFee but keep a sane maxFee cap; you’ll avoid overpaying if the base fee drops between blocks.

📖 Mini cap example (EIP-1559)

- Case 1: if

baseFee + tip = 20 gwei per gasandmaxFee = 30 gwei per gas→ you pay 20 gwei per gas

(15 gwei is burned, 5 gwei is tip to the validator).

The remaining 10 gwei of your cap is unused—it stays in your wallet (not charged or burned).

- Case 2: if

baseFee + tip = 40 gwei per gasandmaxFee = 30 gwei per gas→ you pay 30 gwei per gas.

The tip is trimmed so thatbaseFee + effective tip = maxFee(i.e.,effective tip = maxFee − baseFee).

Any difference above what you actually pay is not charged or burned; it simply remains unspent.

🧐 Minimal EIP-1559 context (why you sometimes see “max fee” and “tip”)

Your per-gas cost is base fee (burned) 🔥 + priority fee/tip 🎩 (to the validator). Your wallet shows maxFeePerGas (cap) and maxPriorityFeePerGas. The final actual cost is usually ≤ the cap because it uses min(maxFeePerGas, baseFee + priorityFee).

(Official details and units). 📘

📟 Cost walkthrough (example)

• Assumptions: gas price = 15 gwei (15e-9 ETH/gas) · ETH price = $3,000/ETH

| Step | Gas used | Fee (ETH) | Cost (USD) |

|---|---|---|---|

| Approve token | 50,000 | 50,000 × 15e-9 = 0.00075 | $2.25 |

| Lock/Burn (source) | 100,000 | 100,000 × 15e-9 = 0.00150 | $4.50 |

| Mint/Release (dest.) | 120,000 | 120,000 × 15e-9 = 0.00180 | $5.40 |

| Subtotal gas | 270,000 | 0.00405 | $12.15 |

Extras (not in subtotal): Bridge fee (if any): e.g., 0.1% or $1–$5 · Optional DEX swap (∼100k gas): 0.00150 ETH ≈ $4.50 + slippage

Note: minor rounding; figures vary with congestion and ETH price.

🎯 WAFFT recap:

Wrapped tokens are a coat check for blockchains: lock the original on A (🔒), use its ticket on B (🎟️), then burn the ticket (🔥) to unlock the original (🔓).

How it works: lock on A → mint on B; to return, burn first, then unlock on A.

- What counts as proof: the bridge acts only after it verifies valid evidence — 🏦 custodian attestation, 👥 signers (TSS), or 🔗 cross-chain verification (light client).

Costs & timing: you pay gas on both chains plus possible bridge/relayer/message fees 💸, and bridges usually wait for confirmations/finality ⏳.

On Ethereum (EIP-1559): actual per-gas price =

min(maxFeePerGas, baseFee + priorityFee)— base fee burns 🔥; tip goes to the validator 🎩.Not just ETH — common flavors: BTC → WBTC is typically custodial 🏦; tBTC uses signers (TSS) 👥; THORChain mixes signers with a rotating validator set 🔐; in Cosmos, “vouchers” move via escrow + cross-chain verification 🔗.

Same idea everywhere: lock → mint; burn → unlock. On popular L2s it’s often cheap, depending on congestion ⚡️.

Up next 👉 meet the crowd favorites — a quick, fun tour of the most-used wrapped tokens, how they’re backed, and where they shine. 🧭✨

Wrapped Tokens — Key Examples

In the WAFFT Lab 🧪 we’ve hand-picked the wrapped tokens that actually matter. Our job is to explain, not mystify—so the know-how doesn’t stay locked with a few. For each pick you’ll get: what it is, where it shines, what to watch, and official sources you can verify in one click. 🔎✨

WBTC — Bitcoin’s Bridge to Ethereum

tBTC — Trust-Minimized Bitcoin on Ethereum

renBTC — Bitcoin via Ren Protocol (Historical Risk)

WETH — The ERC-20 Suit for Ether

wstETH — Wrapped Staked Ether (Non-Rebasing)

WPOL / WBNB / WAVAX / WFTM — Wrapped Native Coins

Bridged Stablecoins — USDC.e, axlUSDC & Cross-Chain Dollars

Wrapped Assets Across Blockchains — wSOL, wETH & Use Cases

Why Do Wrapped Tokens Matter?

Wrapped tokens matter because they are the practical bridge between ecosystems that used to live in isolation. They translate an asset from one chain into the ERC-20 standard (or another standard) without you having to sell it or lose its economic exposure.

In plain terms: you move your value to where the best apps, fees, and yields are—without letting go of the original asset.

Here’s the key, WAFFT style 😎👇

🌉 Real interoperability (without selling): You can take BTC to Ethereum (WBTC), move SOL to an EVM environment (e.g., bridged SOL via Wormhole), or wrap SOL as wSOL on Solana so it “fits” the SPL (Solana Program Library) standard. You remain exposed to your asset, but now you operate in the ecosystem that suits you.

💼 Capital efficiency: An “idle” asset becomes collateral or liquidity in DeFi: you borrow, farm fees, participate in vaults… all without leaving the base asset.

🧱 Composability (money LEGO): By adhering to standards (e.g., ERC-20), wrapped tokens work with almost any smart contract: DEXs, lending, options, NFT marketplaces… Less friction, more possibilities.

💧 More liquidity, better pricing: By bringing “blue chips” (BTC, ETH, stETH) to more chains, pools grow and price discovery improves. Result: tighter spreads and less slippage.

🧮 Cleaner accounting (wstETH & co.): Non-rebasing versions (e.g., wstETH) avoid changing your token amount; instead, value per token grows. For DeFi and reporting, it’s much simpler.

⚙️ Multichain strategies: “Go where it yields”: you choose a cheap and fast chain to operate, while keeping the asset exposure you like. Ideal for rebalances, hedges, and arbitrage.

🔍 Transparency and auditability (PoR): In serious, audited custodial wrappers, Proof of Reserves demonstrates 1:1 backing for the issued tokens. For treasuries and DAOs, this eases controls and compliance.

🧭 Simpler user experience: WETH “standardizes” ETH for ERC-20 contracts; WPOL/WBNB/WAVAX do the same in their ecosystems. Fewer technical exceptions, fewer silly mistakes.

🧪 Frictionless innovation: By “teleporting” liquidity and collateral across chains, devs ship new products faster — perps (perpetual futures), options, structured vaults — and you can try them without changing your asset.

😎 WAFFT rule:

wrapped tokens = freedom of movement. They let you be where the action is without giving up your investment thesis. The trick? Choose the right type of wrapper (canonical vs. bridged, custodial vs. trust-minimized) and check reserves and liquidity.

Next up—fresh from the WAFFT lab: your Survival Guide to bridged stables and wrappers. 🛟🌉📊

Wrapped Tokens: WAFFT Survival Guide

Wrapped tokens give you superpowers, but they come with unique risks. This is your checklist to navigate them with confidence. 🦸♂️

1. Identify the Type of Wrapper 🧩:

- Local wrapper (e.g., WETH on Ethereum): Standardizes on the same chain. Low risk.

- Cross-chain wrapper (e.g., bridged SOL (e.g., via Wormhole) on EVM; wSOL on Solana (SPL)):Locks at origin, mints at destination. Includes bridge risk.

- Custodial (WBTC): Maximum liquidity, but you depend on a custodian.

- Trust-minimized (tBTC): Less custody, but more complexity and less liquidity.

2. Technical Verification (Sacred) 🔢:

- Contract: Verify the canonical address in docs or official block explorer. Never trust a Google search!

- Decimals: Know them and respect them. WETH/wstETH 18, WBTC 8, USDC/USDT 6.

- Example: 1.5 USDC = 1,500,000 units (6 decimals). An error here breaks everything.

3. Choice of Bridge and Route 🌉:

🔎 Always use official bridges and look for at least two independent audits. Check TVL, audits, and admin keys.

🗳️ Test small first, then scale. Always.

⛽ You need gas on BOTH chains to operate (origin and destination).

4. Economic Risk Management ⚖️:

- Peg and Liquidity: Under stress, the wrapped can trade at a premium/discount. Check pool depth and slippage before operating.

- Fragmentation: Native “USDC” ≠ USDbC (Base bridged) ≠ axlUSDC. Choose the most liquid.

- Exit Route: Be clear on how to return to the original asset (unwrap or bridge back). Local is 1:1; bridged depends on the bridge.

5. Security and Governance 🛡️:

Approval hygiene: Avoid unlimited approvals. Revoke permissions you don’t use. Beware of approval poisoning!

- Admin Controls: Is the contract pausable or upgradeable? Multisig with timelock is better.

- Compliance: USDC/USDT can freeze funds. Bridges can also pause withdrawals.

6. Continuous Monitoring 🚨:

Set alerts for peg deviation, TVL changes, and spreads.

- Avoid zombie liquidity: If the market migrates (e.g., from USDC.e to native USDC), move in time.

💥WAFFTip:

Wrapped tokens give you freedom of movement; your job is to verify.

👉 Correct contract, decimals OK, official bridge, and small test.

If in doubt, look it up in the WAFFT search engine — the"Google of money" — and cross chains wisely. 🚀🦊

What’s Next? — The Future of Wrapped Tokens

🪙 Fewer “bridged,” more native burn/mint:

Serious issuers (Circle, Tether) are pushing migrations from bridged versions (e.g., wUSDC/USDC — Wormhole) to native issuance on each chain. With Circle’s CCTP (Cross-Chain Transfer Protocol), USDC “teleports” value by burning on chain A and minting on B (no bridge token). CCTP is already on 15+ chains (Solana, Arbitrum, Base...) and integrates into apps like UniswapX. This unifies liquidity and reduces peg risks. Alternatives like Chainlink CCIP (Cross-Chain Interoperability Protocol) point in the same direction.

🏷️ Goodbye to ticker soup (USDC vs wUSDC/USDC — Wormhole):

Migrations from bridged to native continue: where native exists, prioritize it. Example: on Arbitrum, the shift from USDC.e to native USDC happened in June 2023. Bridged remains plan B for chains without native issuance.

🛡️ Security: more ZK/light clients and less blind faith

Bridges are adopting cryptographic verification. Wormhole has a ZK (zero-knowledge) roadmap underway (already in testnet), LayerZero v2 with DVNs (Decentralized Verifier Networks) is on mainnet, and Axelar uses light clients.

👉 Fewer multisigs, more trust-minimization = smaller hack surface (if implemented well).

⚠️ Even so, bridge risk will remain on the map:

Recent incidents (e.g., Orbit Bridge in January 2024) remind us that risks persist. This forces more audits, insurance, and limits. Adoption of native burn/mint is accelerating.

WAFFT conclusion: security is improving, but it’s not magic; verify routes and contracts.

₿ Wrapped BTC: more “trust-minimized” and Bitcoin layers

The market rewards decentralized solutions (tBTC) and native pegs on Bitcoin (sBTC on Stacks, already on mainnet). Less single custody, more ways to use BTC in DeFi without losing sleep. In 2025–2026, sBTC expands and tBTC gains integrations.

🧭 Multichain UX: toward “chain abstraction”

Apps hide the chain hop: you pick the asset, sign, and you’re done. Under the hood, they use native burn/mint + messaging (Wormhole/LayerZero). Intents and projects like Polygon AggLayer push the experience to “choose what you want, not where you are.” Wrapped becomes invisible infra.

♻️ Local classics (WETH/WPOL/WBNB…) are here to stay:

Within EVM, WETH and friends remain the standard adapter so contracts speak ERC-20. Pure UX (just remember your approval hygiene 😉).

🎯 WAFFT recap:

Direction of travel: from “a thousand bridged versions” to native burn/mint + bridges with cryptographic verification.

For you, WAFFTer: prioritize natives when they exist, verify contracts/decimals, and measure liquidity and peg before sizing up.

Where to stay informed: follow updates at WAFFT / WAFFT Academy and act wisely. The future is multichain, but the control is yours. 🦊⚡️

Final Bounce: Reflections on Wrapped Tokens

🌉 LayerZero and cross-chain liquidity:

LayerZero is tightening its integration with the Stargate ecosystem, creating deeper liquidity routes across chains and reducing fragmentation in wrapped token flows.

🪙 OFT standard picks up adoption:

The Omnichain Fungible Token (OFT) approach is gaining traction among issuers and apps, enabling cross-chain transfers without spawning dozens of wrapped variants.

🛡️ Modular security stacks:

With LayerZero v2 and DVNs (Decentralized Verifier Networks), projects can tune cost, speed, and trust—shifting away from opaque multisigs toward configurable, cryptographic verification.

🔍 Native burn/mint outshines classic bridges:

Protocols like CCTP make value move by burning on chain A and minting on chain B. Liquidity unifies, tickers simplify, and peg risk drops—bridges remain relevant, but face higher scrutiny.

⚡ From theory to production:

More teams are adopting OFT-style interoperability to simplify integrations and reduce operational overhead—evidence that the model works beyond whitepapers.

🎯 WAFFT recap:

- 📈 Trendline: Fewer separate wrapped versions; more native issuance and OFT-style interoperability.

- 🛡️ Security: Fewer multisigs; more modular, cryptographically verified stacks.

- 🎯 Action for WAFFTer: Prefer native when available; if using bridged/OFT, verify contract addresses/decimals and check liquidity + peg before sizing up.

- 🌐 Big picture: Wrapped tokens are fading into invisible multichain infrastructure—a cleaner UX with stronger guarantees. 🚀

👉 Stay connected: Follow WAFFT on X (Twitter), Telegram, Facebook, and TikTok; check WAFFT Academy for deep dives. 💬📡

Wanna explore other token types taking over the crypto world? Don’t be shy—click away! ![]() Below, you’ll find clickable names that’ll teleport you straight to each section. Still curious or looking for anything related to crypto, traditional finance, or economics? Hit up our search bar and find everything you need to level up your knowledge.

Below, you’ll find clickable names that’ll teleport you straight to each section. Still curious or looking for anything related to crypto, traditional finance, or economics? Hit up our search bar and find everything you need to level up your knowledge.

Let’s go! ![]()

![]()